Answered step by step

Verified Expert Solution

Question

1 Approved Answer

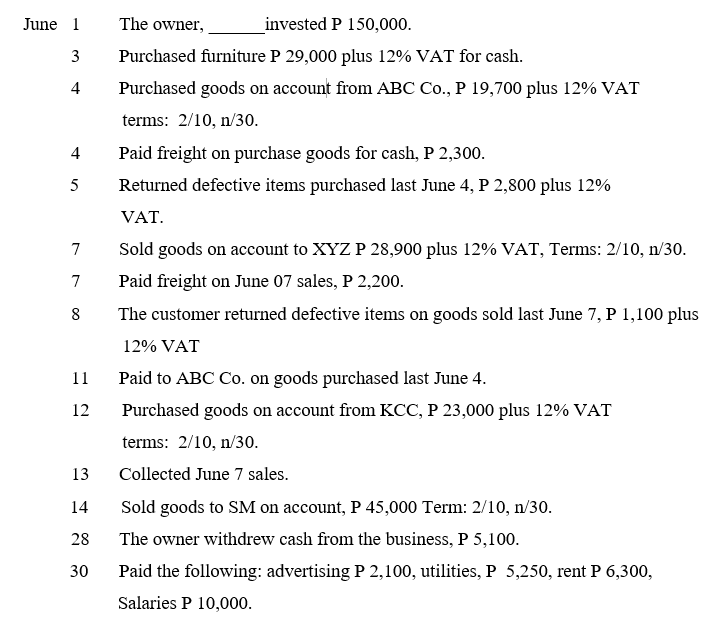

June 1 The owner, 3 4 4 5 7 7 8 11 12 _invested P 150,000. Purchased furniture P 29,000 plus 12% VAT for

June 1 The owner, 3 4 4 5 7 7 8 11 12 _invested P 150,000. Purchased furniture P 29,000 plus 12% VAT for cash. Purchased goods on account from ABC Co., P 19,700 plus 12% VAT terms: 2/10, n/30. Paid freight on purchase goods for cash, P 2,300. Returned defective items purchased last June 4, P 2,800 plus 12% VAT. Sold goods on account to XYZ P 28,900 plus 12% VAT, Terms: 2/10, n/30. Paid freight on June 07 sales, P 2,200. The customer returned defective items on goods sold last June 7, P 1,100 plus 12% VAT Paid to ABC Co. on goods purchased last June 4. Purchased goods on account from KCC, P 23,000 plus 12% VAT terms: 2/10, n/30. 13 Collected June 7 sales. 14 18 28 30 Sold goods to SM on account, P 45,000 Term: 2/10, n/30. The owner withdrew cash from the business, P 5,100. Paid the following: advertising P 2,100, utilities, P 5,250, rent P 6,300, Salaries P 10,000. Prepare the following: 1. JOURNAL ENTRIES 2. POST THE JOURNAL ENTRIES TO THE GENERAL LEDGER

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the given transactions lets create a general journal to record each entry General Journal Date Account Debit Credit Jun 1 Owners Capital P ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started