Just answer Q10.3

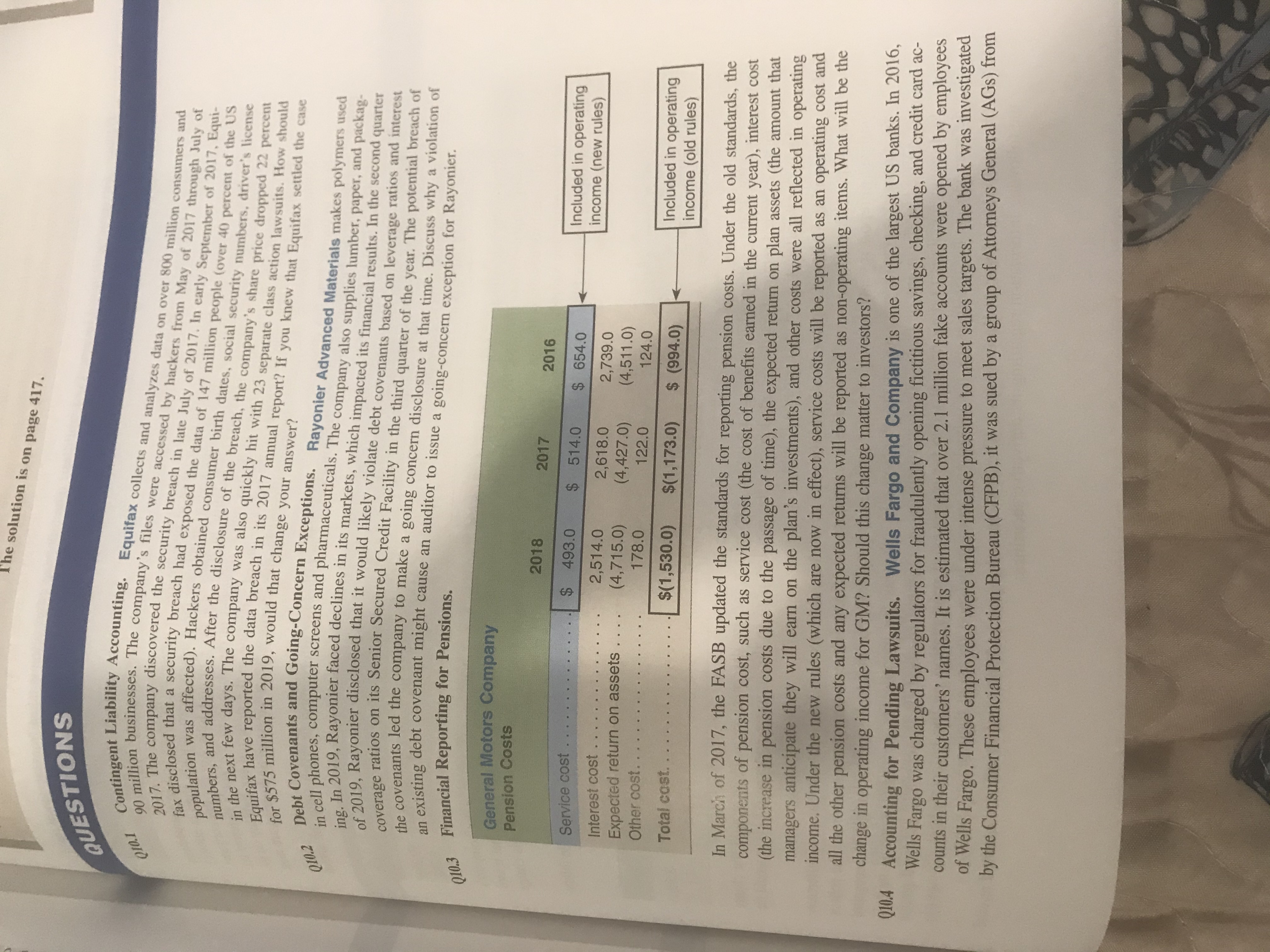

The solution is on page 417. QUESTIONS Q10.1 Contingent Liability Accounting. Equifax collects and analyzes data on over 800 million consumers and 0 million businesses. The company's files were accessed by hackers from May of 2017 through July of 2017. The company discovered the security breach in late July of 2017. In early September of 2017. Equi zix disclosed that a security breach had exposed the data of 147 million people (over 40 percent of the US population was affected). Hackers obtained consumer birth dates, social security numbers, driver's license Plumbers, and addresses. After the disclosure of the breach, the company's share price dropped 22 percent " the next few days. The company was also quickly hit with 23 separate class action lawsuits. How should Equifax have reported the data breach in its 2017 annual report? If you knew that Equifax settled the case for $575 million in 2019, would that change your answer? Q10.2 Debt Covenants and Going-Concern Exceptions. Rayonier Advanced Materials makes polymers used in cell phones, computer screens and pharmaceuticals. The company also supplies lumber, paper, and package ing. In 2019, Rayonier faced declines in its markets, which impacted its financial results. In the second quarter of 2019, Rayonier disclosed that it would likely violate debt covenants based on leverage ratios and interest coverage ratios on its Senior Secured Credit Facility in the third quarter of the year. The potential breach of the covenants led the company to make a going concern disclosure at that time. Discuss why a violation of an existing debt covenant might cause an auditor to issue a going-concern exception for Rayonier. Q10.3 Financial Reporting for Pensions. General Motors Company Pension Costs 2018 2017 2016 Service cost . . ..... . . . . $ 493.0 $ 514.0 $ 654.0 Included in operating income (new rules) Interest cost .. . . . . . . . 2,514.0 2,618.0 2,739.0 Expected return on assets . . .. (4, 715.0) (4,427.0) (4,511.0) Other cost. . .. . . . . . . 178.0 122.0 124.0 Total cost. . ...... $(1,530.0) $(1, 173.0) $ (994.0) Included in operating income (old rules) In March of 2017, the FASB updated the standards for reporting pension costs. Under the old standards, the components of pension cost, such as service cost (the cost of benefits earned in the current year), interest cost (the increase in pension costs due to the passage of time), the expected return on plan assets (the amount that managers anticipate they will earn on the plan's investments), and other costs were all reflected in operating income. Under the new rules (which are now in effect), service costs will be reported as an operating cost and all the other pension costs and any expected returns will be reported as non-operating items. What will be the change in operating income for GM? Should this change matter to investors? Q10.4 Accounting for Pending Lawsuits. Wells Fargo and Company is one of the largest US banks. In 2016, Wells Fargo was charged by regulators for fraudulently opening fictitious savings, checking, and credit card ac- counts in their customers' names. It is estimated that over 2. 1 million fake accounts were opened by employees of Wells Fargo. These employees were under intense pressure to meet sales targets. The bank was investigated by the Consumer Financial Protection Bureau (CFPB), it was sued by a group of Attorneys General (AGs) from