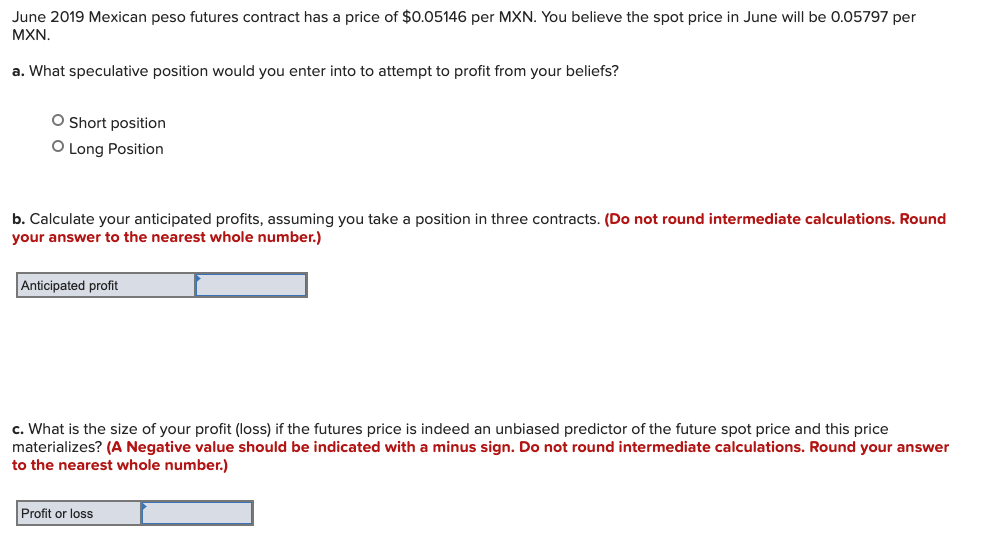

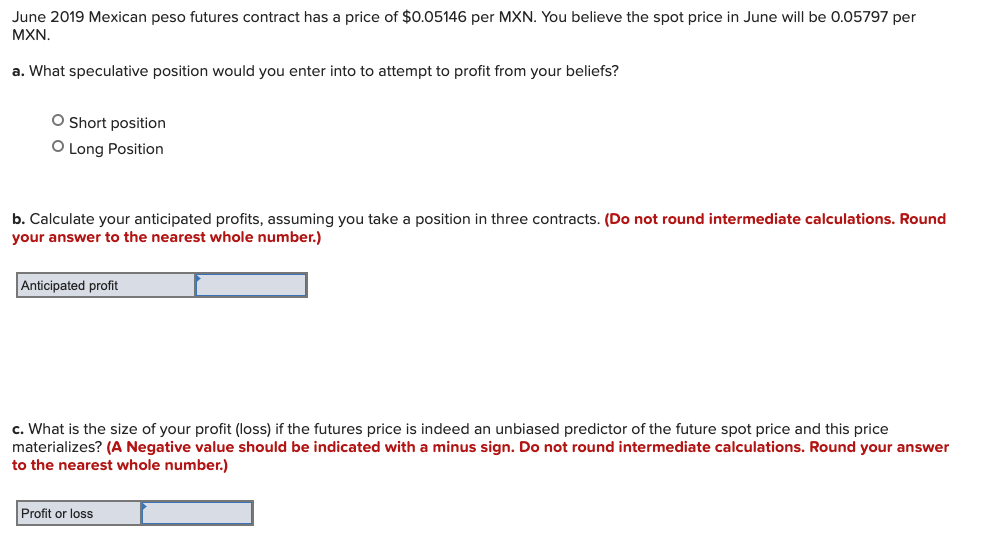

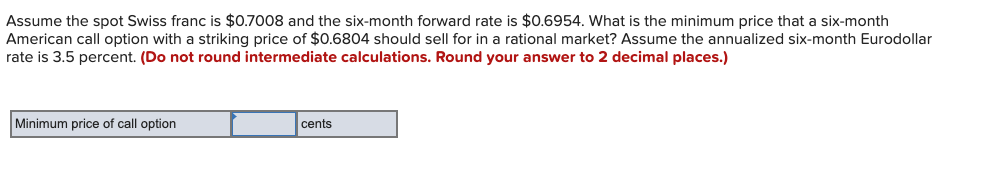

June 2019 Mexican peso futures contract has a price of $0.05146 per MXN. You believe the spot price in June will be 0.05797 per MXN. a. What speculative position would you enter into to attempt to profit from your beliefs? O Short position O Long Position b. Calculate your anticipated profits, assuming you take a position in three contracts. (Do not round intermediate calculations. Round your answer to the nearest whole number.) Anticipated profit c. What is the size of your profit (loss) if the futures price is indeed an unbiased predictor of the future spot price and this price materializes? (A Negative value should be indicated with a minus sign. Do not round intermediate calculations. Round your answer to the nearest whole number.) Profit or loss Assume the spot Swiss franc is $0.7008 and the six-month forward rate is $0.6954. What is the minimum price that a six-month American call option with a striking price of $0.6804 should sell for in a rational market? Assume the annualized six-month Eurodollar rate is 3.5 percent. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Minimum price of call option cents June 2019 Mexican peso futures contract has a price of $0.05146 per MXN. You believe the spot price in June will be 0.05797 per MXN. a. What speculative position would you enter into to attempt to profit from your beliefs? O Short position O Long Position b. Calculate your anticipated profits, assuming you take a position in three contracts. (Do not round intermediate calculations. Round your answer to the nearest whole number.) Anticipated profit c. What is the size of your profit (loss) if the futures price is indeed an unbiased predictor of the future spot price and this price materializes? (A Negative value should be indicated with a minus sign. Do not round intermediate calculations. Round your answer to the nearest whole number.) Profit or loss Assume the spot Swiss franc is $0.7008 and the six-month forward rate is $0.6954. What is the minimum price that a six-month American call option with a striking price of $0.6804 should sell for in a rational market? Assume the annualized six-month Eurodollar rate is 3.5 percent. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Minimum price of call option cents