Answered step by step

Verified Expert Solution

Question

1 Approved Answer

JUNE 2011: INCEPTION OF THE COMPANY Last month, Jim Logan completed his undergraduate degree in finance and decided to pursue his dream of managing his

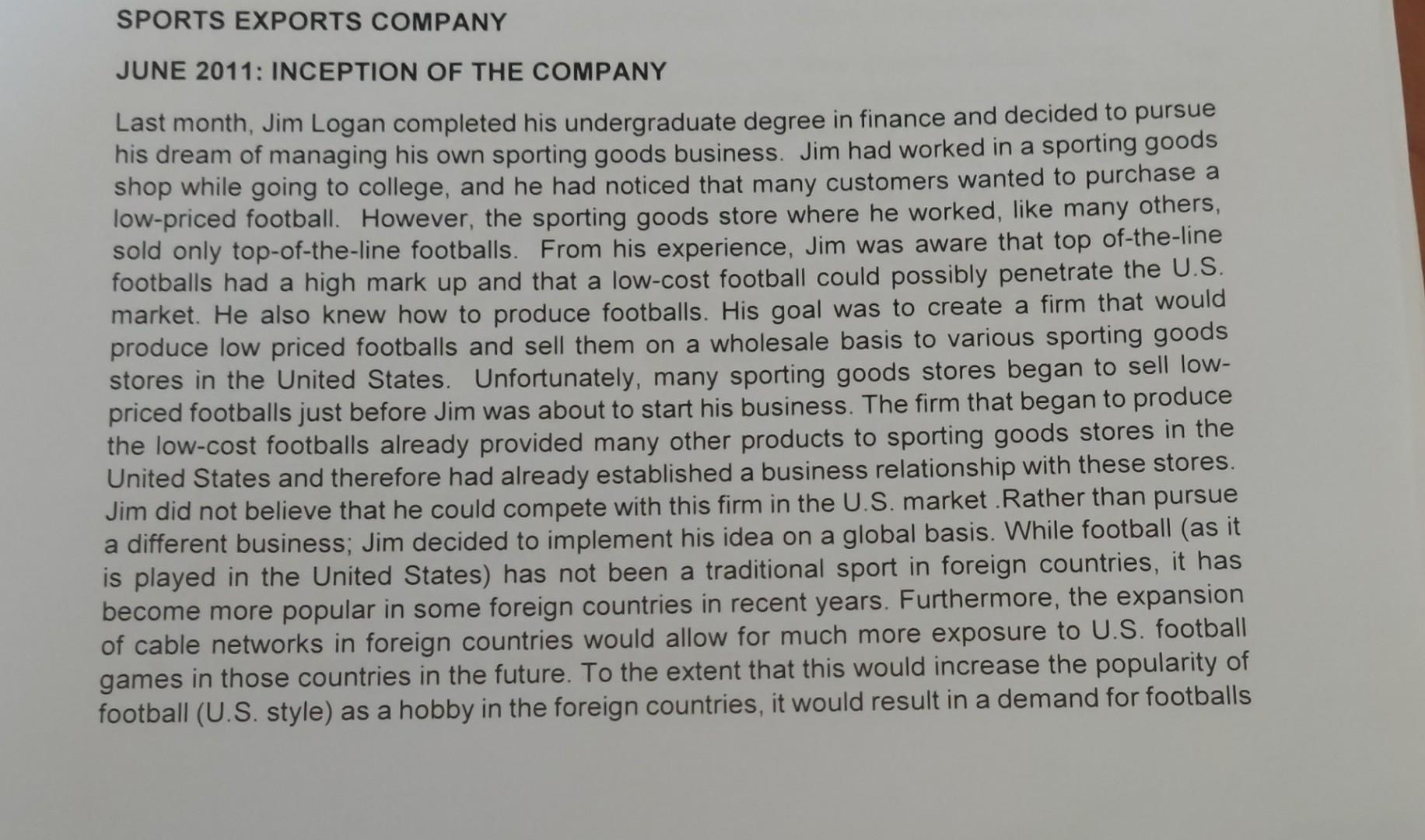

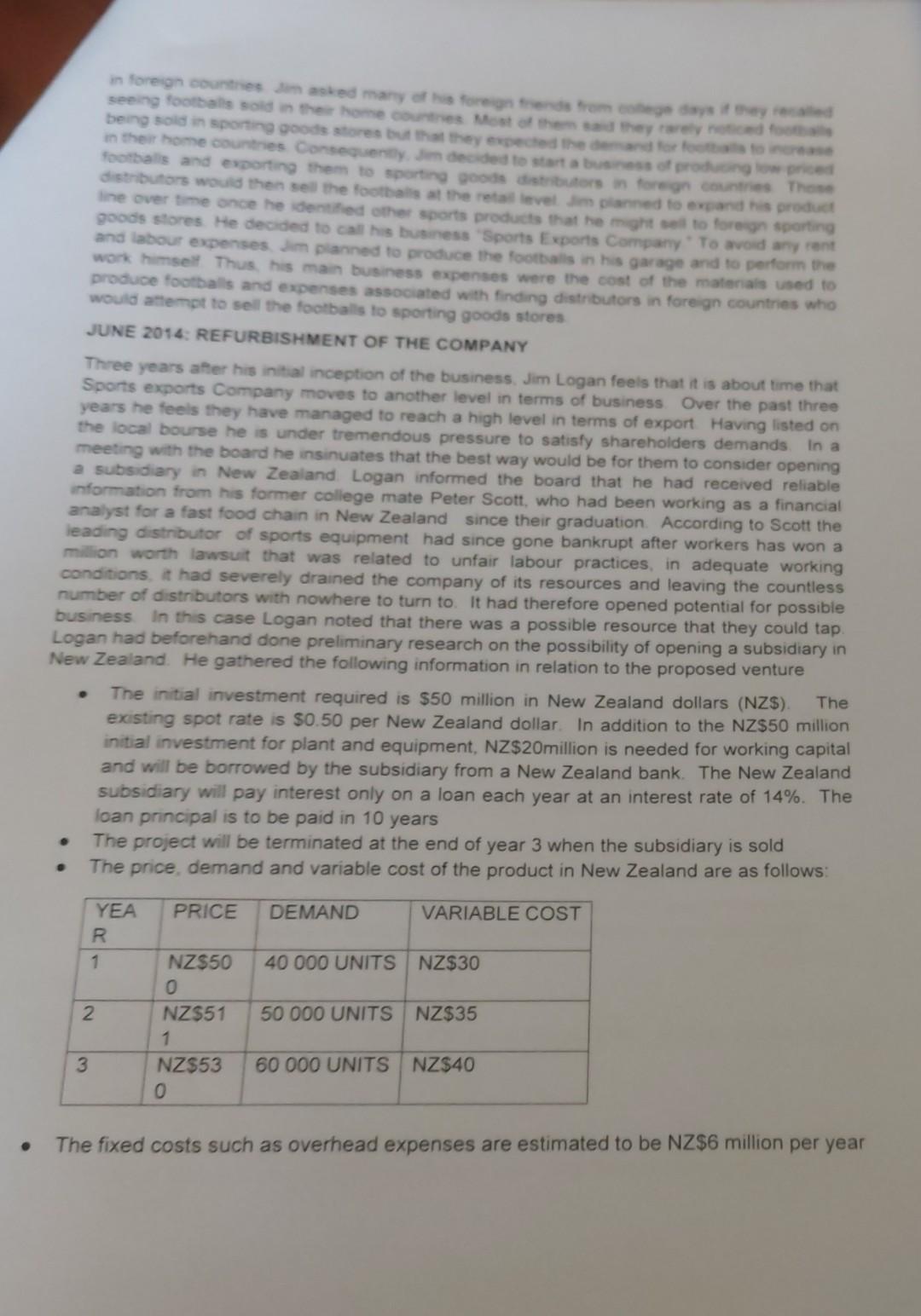

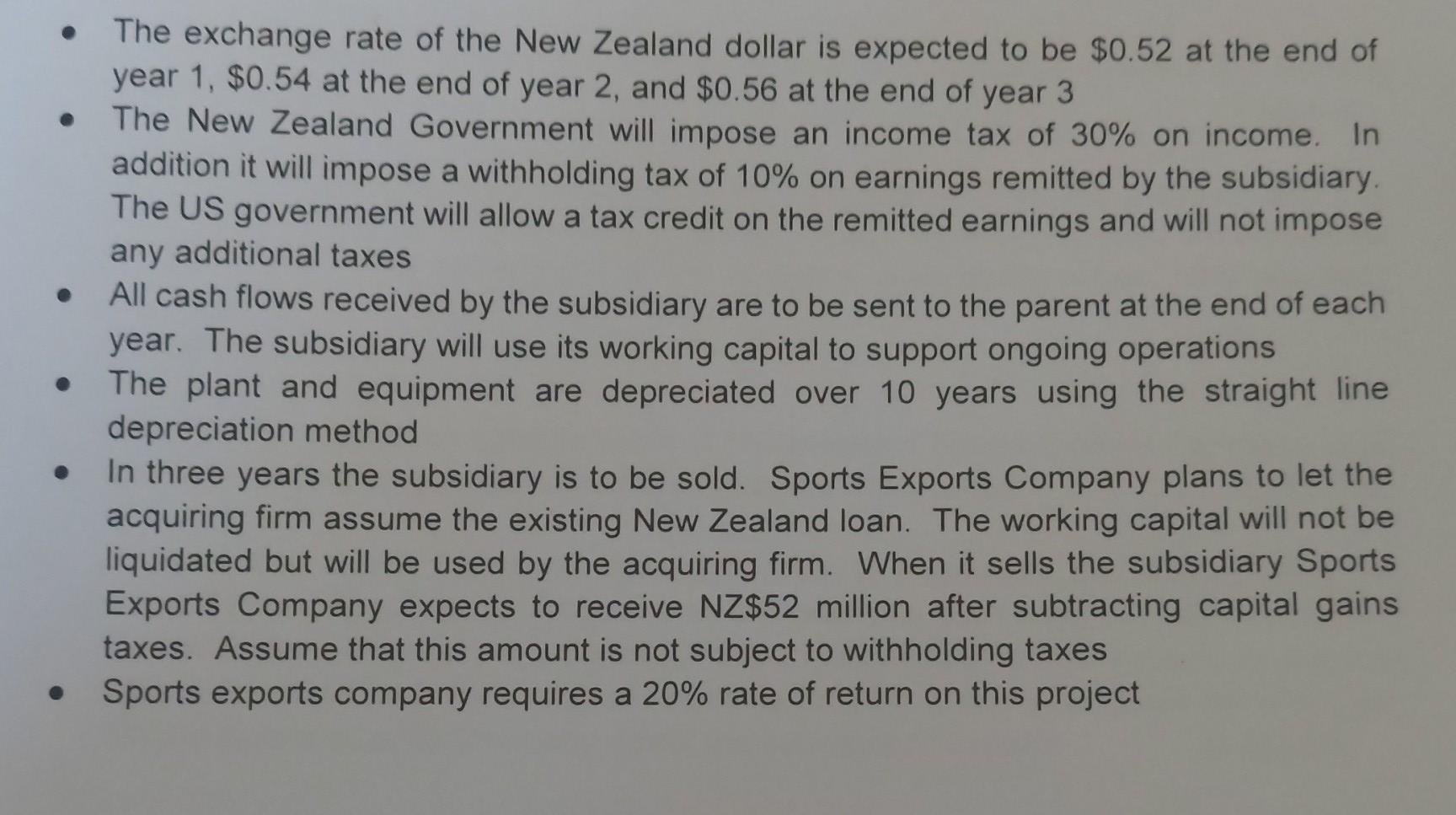

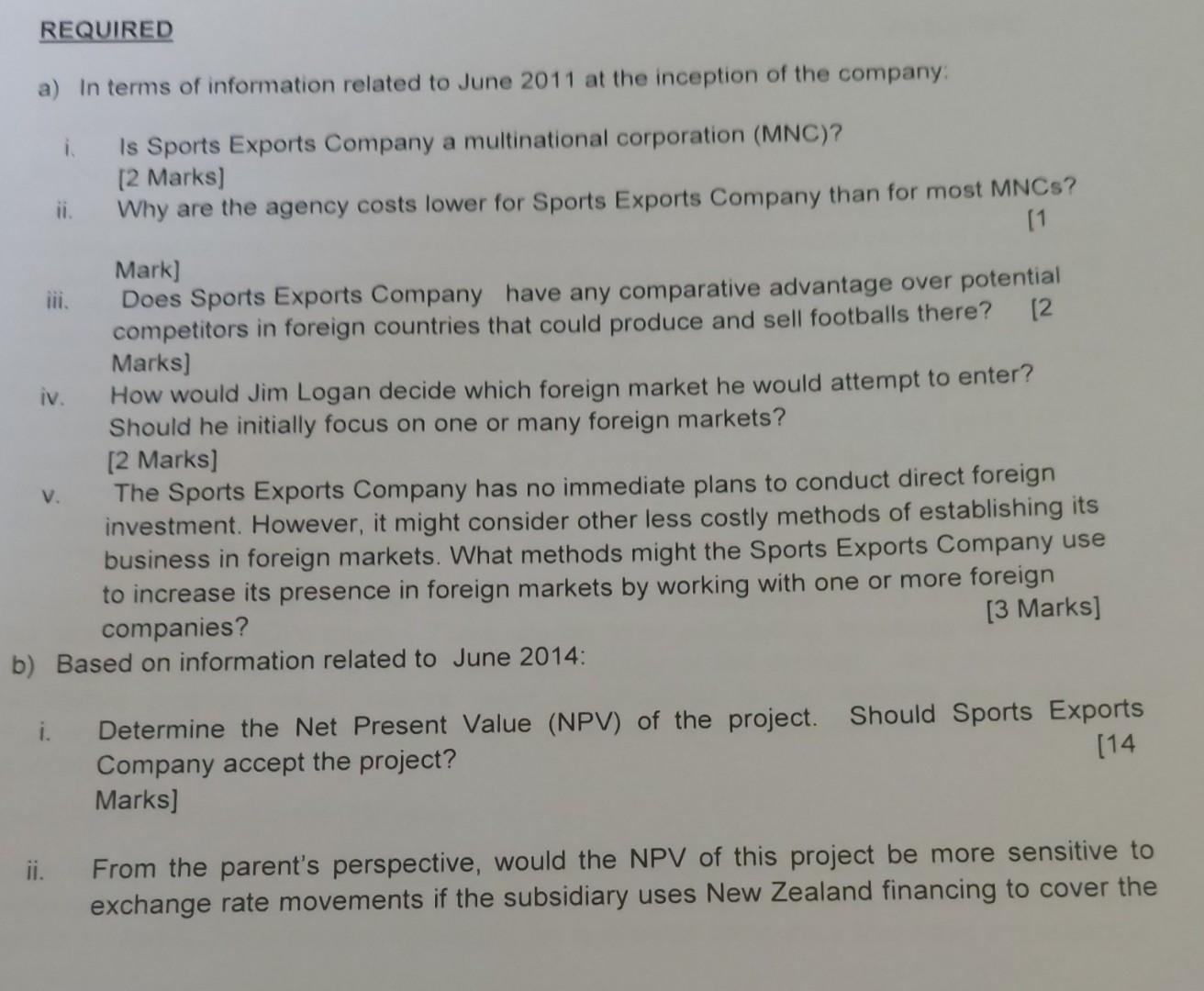

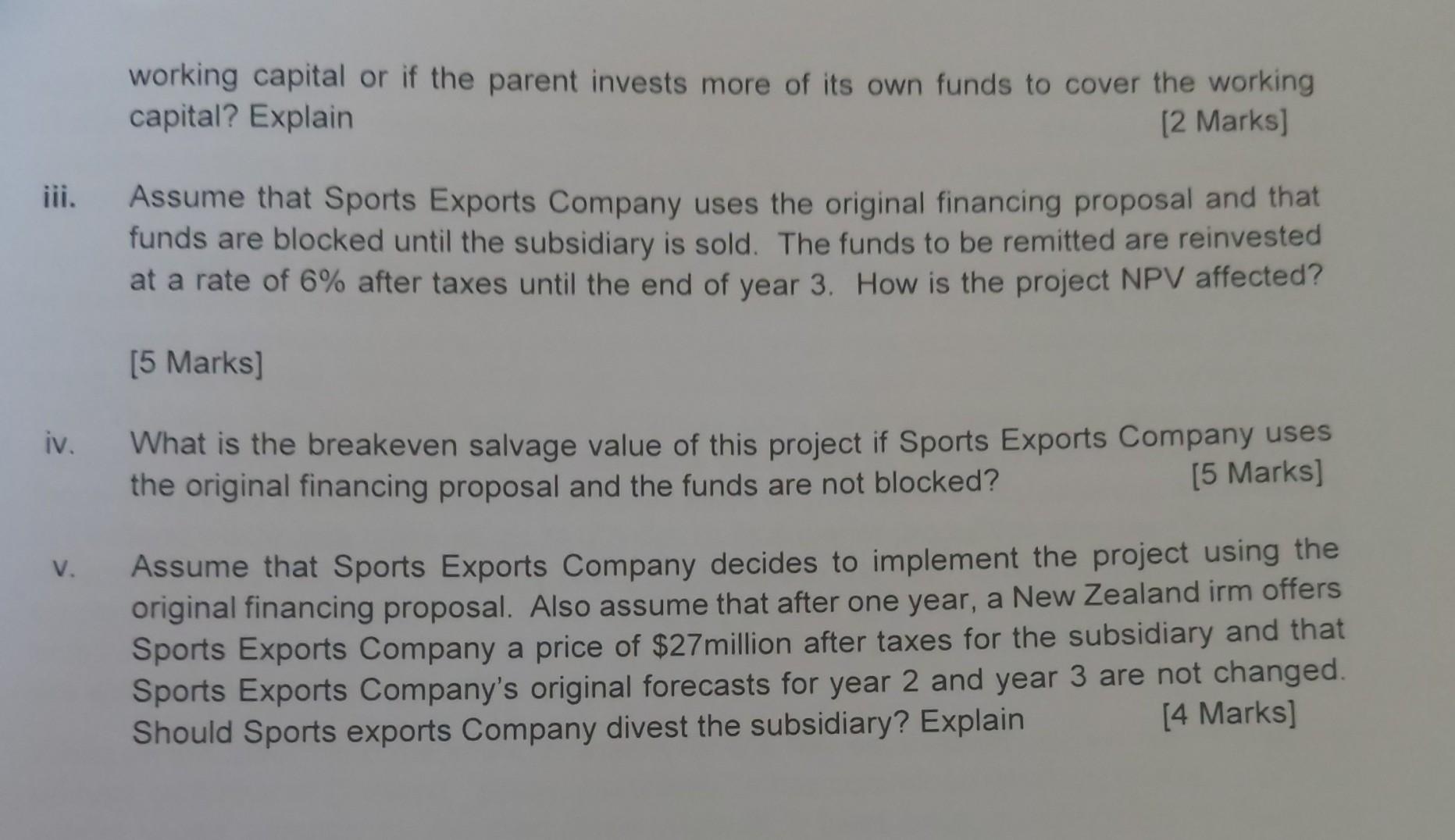

JUNE 2011: INCEPTION OF THE COMPANY Last month, Jim Logan completed his undergraduate degree in finance and decided to pursue his dream of managing his own sporting goods business. Jim had worked in a sporting goods shop while going to college, and he had noticed that many customers wanted to purchase a low-priced football. However, the sporting goods store where he worked, like many others, sold only top-of-the-line footballs. From his experience, Jim was aware that top of-the-line footballs had a high mark up and that a low-cost football could possibly penetrate the U.S. market. He also knew how to produce footballs. His goal was to create a firm that would produce low priced footballs and sell them on a wholesale basis to various sporting goods stores in the United States. Unfortunately, many sporting goods stores began to sell lowpriced footballs just before Jim was about to start his business. The firm that began to produce