Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Juniper Limited Juniper Limited (Juniper) is a diversified Newfoundland based privately owned company. According to the terms of a lending agreement Juniper has with

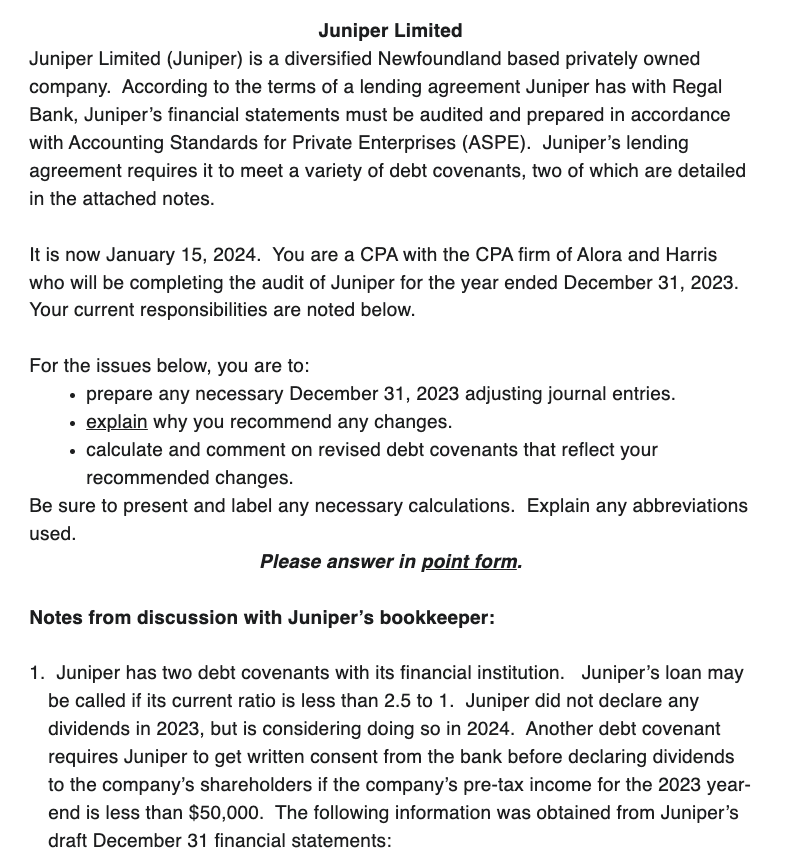

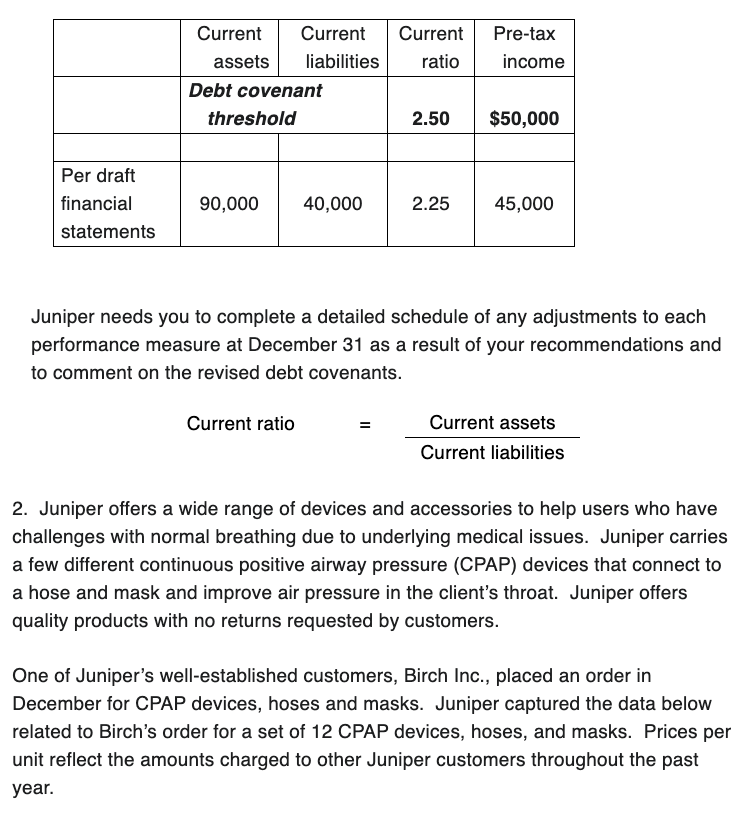

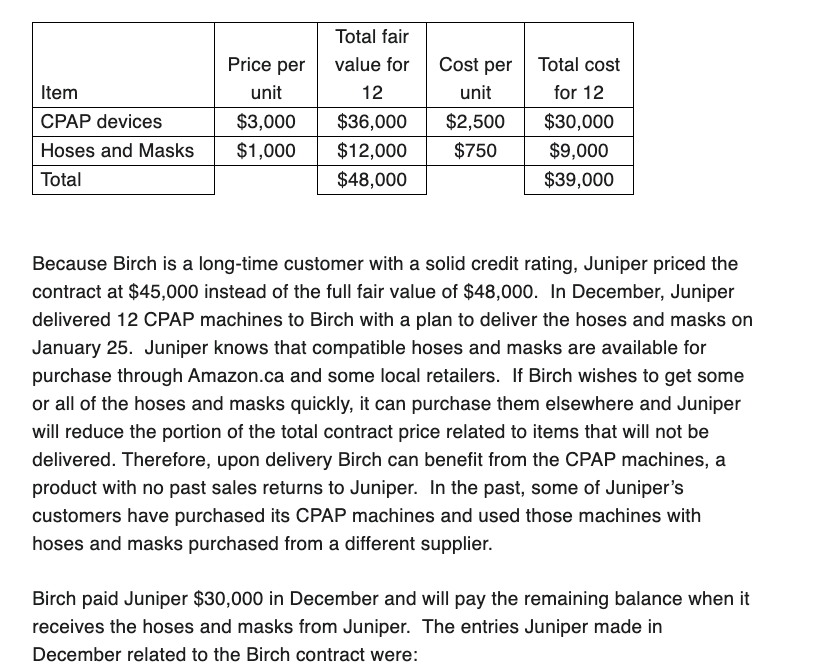

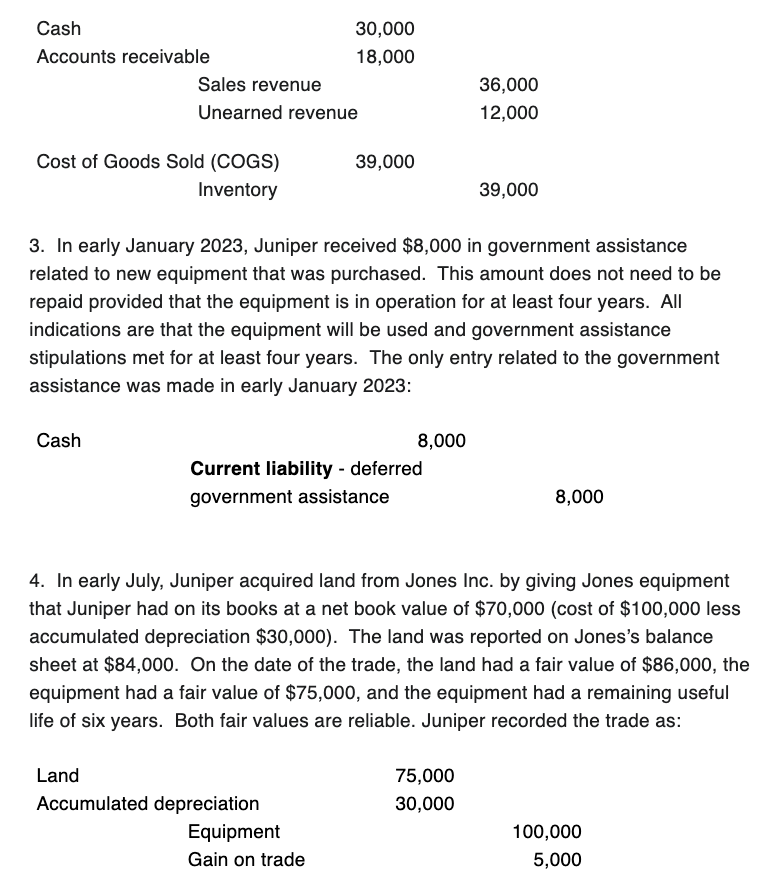

Juniper Limited Juniper Limited (Juniper) is a diversified Newfoundland based privately owned company. According to the terms of a lending agreement Juniper has with Regal Bank, Juniper's financial statements must be audited and prepared in accordance with Accounting Standards for Private Enterprises (ASPE). Juniper's lending agreement requires it to meet a variety of debt covenants, two of which are detailed in the attached notes. It is now January 15, 2024. You are a CPA with the CPA firm of Alora and Harris who will be completing the audit of Juniper for the year ended December 31, 2023. Your current responsibilities are noted below. For the issues below, you are to: prepare any necessary December 31, 2023 adjusting journal entries. explain why you recommend any changes. calculate and comment on revised debt covenants that reflect your recommended changes. Be sure to present and label any necessary calculations. Explain any abbreviations used. Please answer in point form. Notes from discussion with Juniper's bookkeeper: 1. Juniper has two debt covenants with its financial institution. Juniper's loan may be called if its current ratio is less than 2.5 to 1. Juniper did not declare any dividends in 2023, but is considering doing so in 2024. Another debt covenant requires Juniper to get written consent from the bank before declaring dividends to the company's shareholders if the company's pre-tax income for the 2023 year- end is less than $50,000. The following information was obtained from Juniper's draft December 31 financial statements: Current assets Current Current Pre-tax liabilities ratio income 2.50 $50,000 Debt covenant threshold Per draft financial statements 90,000 40,000 2.25 45,000 Juniper needs you to complete a detailed schedule of any adjustments to each performance measure at December 31 as a result of your recommendations and to comment on the revised debt covenants. Current ratio Current assets Current liabilities 2. Juniper offers a wide range of devices and accessories to help users who have challenges with normal breathing due to underlying medical issues. Juniper carries a few different continuous positive airway pressure (CPAP) devices that connect to a hose and mask and improve air pressure in the client's throat. Juniper offers quality products with no returns requested by customers. One of Juniper's well-established customers, Birch Inc., placed an order in December for CPAP devices, hoses and masks. Juniper captured the data below related to Birch's order for a set of 12 CPAP devices, hoses, and masks. Prices per unit reflect the amounts charged to other Juniper customers throughout the past year. Total fair Price per value for Cost per Total cost Item unit 12 unit for 12 CPAP devices $3,000 $36,000 $2,500 $30,000 Hoses and Masks $1,000 $12,000 $750 $9,000 Total $48,000 $39,000 Because Birch is a long-time customer with a solid credit rating, Juniper priced the contract at $45,000 instead of the full fair value of $48,000. In December, Juniper delivered 12 CPAP machines to Birch with a plan to deliver the hoses and masks on January 25. Juniper knows that compatible hoses and masks are available for purchase through Amazon.ca and some local retailers. If Birch wishes to get some or all of the hoses and masks quickly, it can purchase