Question

July Ledger Account Employee Wages: Name Role Gross pay -per hour PAYG Tax Per Hour Julia Hilton Dive instructor $25 $6 Peter Ball Shop assistant

July Ledger Account

Employee Wages:

| Name | Role | Gross pay -per hour | PAYG Tax Per Hour |

| Julia Hilton | Dive instructor | $25 | $6 |

| Peter Ball | Shop assistant | $20 | $5 |

Question - Record end of month adjustments in the general journal:

1. Depreciation of motor vehicle 20 % per annum at cost.

2. Depreciation of diving equipment and boat $6000 per annum.

3. Depreciation of Shop Fittings 10 % per annum at written down value.

4. Accrued wages: Peter 28 hour and Julia 22 hours.

5. Accrued Cleaning expenses for August $ 1100(including GST). A tax invoice has been received.

6. Stationery on hand at 31 August 2018 totaled $ 1590.

7. The portion of prepaid insurance expired as of 31 August 2018 is $2,500.

8. Water bill for August is unpaid and unrecorded $750 Plus GST. A tax invoice has been received

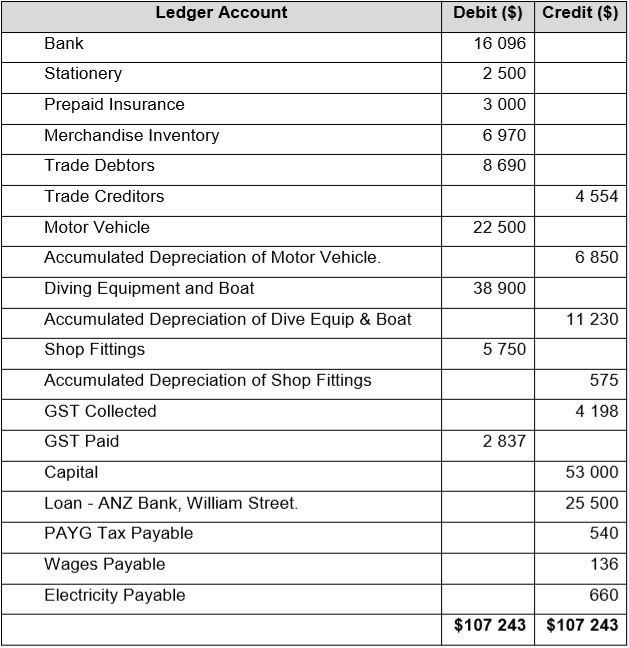

Ledger Account Debit ($) Credit ($) Bank Stationery Prepaid Insurance Merchandise Inventory Trade Debtors Trade Creditors Motor Vehicle Accumulated Depreciation of Motor Vehicle Diving Equipment and Boat Accumulated Depreciation of Dive Equip & Boat Shop Fittings Accumulated Depreciation of Shop Fittings GST Collected GST Paid Capital Loan ANZ Bank, William Street PAYG Tax Payable Wages Payable Electricity Payable 16 096 2 500 3 000 6 970 8 690 4 554 22 500 6 850 38 900 11 230 5 750 575 4 198 2 837 53 000 25 500 540 136 660 $107 243 $107 243

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started