Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just Dew It Corporation reports the following balance sheet information for 2017 and 2018. JUST DEW IT CORPORATION 2017 and 2018 Balance Sheets Assets Liabilities

| Just Dew It Corporation reports the following balance sheet information for 2017 and 2018. |

| JUST DEW IT CORPORATION 2017 and 2018 Balance Sheets | ||||||||||||||||

| Assets | Liabilities and Owners Equity | |||||||||||||||

| 2017 | 2018 | 2017 | 2018 | |||||||||||||

| Current assets | Current liabilities | |||||||||||||||

| Cash | $ | 11,250 | $ | 19,440 | Accounts payable | $ | 30,600 | $ | 49,200 | |||||||

| Accounts receivable | 11,850 | 16,080 | Notes payable | 24,900 | 31,200 | |||||||||||

| Inventory | 39,150 | 60,240 | ||||||||||||||

| Total | $ | 62,250 | $ | 95,760 | Total | $ | 55,500 | $ | 80,400 | |||||||

| Long-term debt | $ | 27,000 | $ | 24,000 | ||||||||||||

| Owners equity | ||||||||||||||||

| Common stock and paid-in surplus | $ | 48,000 | $ | 48,000 | ||||||||||||

| Retained earnings | 169,500 | 327,600 | ||||||||||||||

| Net plant and equipment | $ | 237,750 | $ | 384,240 | Total | $ | 217,500 | $ | 375,600 | |||||||

| Total assets | $ | 300,000 | $ | 480,000 | Total liabilities and owners equity | $ | 300,000 | $ | 480,000 | |||||||

| For each account on this companys balance sheet, show the change in the account during 2018 and note whether this change was a source or use of cash. (If there is no action select "None" from the dropdown options. Leave no cells blank - be certain to enter "0" wherever required. A negative answer should be indicated by a minus sign |

please solve all questions

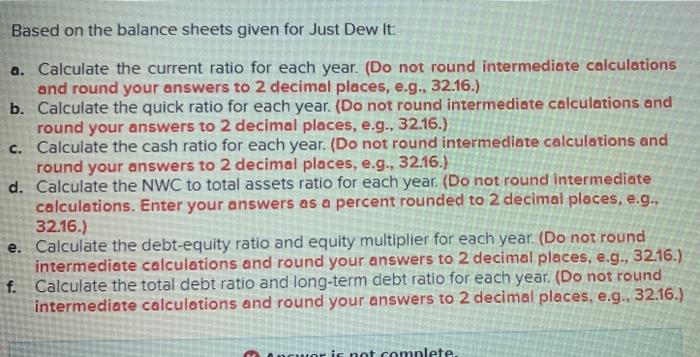

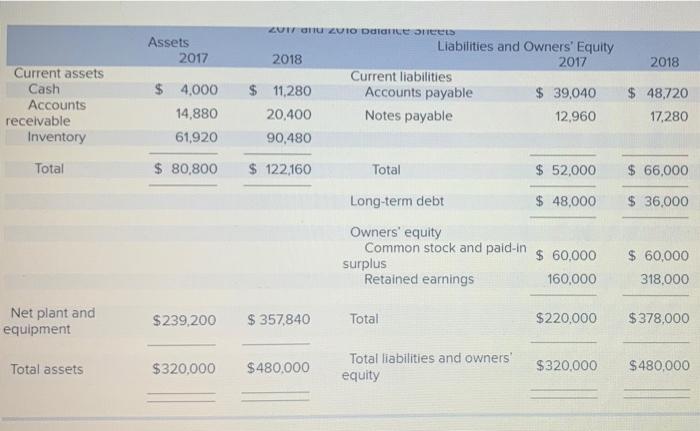

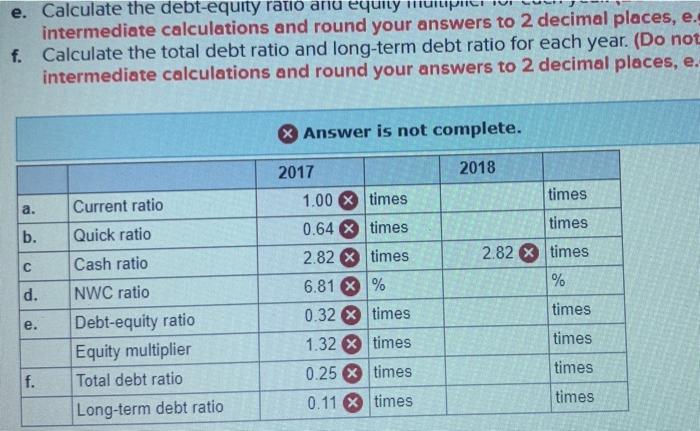

Based on the balance sheets given for Just Dew it: a. Calculate the current ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Calculate the quick ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. Calculate the cash ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) d. Calculate the NWC to total assets ratio for each year. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) e. Calculate the debt-equity ratio and equity multiplier for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) f. Calculate the total debt ratio and long-term debt ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) mor is not comnlete. Assets 2017 2018 Current assets Cash Accounts receivable Inventory Total $ 4,000 14,880 61,920 Liabilities and Owners' Equity 2018 2017 Current liabilities $ 11,280 Accounts payable $ 39,040 20,400 Notes payable 12,960 90,480 $ 48,720 17,280 $ 80,800 $ 122,160 Total $ 52,000 $ 66,000 Long-term debt $ 48,000 $36.000 Owners' equity Common stock and paid-in surplus Retained earnings $ 60,000 160,000 $ 60,000 318.000 Net plant and equipment $239,200 $ 357,840 Total $220,000 $378,000 Total assets $320,000 $480,000 Total liabilities and owners' equity $320,000 $480,000 e. Calculate the debt-equity ratio anu equity TUILI intermediate calculations and round your answers to 2 decimal places, e. f. Calculate the total debt ratio and long-term debt ratio for each year. (Do not intermediate calculations and round your answers to 2 decimal places, e. & Answer is not complete. 2018 times a. Current ratio Quick ratio b. times 2.82 X times C Cash ratio 2017 1.00 X times 0.64 x times 2.82 X times 6.81 X % 0.32 X times 1.32 X times 0.25 X times % d. times e. times NWC ratio Debt-equity ratio Equity multiplier Total debt ratio Long-term debt ratio times f. 0.11 X times times sed on the balance sheets given for Just Dew It: Calculate the current ratio for each year. (Do not round intermediate calculat and round your answers to 2 decimal places, e.g., 32.16.) Calculate the quick ratio for each year. (Do not round intermediate calculations round your answers to 2 decimal places, e.g., 32.16.) Calculate the cash ratio for each year. (Do not round intermediate calculations round your answers to 2 decimal places, e.g., 32.16.) Calculate the NWC to total assets ratio for each year. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e. 32.16.) Calculate the debt-equity ratio and equity multiplier for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 3- Calculate the total debt ratio and long-term debt ratio for each year. (Do not rou intermediate calculations and round your answers to 2 decimal places, e.g., 3 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started