Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just asking about question 3. The information for it is in the first picture from question 1. Question 1 (25 points): An investor has two

Just asking about question 3. The information for it is in the first picture from question 1.

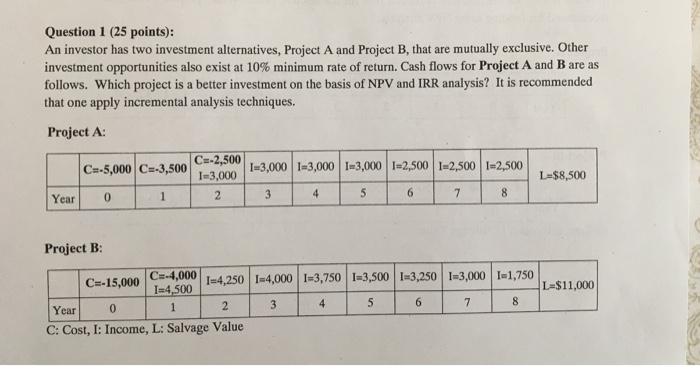

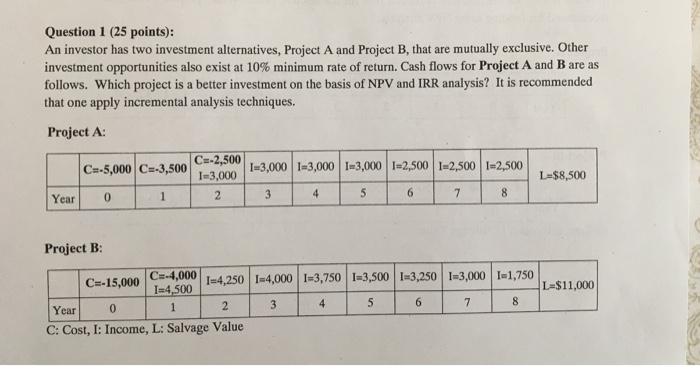

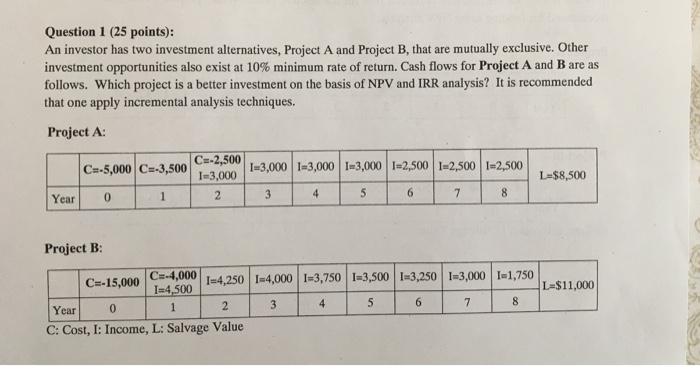

Question 1 (25 points): An investor has two investment alternatives, Project A and Project B, that are mutually exclusive. Other investment opportunities also exist at 10% minimum rate of return. Cash flows for Project A and B are as follows. Which project is a better investment on the basis of NPV and IRR analysis? It is recommended that one apply incremental analysis techniques. Project A: C=-5,000 C--3.500 C-2,500 1-3,000 001-3,000 1-3,000 13,000 1=2,500 1-2,500 1-2,500 , 0 00 0 1 2 3 4 5 6 7 8 L-$8,500 Year Project B: L=$11,000 CH-15,000 C24,000 1-4,250 1-4,000 1-3,750 1-3,500 1-3,250 1-3,000 1-1,750 Year 0 1 2 3 4 5 6 7 8 C: Cost, I: Income, L: Salvage Value Question 3 (25 points): Same as question 1, but project A is being pushed back two years. Re-do your analysis

Question 1 (25 points): An investor has two investment alternatives, Project A and Project B, that are mutually exclusive. Other investment opportunities also exist at 10% minimum rate of return. Cash flows for Project A and B are as follows. Which project is a better investment on the basis of NPV and IRR analysis? It is recommended that one apply incremental analysis techniques. Project A: C=-5,000 C--3.500 C-2,500 1-3,000 001-3,000 1-3,000 13,000 1=2,500 1-2,500 1-2,500 , 0 00 0 1 2 3 4 5 6 7 8 L-$8,500 Year Project B: L=$11,000 CH-15,000 C24,000 1-4,250 1-4,000 1-3,750 1-3,500 1-3,250 1-3,000 1-1,750 Year 0 1 2 3 4 5 6 7 8 C: Cost, I: Income, L: Salvage Value Question 3 (25 points): Same as question 1, but project A is being pushed back two years. Re-do your analysis

Just asking about question 3. The information for it is in the first picture from question 1.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started