Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jungleland, Inc., acquired 1,000 of the 4,000 shares of Clemmons Corporation for $300 each on January 1, 2024. The book value of Jungleland's share

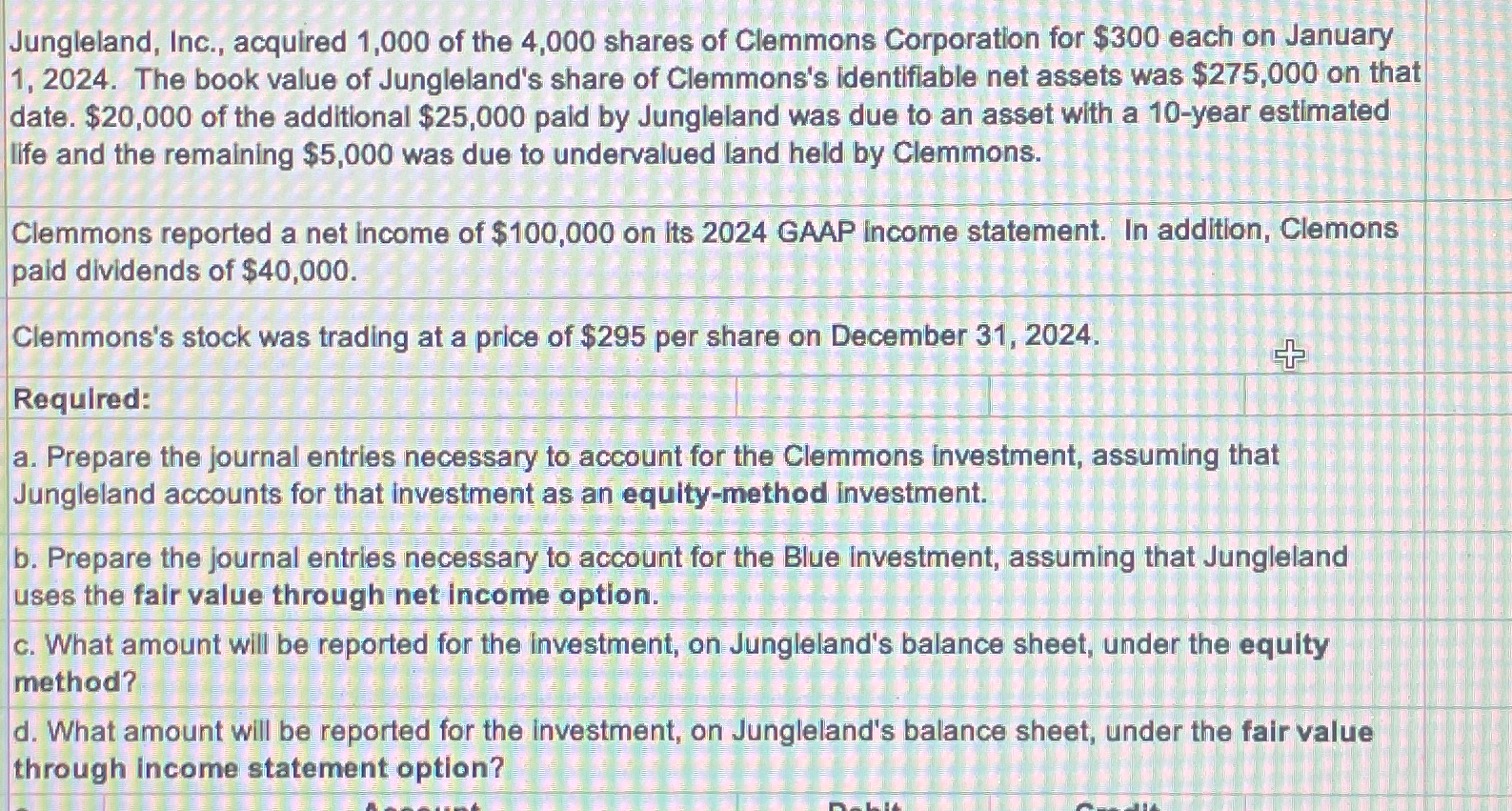

Jungleland, Inc., acquired 1,000 of the 4,000 shares of Clemmons Corporation for $300 each on January 1, 2024. The book value of Jungleland's share of Clemmons's identifiable net assets was $275,000 on that date. $20,000 of the additional $25,000 paid by Jungleland was due to an asset with a 10-year estimated life and the remaining $5,000 was due to undervalued land held by Clemmons. Clemmons reported a net income of $100,000 on its 2024 GAAP income statement. In addition, Clemons paid dividends of $40,000. Clemmons's stock was trading at a price of $295 per share on December 31, 2024. Required: a. Prepare the journal entries necessary to account for the Clemmons investment, assuming that Jungleland accounts for that investment as an equity-method investment. + b. Prepare the journal entries necessary to account for the Blue investment, assuming that Jungleland uses the fair value through net income option. c. What amount will be reported for the investment, on Jungleland's balance sheet, under the equity method? d. What amount will be reported for the investment, on Jungleland's balance sheet, under the fair value through income statement option?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a Journal entries for the equitymethod investment Date Account Debit Credit Jan 1 24 Inv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started