Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just a little bit confused about problem 5. Can someone give me a thought on how to answer problem 5? Do I need to use

Just a little bit confused about problem 5. Can someone give me a thought on how to answer problem 5? Do I need to use NPV, NFV, or net wealth to solve it? Or just compare the total amount spent on renting and buying in 10 years?

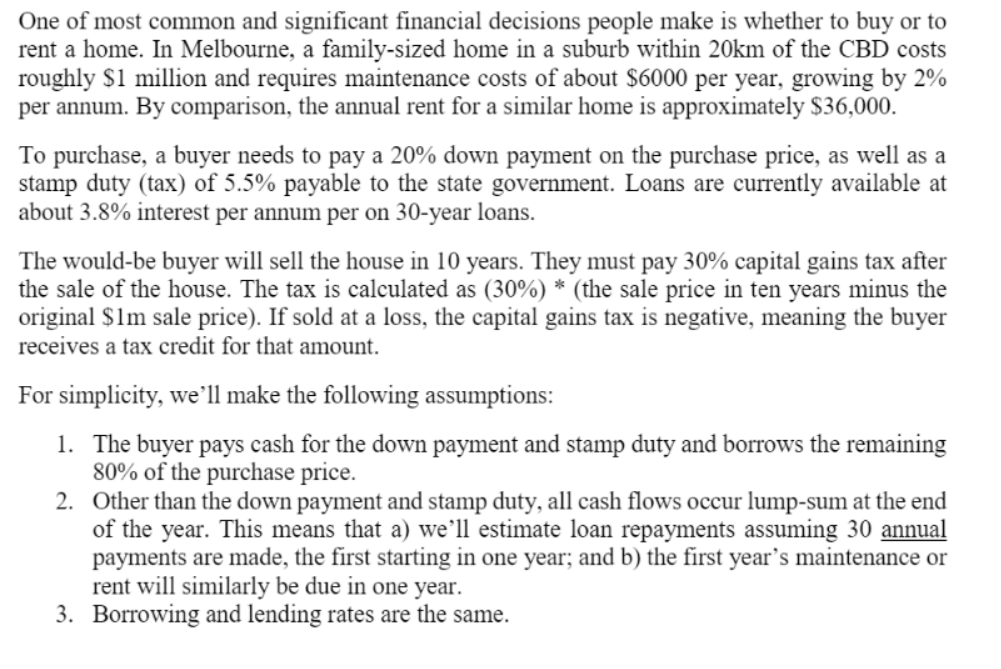

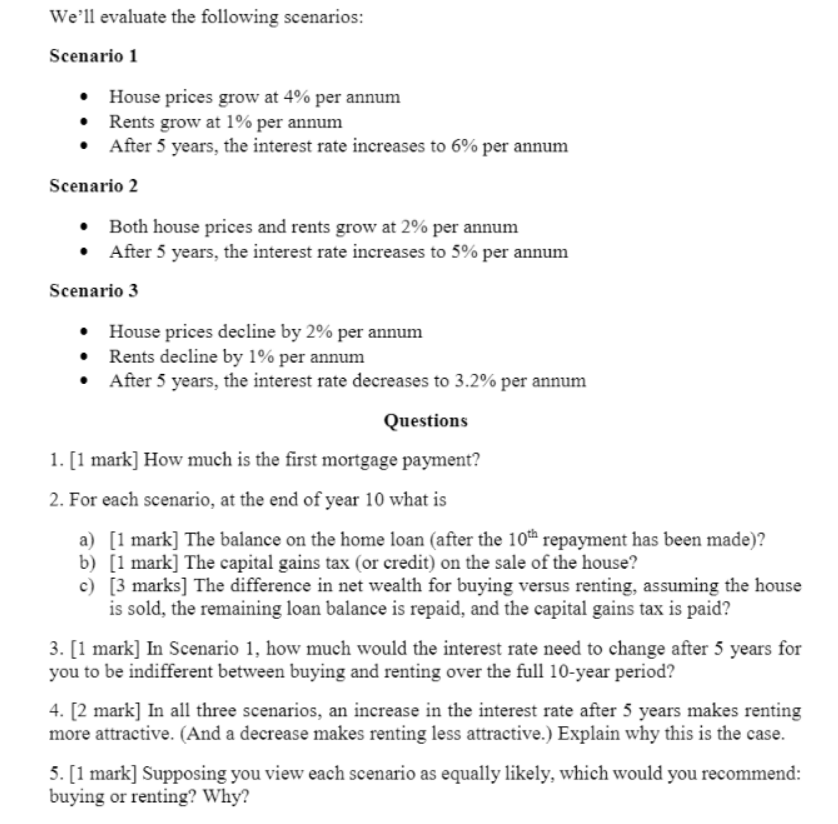

One of most common and significant financial decisions people make is whether to buy or to rent a home. In Melbourne, a family-sized home in a suburb within 20km of the CBD costs roughly $1 million and requires maintenance costs of about $6000 per year, growing by 2% per annum. By comparison, the annual rent for a similar home is approximately $36,000. To purchase, a buyer needs to pay a 20% down payment on the purchase price, as well as a stamp duty (tax) of 5.5% payable to the state government. Loans are currently available at about 3.8% interest per annum per on 30-year loans. The would-be buyer will sell the house in 10 years. They must pay 30% capital gains tax after the sale of the house. The tax is calculated as (30%) * (the sale price in ten years minus the original $1m sale price). If sold at a loss, the capital gains tax is negative, meaning the buyer receives a tax credit for that amount. For simplicity, we'll make the following assumptions: 1. The buyer pays cash for the down payment and stamp duty and borrows the remaining 80% of the purchase price. 2. Other than the down payment and stamp duty, all cash flows occur lump-sum at the end of the year. This means that a) we'll estimate loan repayments assuming 30 annual payments are made, the first starting in one year; and b) the first year's maintenance or rent will similarly be due in one year. 3. Borrowing and lending rates are the same. We'll evaluate the following scenarios: Scenario 1 House prices grow at 4% per annum Rents grow at 1% per annum After 5 years, the interest rate increases to 6% per annum Scenario 2 Both house prices and rents grow at 2% per annum After 5 years, the interest rate increases to 5% per annum Scenario 3 House prices decline by 2% per annum Rents decline by 1% per annum After 5 years, the interest rate decreases to 3.2% per annum Questions 1. [1 mark] How much is the first mortgage payment? 2. For each scenario, at the end of year 10 what is a) [1 mark] The balance on the home loan (after the 10th repayment has been made)? b) [1 mark] The capital gains tax (or credit) on the sale of the house? c) [3 marks] The difference in net wealth for buying versus renting, assuming the house is sold, the remaining loan balance is repaid, and the capital gains tax is paid? 3. [1 mark] In Scenario 1, how much would the interest rate need to change after 5 years for you to be indifferent between buying and renting over the full 10-year period? 4. [2 mark] In all three scenarios, an increase in the interest rate after 5 years makes renting more attractive. (And a decrease makes renting less attractive.) Explain why this is the case. 5. [1 mark] Supposing you view each scenario as equally likely, which would you recommend: buying or renting? WhyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started