the low-cost footballs already provided many other products to sporting goods stores in the United States and therefore had already established a business relationship with these stores. Jim did not believe that he could compete with this firm in the U.S. market. Rather than pursue a different business; Jim decided to implement his idea on a global basis. While football (as it is played in the United States) has not been a traditional sport in foreign countries, it has become more popular in some foreign countries in recent years. Furthermore, the expansion of cable networks in foreign countries would allow for much more exposure to U.S. football games in those countries in the future. To the extent that this would increase the popularity of football (U.S. style) as a hobby in the foreign countries, it would result in a demand for footballs in foreigh courtines dim arked mary foothalls and exporting them to spurting goods distibutors in foreign cokintries Those Qoods slores He decided to call his business Hports Exports Compary * To avoed ary rent and labour expenses dim planned to produce the foctballs in his garace and to perform the work himself Thus, his man business expenses were the cost of the materials used to produce foothalis and expenses associated with finding distributors in foreign countries who would attempt to sell the foctbalis to spoiting goods stores JUNE 2014: REFURBISMMENT OF THE COMPANY Three years affer his initial inception of the business. Jim Logan feels that it is about time that Sports exports Company moves to another level in terms of business Over the past three years he feels they have managed to reach a high level in terms of export Having listed on the local bourse he is under tremendous pressure to satisfy shareholders demands in a meeting with the board he insinuates that the best way would be for them to consider opening a subsidiary in New Zealand Logan informed the board that he had received reliable information from his former college mate Peter Scott, who had been working as a financia! analyst for a fast food chain in New Zealand since their graduation. According to Scott the leading distributor of sports equipment had since gone bankrupt after workers has won a milion worth lawsuit that was related to unfair labour practices, in adequate working conditions, it had severely drained the company of its resources and leaving the countless number of distributors with nowhere to turn to. It had therefore opened potential for possible business In this case Logan noted that there was a possible resource that they could tap Logan had beforehand done preliminary research on the possibility of opening a subsidiary in New Zealand. He gathered the following information in relation to the