them elsewhere and Juniper will reduce the portion of the total contract price related to items that will not be delivered. Therefore, upon delivery Birch can benefit from the CPAP machines, a product with no past sales returns to Juniper. In the past, some of Juniper's customers have purchased its CPAP machines and used those machines with hoses and masks purchased from a different supplier. Birch paid Juniper $30,000 in December and will pay the remaining balance when it receives the hoses and masks from Juniper. The entries Juniper made in December related to the Birch contract were: Cash 30,000 Accounts receivable 18,000 Sales revenue 36,000 Unearned revenue 12,000 Cost of Goods Sold (COGS) 39,000 Inventory 39,000 3. In early January 2023, Juniper received $8,000 in government assistance related to new equipment that was purchased. This amount does not need to be repaid provided that the equipment is in operation for at least four years. All indications are that the equipment will be used and government assistance stipulations met for at least four years. The only entry related to the government assistance was made in early January 2023: Cash 8,000 Current liability - deferred government assistance 8,000 4. In early July, Juniper acquired land from Jones Inc. by giving Jones equipment that Juniper had on its books at a net book value of $70,000 (cost of $100,000 less accumulated depreciation $30,000). The land was reported on Jones's balance sheet at $84,000. On the date of the trade, the land had a fair value of $86,000, the equipment had a fair value of $75,000, and the equipment had a remaining useful life of six years. Both fair values are reliable. Juniper recorded the trade as: Land Accumulated depreciation 75,000 30,000 Equipment 100,000 Gain on trade 5,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started