Answered step by step

Verified Expert Solution

Question

1 Approved Answer

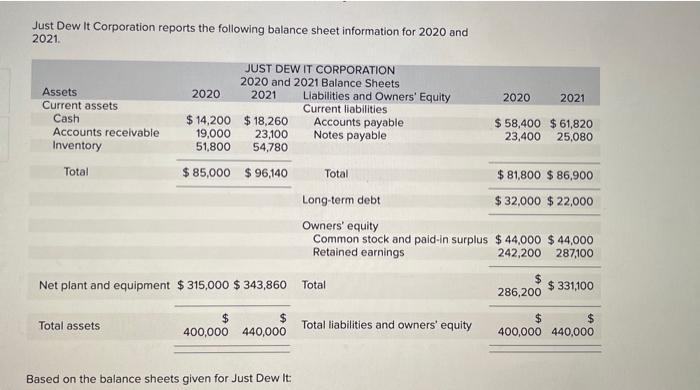

Just Dew It Corporation reports the following balance sheet information for 2020 and 2021. Assets 2020 JUST DEW IT CORPORATION 2020 and 2021 Balance

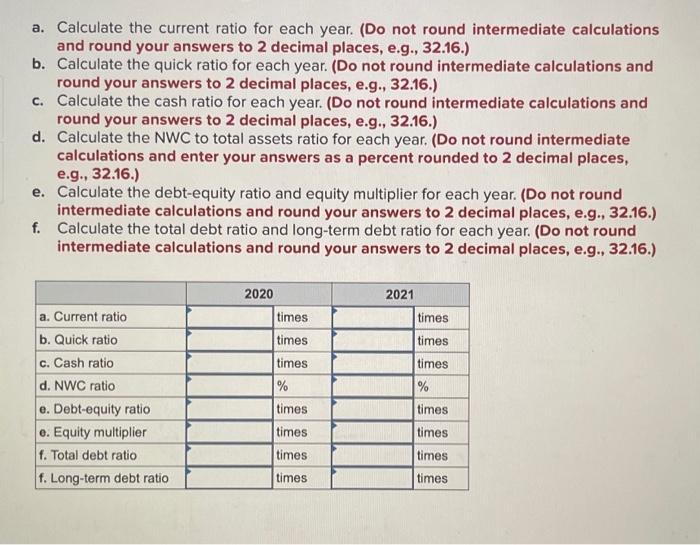

Just Dew It Corporation reports the following balance sheet information for 2020 and 2021. Assets 2020 JUST DEW IT CORPORATION 2020 and 2021 Balance Sheets 2021 $14,200 $18,260 19,000 23,100 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Current assets Cash Accounts receivable Inventory 51,800 54,780 Total $85,000 $96,140 Total Long-term debt Owners' equity 2020 2021 $ 58,400 $ 61,820 23,400 25,080 $ 81,800 $ 86,900 $32,000 $22,000 Common stock and paid-in surplus $44,000 $44,000 Retained earnings 242,200 287,100 Net plant and equipment $315,000 $ 343,860 Total $331,100 286,200 $ Total assets Total liabilities and owners' equity 400,000 440,000 $ $ 400,000 440,000 Based on the balance sheets given for Just Dew It: a. Calculate the current ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Calculate the quick ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. Calculate the cash ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) d. Calculate the NWC to total assets ratio for each year. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) e. Calculate the debt-equity ratio and equity multiplier for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) f. Calculate the total debt ratio and long-term debt ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) 2020 2021 a. Current ratio b. Quick ratio times times times times c. Cash ratio times times d. NWC ratio % % e. Debt-equity ratio times times e. Equity multiplier times times f. Total debt ratio times times f. Long-term debt ratio times times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started