proposed venture - The initial investment required is $50 million in New Zealand dollars (NZ\$). The existing spot rate is $0.50 per New Zealand dollar. In addition to the NZS50 million initial investment for plant and equipment, NZ\$2Omillion is needed for working capital and will be borrowed by the subsidiary from a New Zealand bank. The New Zealand subsidiary will pay interest only on a loan each year at an interest rate of 14%. The Ioan principal is to be paid in 10 years - The project will be terminated at the end of year 3 when the subsidiary is sold - The price, demand and variable cost of the product in New Zealand are as follows: - The fixed costs such as overhead expenses are estimated to be NZ\$6 million per year - The exchange rate of the New Zealand dollar is expected to be $0.52 at the end of year 1, $0.54 at the end of year 2, and $0.56 at the end of year 3 - The New Zealand Government will impose an income tax of 30% on income. In addition it will impose a withholding tax of 10% on earnings remitted by the subsidiary. The US government will allow a tax credit on the remitted earnings and will not impose any additional taxes - All cash flows received by the subsidiary are to be sent to the parent at the end of each year. The subsidiary will use its working capital to support ongoing operations - The plant and equipment are depreciated over 10 years using the straight line depreciation method - In three years the subsidiary is to be sold. Sports Exports Company plans to let the acquiring firm assume the existing New Zealand loan. The working capital will not be liquidated but will be used by the acquiring firm. When it sells the subsidiary Sports Exports Company expects to receive NZ$52 million after subtracting capital gains taxes. Assume that this amount is not subject to withholding taxes - Sports exports company requires a 20% rate of return on this project a) In terms of information related to June 2011 at the inception of the company: i. Is Sports Exports Company a multinational corporation (MNC)? [2 Marks] ii. Why are the agency costs lower for Sports Exports Company than for most MNCs? [1 Mark] iii. Does Sports Exports Company have any comparative advantage over potential competitors in foreign countries that could produce and sell footballs there? [2 Marks] iv. How would Jim Logan decide which foreign market he would attempt to enter? Should he initially focus on one or many foreign markets? [2 Marks] v. The Sports Exports Company has no immediate plans to conduct direct foreign investment. However, it might consider other less costly methods of establishing its business in foreign markets. What methods might the Sports Exports Company use to increase its presence in foreign markets by working with one or more foreign companies? [3 Marks] b) Based on information related to June 2014 : i. Determine the Net Present Value (NPV) of the project. Should Sports Exports Company accept the project? [14 Marks] ii. From the parent's perspective, would the NPV of this project be more sensitive to exchange rate movements if the subsidiary uses New Zealand financing to cover the working capital or if the parent invests more of its own funds to cover the working capital? Explain [2 Marks] iii. Assume that Sports Exports Company uses the original financing proposal and that funds are blocked until the subsidiary is sold. The funds to be remitted are reinvested at a rate of 6% after taxes until the end of year 3 . How is the project NPV affected? [5 Marks] iv. What is the breakeven salvage value of this project if Sports Exports Company uses the original financing proposal and the funds are not blocked? [5 Marks] v. Assume that Sports Exports Company decides to implement the project using the original financing proposal. Also assume that after one year, a New Zealand irm offers Sports Exports Company a price of $27 million after taxes for the subsidiary and that Sports Exports Company's original forecasts for year 2 and year 3 are not changed. Should Sports exports Company divest the subsidiary? Explain [4 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started