Answered step by step

Verified Expert Solution

Question

1 Approved Answer

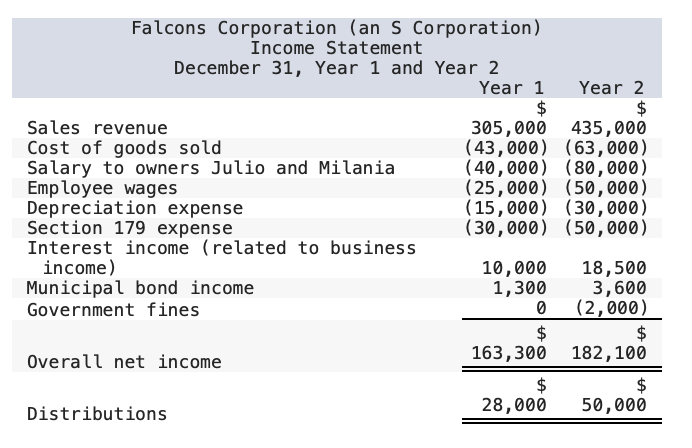

Julio and Milania are owners of Falcons Corporation, an S corporation. Each owns 50 percent of Falcons Corporation. In year 1, Julio and Milania each

Julio and Milania are owners of Falcons Corporation, an S corporation. Each owns 50 percent of Falcons Corporation. In year 1, Julio and Milania each received distributions of $14,000 from Falcons Corporation.

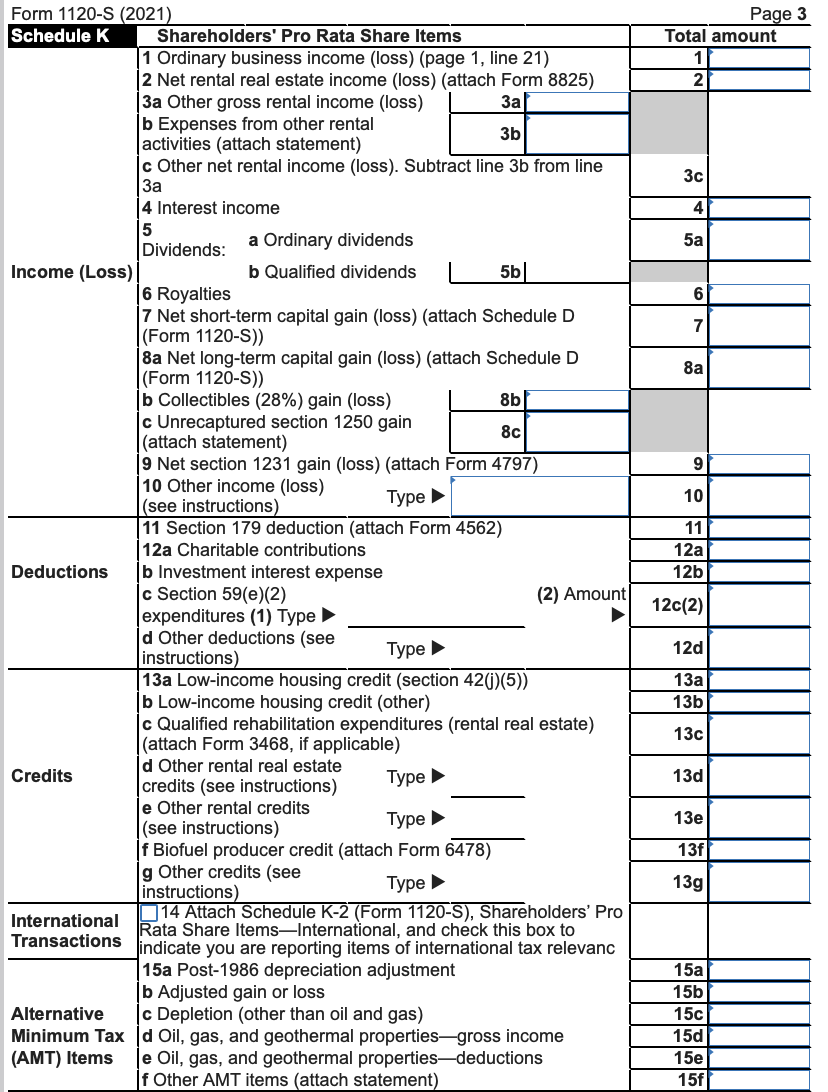

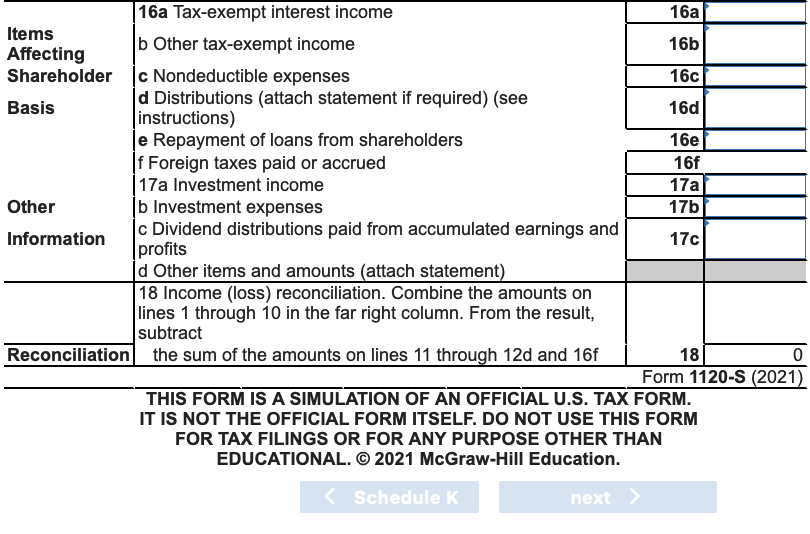

b. Complete Falconss Form 1120-S, Schedule K, for year 1.

Note: Use 2022 tax rules regardless of year on tax form. Input all values as positive numbers.

Form 1120-S (2021) Page 3 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. @ 2021 McGraw-Hill Education.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started