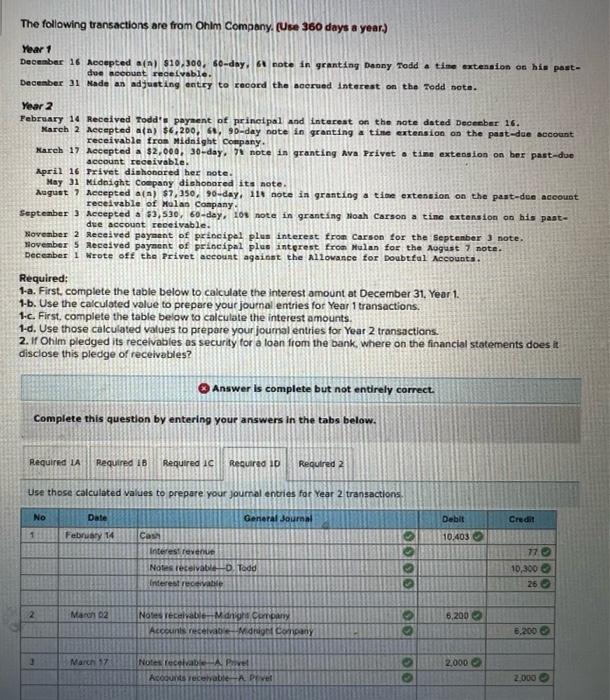

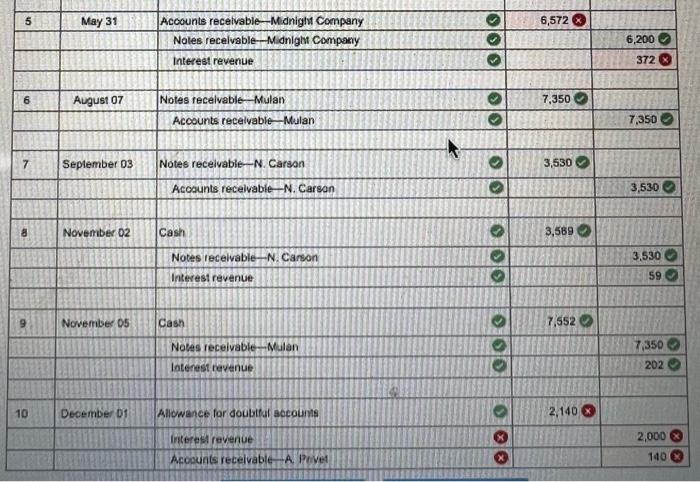

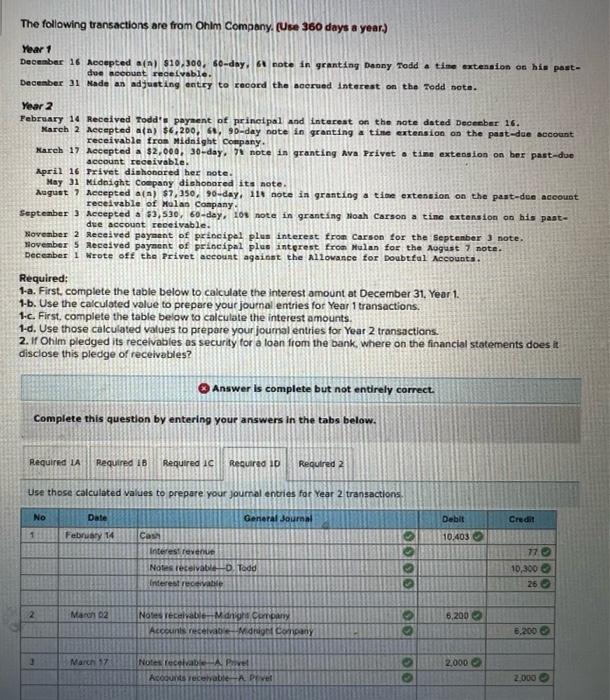

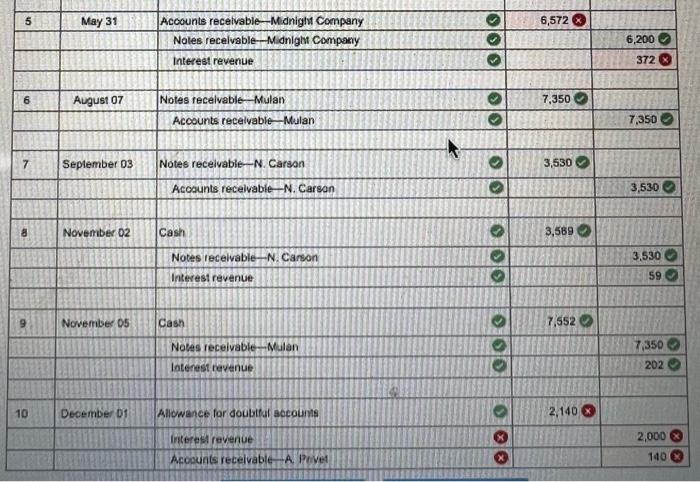

just 1D, parts in red please.

