Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jurses / FIN710STACKED-STACKED-34731-SUMMER2019 / Module 2 / Practice Exam 2 Suppose that you enter into a long position on a 6-month pound forward today and

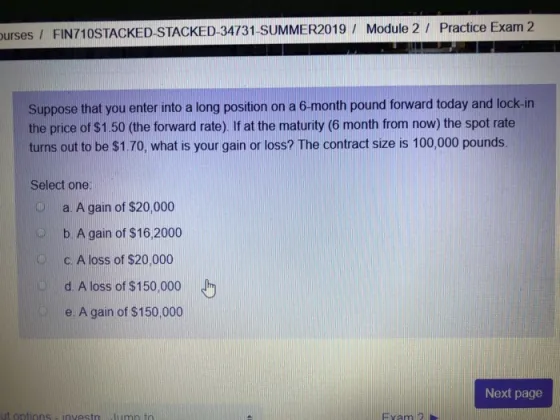

Jurses / FIN710STACKED-STACKED-34731-SUMMER2019 / Module 2 / Practice Exam 2 Suppose that you enter into a long position on a 6-month pound forward today and lock-in the price of $1.50 (the forward rate). If at the maturity (6 month from now) the spot rate turns out to be $1.70, what is your gain or loss? The contract size is 100,000 pounds. Select one: C a. A gain of $20,000 O b. A gain of $16, 2000 c. A loss of $20,000 O d. A loss of $150,000 e. A gain of $150,000 Next page tontiene investn minn

Ourses FIN710STACKED-STACKED-34731-SUMMER2019 Module 2 Practice Exam 2 Suppose that you enter into a long position on a 6-month pound forward today and lock-in the price of $1.50 (the forward rate). If at the maturity (6 month from now) the spot rate turns out to be $1.70, what is your gain or loss? The contract size is 100,000 pounds. Select one: O a. A gain of $20,000 b. A gain of $16,2000 c. A loss of $20,000 d. A loss of $150,000 h e. A gain of $150,000 Next page ut options investo Jump to Exam 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started