Question

Record the following transactions in the appropriate special journals or general journal for the month of June. Record and post all transactions in accordance with

Record the following transactions in the appropriate special journals or general journal for the month of June. Record and post all transactions in accordance with accounting procedures. Once you have recorded all of the transactions, total the columns in each journal and cross check that they balance before submitting for assessment.

(Note: In each journal, enter transactions in order of transaction date and then in the order they appear in the transaction list below. For example, enter transactions from 12 June before transactions from 14 June and then enter the 12 June transactions in the order they appear in the transaction list below. If an account total or balance returns to zero, enter 0.00 in the required field, otherwise leave the field blank.)

| June 1 | Cash sale #3357 for hire of equipment, total value $317.70, including GST. The customer paid by EFTPOS which went directly into our bank account. | |

| June 4 | Received the telephone bill (invoice #289467) from Telstra for $376.42, including GST. This was paid immediately with cheque #1194. | |

| June 5 | Paid Mitchell Jordan $960.00 with cheque #1195, the amount owing to him for invoice #1753. | |

| June 6 | Receive 30 new helmets (hire equipment) costing $2,660.00 including GST, from Spida Headgear together with their invoice #23116 for $2,770.00 which included a freight charge of $110.00. Terms on this invoice are 5/10, N30 and prices include GST. | |

| June 7 | Invoiced (invoice #3358) Snow Ski Holidays for the hire of equipment ($1,180.00) and lessons ($1,980.00). Total invoice value $3,160.00 including GST and terms are N30. | |

| June 10 | Received and banked a cheque for $1,320.00 from Snow Ski Holidays. | |

| June 12 | Purchased postage stamps ($60.00 including GST) from Australia Post. These were paid for with cash from petty cash. | |

| June 12 | Sent cheque #1196 for $2,400.00 to Skicentral NZ Wholesalers in payment of their invoice #13467. | |

| June 12 | The owner, Kurt Rendell, cashed cheque #1197 for $3,004.00 for his own use. | |

| June 14 | Paid Spida Headgear $2,631.50 with cheque #1198. This was in payment of their invoice #23116 less prompt payment discount. | |

| June 15 | Purchased coffee and biscuits (staff amenities) for $26.85 from the Falls Creek Deli. This amount includes only $0.72 GST as some of the items are GST free. These were paid for with cash from petty cash. | |

| June 17 | Sold ex hire equipment to Jack Small for $664.00 including GST. His cheque for this amount was banked today. This equipment originally cost $811.00, but was written down to $320.00 at the date of sale. Calculate and journalise the profit on the sale. | |

| June 17 | Received a bill (invoice #2234) from Mitchell Jordan for $1,321.00 including GST for ski instruction provided. His terms are N7. | |

| June 18 | Cash sale (invoice #3359) for hire of equipment $281.60 and lessons $1,320.00. The customer paid the $1,601.60 including GST by EFTPOS. | |

| June 19 | Invoiced (invoice #3360) Snowlink for hire of equipment $2,217.60 and lessons $1,188.00. Total value of invoice $3,405.60 including GST with terms of 10/10, N30. | |

| June 20 | Purchase fuel for the motor vehicle costing $88.00 including GST. This was paid for with cheque #1199. | |

| June 24 | Received and banked a cheque for $2,160.00 from Mountain Lake Resort. | |

| June 24 | Cashed cheque #1200 for $86.85 to reimburse petty cash. | |

| June 24 | Paid David’s Repair Shop with cheque #1201 for repairs to ski equipment costing $352.00 including GST. | |

| June 25 | Sent cheque #1202 for $432.00 to Australian Super. This was in payment of the amount of superannuation owing for May. | |

| June 26 | Credit sale to Alpine Sports (invoice #3361) for hire of equipment $792.00 and lessons $1,320.00. Prices include GST and terms are N30. | |

| June 26 | Received new hire equipment ($1,650.00) from The South Face together with their invoice #9457 for $1,705.00 including GST, which included a freight charge of $55.00. Terms N30. | |

| June 27 | Received adjustment note #9462 from The South Face for $165.00 including GST. This was for the return of one of the items of new hire equipment on their invoice #9457. | |

| June 28 | Paid Valley Cleaners for cleaning services provided in June $110.00 including GST, by cheque #1203. | |

| June 28 | Cashed cheque #1204 for $4,060.00 for wages for the month. Gross wages are $4,600.00 and PAYG Withholding deducted was $540.00. | |

| June 28 | Received and banked a cheque for $3,065.04 from Snowlink. |

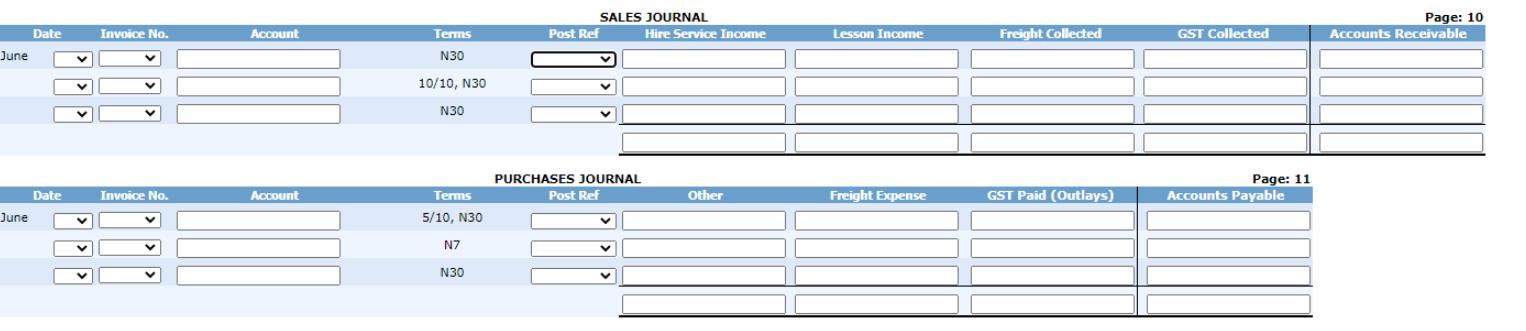

Page: 10 Accounts Receivable SALES JOURNAL Date Invoice No. Account Terms Post Ref Hire Service Income Lesson Income Freight Collected GST Collected June N30 10/10, N30 N30 Page: 11 Accounts Payable PURCHASES JOURNAL Date Invoice No. Account Terms Post Ref Other Freight Expense GST Paid (Outlays) June 5/10, N30 N7 N30

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Amount in Amount in Date Particulars Voucher Dr Cr June 1 Bank Ac Sales 31640 Hire of Equipments Ac 31640 June 4 Telephone Expenses Ac General Journal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started