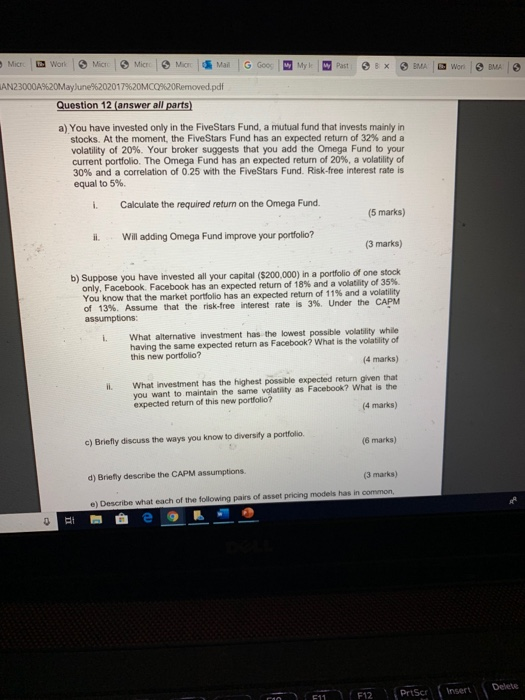

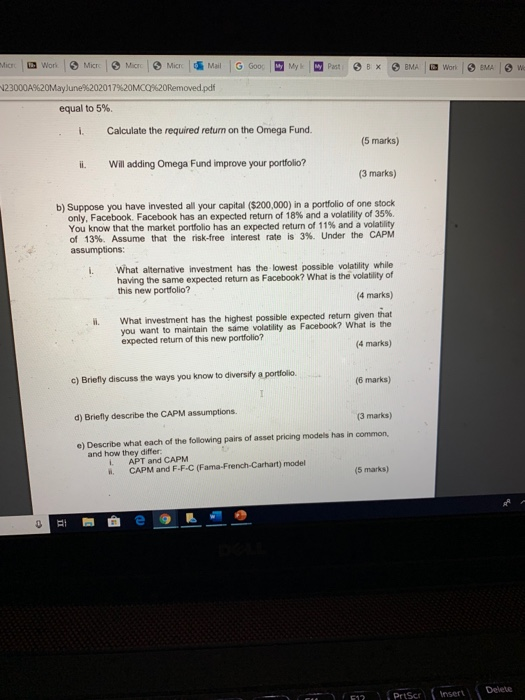

June%2020 1 79620MC0%20Removedpdf Question 12 (answer all parts a) You have invested only in the FiveStars Fund, a mutual fund that invests mainly in stocks. At the moment, the FiveStars Fund has an expected return of 32% and a volatility of 20%. Your broker suggests that you add the Omega Fund to your current portfolio. The Omega Fund has an expected return of 20%, a volatility of 30% and a correlation of 0.25 with the FiveStars Fund. Risk-free interest rate is equal to 5%. i Calculate the required return on the Omega Fund (5 marks) i. Will adding Omega Fund improve your portfolio? (3 marks) b) Suppose you have invested all your capital ($200,000) in a portfolio of one stock only. Facebook Facebook has an expected return of 18% and a vol tity of 35% You know that the market portfolio has an expected return of 11% and a volat of 13%, Assume that the risk-free interest rate is 3%. Under the CAPM assumptions: . What alternative investment has the lowest possible volatility while having the same expected return as Facebook? What is the volatility of (4 marks) this new portfolio? ii. What investment has the highest possible expected return given that you want to maintain the same volatity as Facebook? What is the (4 marks) expected return of this new portfolio? c) Briefly discuss the ways you know to diversity a portfolic (6 marks) d) Briefly describe the CAPM assumptions (3 marks) e) Describe what each of the following pairs of asset pricing models has in common Delete "; Priser.( Insert E11- , F12 23000A%20MayJune%202017 %20MCO%20Removed pdf equal to 5%. Calculate the required return on the Omega Fund. (5 marks) Will adding Omega Fund improve your portfolio? ii. (3 marks) b) Suppose you have invested all your capital ($200,000) in a portfolio of one stock only, Facebook, Facebook has an expected return of 18% and a volatility of 35%. You know that the market portfolio has an expected return of 11% and a volatility of 13%, Assume that the risk-free interest rate is 3%. Under the CAPM assumptions: t alternative investment has the lowest possible volatility while having the same expected return as Facebook? What is the volatility of this new portfolio? (4 marks) What investment has the highest possible expected return given that you want to maintain the same volatility as Facebook? What is the i. expected return of this new portfolio? (4 marks) c) Briefly discuss the ways you know to diversify a portfolio. (6 marks) d) Briefly describe the CAPM assumptions. (3 marks) e) Describe what each of the following pairs of asset pricing models has in common, and how they differ L APT and CAPM CAPM and F-F-C (Fama-French-Carhart) model (5 marks) 1?PrtScr Insert Delete June%2020 1 79620MC0%20Removedpdf Question 12 (answer all parts a) You have invested only in the FiveStars Fund, a mutual fund that invests mainly in stocks. At the moment, the FiveStars Fund has an expected return of 32% and a volatility of 20%. Your broker suggests that you add the Omega Fund to your current portfolio. The Omega Fund has an expected return of 20%, a volatility of 30% and a correlation of 0.25 with the FiveStars Fund. Risk-free interest rate is equal to 5%. i Calculate the required return on the Omega Fund (5 marks) i. Will adding Omega Fund improve your portfolio? (3 marks) b) Suppose you have invested all your capital ($200,000) in a portfolio of one stock only. Facebook Facebook has an expected return of 18% and a vol tity of 35% You know that the market portfolio has an expected return of 11% and a volat of 13%, Assume that the risk-free interest rate is 3%. Under the CAPM assumptions: . What alternative investment has the lowest possible volatility while having the same expected return as Facebook? What is the volatility of (4 marks) this new portfolio? ii. What investment has the highest possible expected return given that you want to maintain the same volatity as Facebook? What is the (4 marks) expected return of this new portfolio? c) Briefly discuss the ways you know to diversity a portfolic (6 marks) d) Briefly describe the CAPM assumptions (3 marks) e) Describe what each of the following pairs of asset pricing models has in common Delete "; Priser.( Insert E11- , F12 23000A%20MayJune%202017 %20MCO%20Removed pdf equal to 5%. Calculate the required return on the Omega Fund. (5 marks) Will adding Omega Fund improve your portfolio? ii. (3 marks) b) Suppose you have invested all your capital ($200,000) in a portfolio of one stock only, Facebook, Facebook has an expected return of 18% and a volatility of 35%. You know that the market portfolio has an expected return of 11% and a volatility of 13%, Assume that the risk-free interest rate is 3%. Under the CAPM assumptions: t alternative investment has the lowest possible volatility while having the same expected return as Facebook? What is the volatility of this new portfolio? (4 marks) What investment has the highest possible expected return given that you want to maintain the same volatility as Facebook? What is the i. expected return of this new portfolio? (4 marks) c) Briefly discuss the ways you know to diversify a portfolio. (6 marks) d) Briefly describe the CAPM assumptions. (3 marks) e) Describe what each of the following pairs of asset pricing models has in common, and how they differ L APT and CAPM CAPM and F-F-C (Fama-French-Carhart) model (5 marks) 1?PrtScr Insert Delete