Answered step by step

Verified Expert Solution

Question

1 Approved Answer

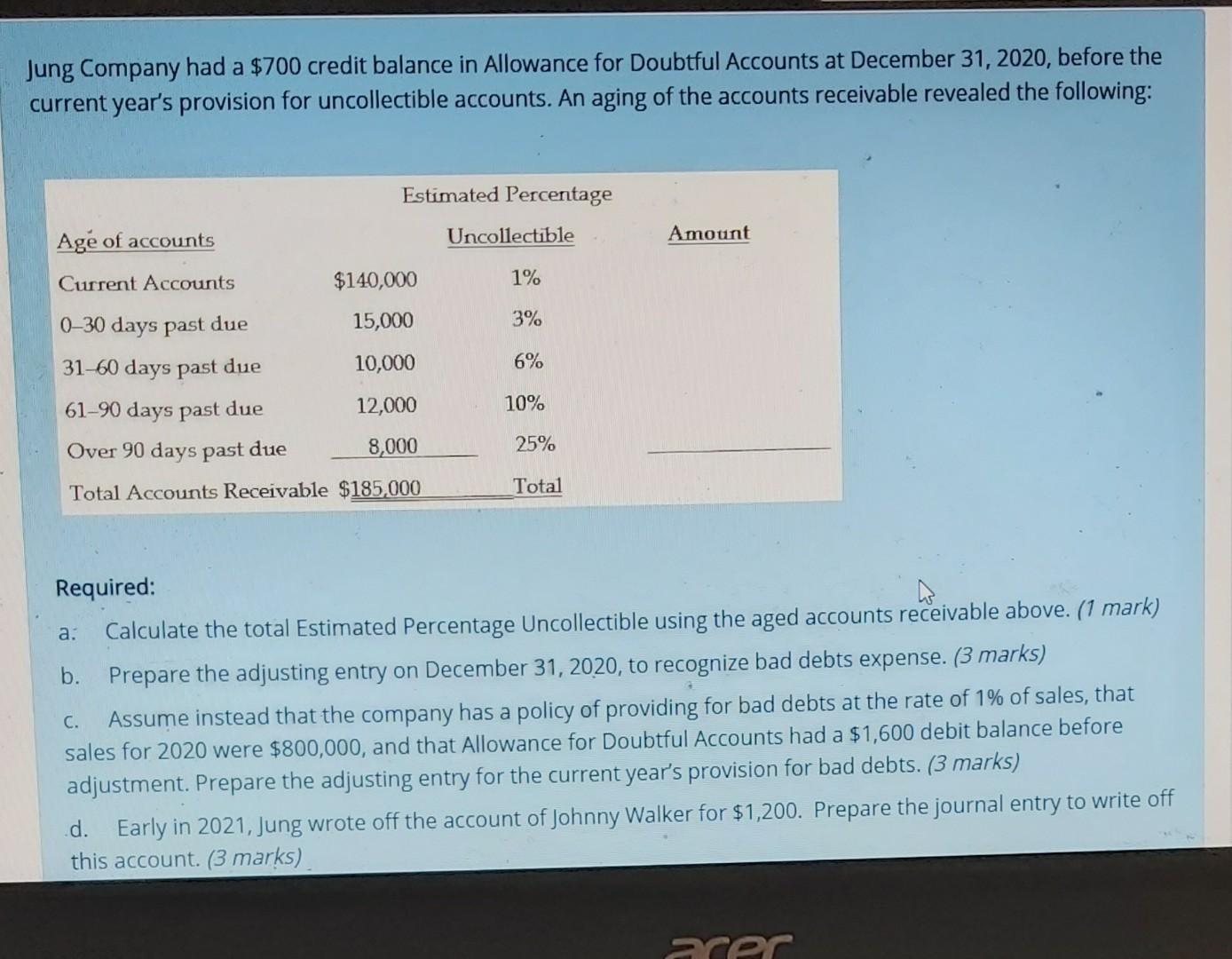

Jung Company had a $700 credit balance in Allowance for Doubtful Accounts at December 31, 2020, before the current year's provision for uncollectible accounts. An

Jung Company had a $700 credit balance in Allowance for Doubtful Accounts at December 31, 2020, before the current year's provision for uncollectible accounts. An aging of the accounts receivable revealed the following: Estimated Percentage Uncollectible Amount Age of accounts 1% 3% 6% Current Accounts $140,000 0-30 days past due 15,000 31-60 days past due 10,000 61-90 days past due 12,000 Over 90 days past due 8,000 Total Accounts Receivable $185,000 10% 25% Total a. Required: Calculate the total Estimated Percentage Uncollectible using the aged accounts receivable above. (1 mark) b. Prepare the adjusting entry on December 31, 2020, to recognize bad debts expense. (3 marks) Assume instead that the company has a policy of providing for bad debts at the rate of 1% of sales, that sales for 2020 were $800,000, and that Allowance for Doubtful Accounts had a $1,600 debit balance before adjustment. Prepare the adjusting entry for the current year's provision for bad debts. (3 marks) d. Early in 2021, Jung wrote off the account of Johnny Walker for $1,200. Prepare the journal entry to write off this account. (3 marks) C. acer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started