Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just answer a ,b,c or d . can you just answer a,b,c or d. with no explanation. PART A: Multiple Choice Questions (MCQs) (Total= 50

Just answer a ,b,c or d .

can you just answer a,b,c or d. with no explanation.

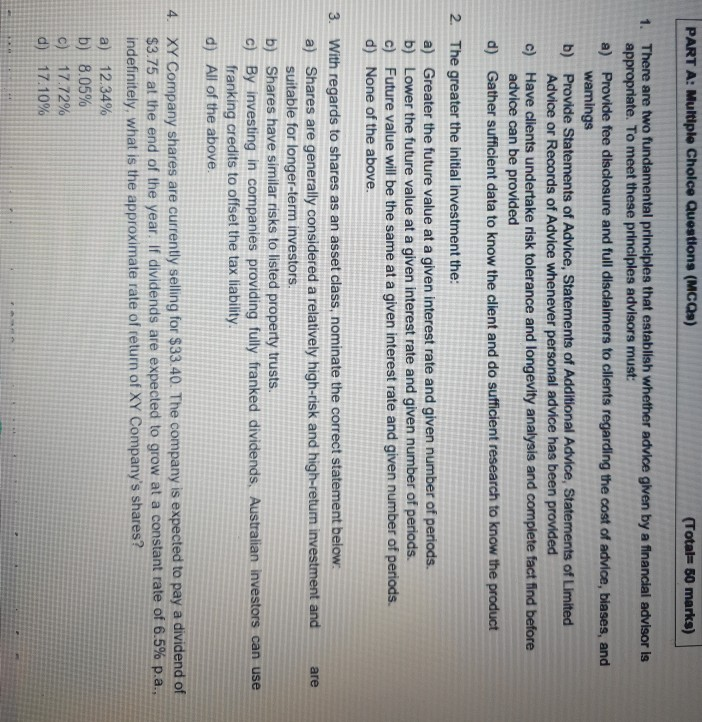

PART A: Multiple Choice Questions (MCQs) (Total= 50 marks) 1. There are two fundamental principles that establish whether advice given by a financial advisor is appropriate. To meet these principles advisors must: a) Provide fee disclosure and full disclaimers to clients regarding the cost of advice, biases, and wamings b) Provide Statements of Advice, Statements of Additional Advice, Statements of Limited Advice or Records of Advice whenever personal advice has been provided c) Have clients undertake risk tolerance and longevity analysis and complete fact find before advice can be provided d) Gather sufficient data to know the client and do sufficient research to know the product 2. The greater the initial investment the: a) Greater the future value at a given interest rate and given number of periods. b) Lower the future value at a given interest rate and given number of periods. c) Future value will be the same at a given interest rate and given number of periods. d) None of the above. 3. With regards to shares as an asset class, nominate the correct statement below: a) Shares are generally considered a relatively high-risk and high-return investment and suitable for longer-term investors. b) Shares have similar risks to listed property trusts. C) By investing in companies providing fully franked dividends, Australian investors can use franking credits to offset the tax liability d) All of the above are 4. XY Company shares are currently selling for $33.40. The company is expected to pay a dividend of $3.75 at the end of the year. If dividends are expected to grow at a constant rate of 6.5% p.a., indefinitely, what is the approximate rate of return of XY Company's shares? a) 12.34% b) 8.05% c) 17.72% d) 17.10%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started