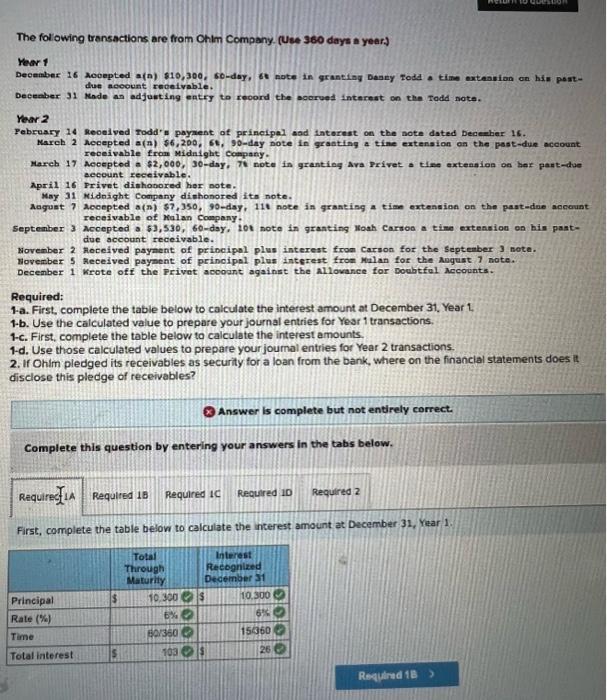

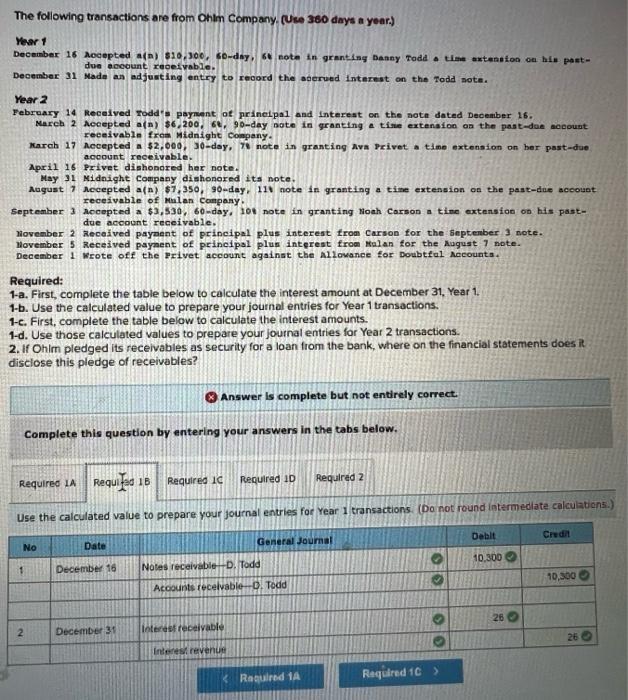

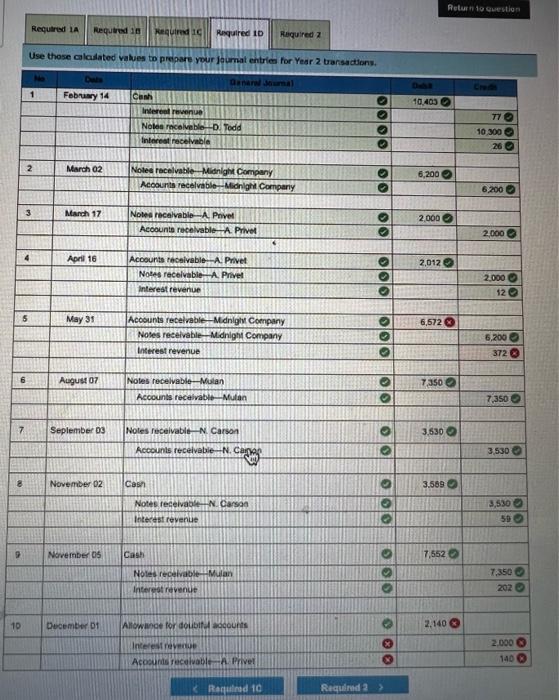

The following transactions are from Ohim Company. (Use 360 days a year) Year 1 Deceaber 16 Acoepted a(A) $10,300,50-doy, 6t note in granting Danny Todd a time extenaion on hin pastdue nocount receivable. Decenber 31 Made an adjusting entry to record the scerued interest on the Fodd nota. Year 2 February 14 Received Todd' w payaent of prinelpal and interest on the note dated Decenber 16. Karch 2 Mecepted a(n)$6,200,51,90-day note in granting a time extension on the past-due scoount receivable from Midaight Conpany. Karch 17 Mecepted a $2,000,30-day, 7 note in granting Ava Frivet a time extension on ber past-due account receivable. April 16 Frivet dishonored her note. May 31 Nidnight Coepany diehonored its note. Aagunt? neepted a(n) $7,350, 90-day, 111 note in granting a tion extension on the past-due account recelvable of Malan Conpany. Septenber 3 Aceepted a 53,530,60-dey, 101 note in granting Hoah Carson a tine extension on his pastdre account reveivable. Novenber 2 Received paynent of prineipel plus interest fron carson for the September 3 note. november 5 Received paynent of prineipal plue interest fron Nulan for the ragust 7 note. Decenber 1 wrote off tho Privet account against the Mllovance for Doubtiful Necounts. Required: 1.a. First, complete the table below to caiculate the interest amount at December 31, Year 1. 1.b. Use the calculated value to prepare your journal entries for Year 1 transactions. 1.c. First, complete the table below to calculate the interest amounts. 1-d. Use those calculated values to prepare your joumal entries for Year 2 transactions. 2. If Ohim pledged its recelvables as security for a loan from the bank, where on the financial statements does it disclose this pledge of receivables? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Use those calculated values to prepare your journal entries for Year 2 transactions. The fol owing transactions are from Chlm Company. (Use 360 days a year.) Year 1 Decenber 16 sooepted a(n) 810,300 , so-doy, 6t note in grantiay Dasey Todd a time extenion on his pestdue nooount recetrable. Deceaber 31 Minde an adjunting entry to record the soorvel interest on the Todd note. Year 2 Pebruary 14 Reoelved Todd' n paynent of prineipal ad intorest on the note dated becember 16. Karch 2 Nocepted a(n)$6,200,5s, g0-day note in granting a time extension on the past-due account receivable from Midnight Conpany. Mareh 17 Aeoepted a $2,000,30-day, Th note in grantiag Ava Privet a tien extenion on her pant-due account receivable. April 16 Privet diahonored her note. May 31 Midnight Company dizhonored ita note. Aaguat? socepted a(n) 57,350,90-dsy, 112 note in granting a time extendion on the past-dne socaunt receivable of Malan Company. September 3 Mccepted a 53,530,60-day, 101 noto in granting loak Carsoo a time extension on bis pastdue account receivable. November 2 Moceived paynent of pripeipol plus interest from Carson for the septenber 3 note. Noverber 5 Meceived paynent of prinoipal plus interest from Malan for the Angust. 1 note. Decenber 1 Krote off the Privet acooant against the Allovance for Doubtfol Accounts. Required: 1-a. First, complete the table below to calculate the interest amount at December 31, Year 1 . 1-b. Use the calculated value to prepare your journal entries for Year 1 transactions. 1-c. First, complete the table below to calculate the interest amounts. 1-d. Use those calculated values to prepare your joumal entries for Year 2 transactions. 2. If Ohim pledged its receivables as security for a loan from the bank, where on the financial statements does it disclose this pledge of receivables? x) Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. First, complete the table below to calculate the nterest amount at December 31 , Year 1 . The following transactions are from Ohlm Company, (Use 380 days a year.) Year 1 December 15 Aocepted a(n) 810,300 , Go-dny, 6t noth in granting Danny rodd a the axtenston on hle pastdoe ecoount redeivable. December 31 Made an adjusting entry to reoord the agerued interest on the 7odd note. Year 2 Febroary 14. Received Todd's payment of prinelpa1 and interest on the noth dated December 16. March 2 Aceepted a(n) 36,200,60,90-day note in granting a tire extenaion an the past-doe accoust reeeivable irea Midnight company. Karch 17 Mecepted a $2,000, 30-doy, 7e note in qranting Ava Privet a time extenaion on ber past-due acoount receivable. April if Privet dishoncred her note. May 31 Midnight Company diahonored its note. August 7 Mecepted a(n) $7,350,90-day. 111 note in granting a time extension on the past-due account receivable of Mulan Canpany. September 3 accopted a $3,530,60-day, 101 note in granting Noah Carson a time extersion on his pastdue account receivable. noveaber 2 Received payment of principal plus interest from carson for the septenber 3 note. November 5 Received payment of principal plue interest from Malan for the August 7 note. December 1 Wrote off the Privet account againat the Allovanee for Doubtfal Necounta. Required: 1-a. First, complete the table below to calculate the interest amount at December 31, Year 1. 1-b. Use the calculated value to prepare your journal entries for Year 1 transactions. 1-c. First, complete the table below to calculate the interest amounts. 1-d. Use those calculated values to prepare your journal entries for Year 2 transactions. 2. If Ohim pledged its receivables as security for a loan from the bank, where on the financial statements does it disclose this pledge of receivables? (x) Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Use the calculated value to prepare your journal entries for Year 1 transactions. (Do not round intermedate calculations.) Petarn 10 cenection Use those calcalatod values to prepare your foumat entrien for Year 2 barsadians