Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just for reference, Answer is ROC=30% ROE=56.6% NI t+1 = 2131 NI t+2 = 2613 NI t+3 = 3204 Equity t+3 = 3765+0.4(2131+2613+3204)+5000=11944 NI t+4

Just for reference, Answer is

ROC=30%

ROE=56.6%

NI t+1 = 2131

NI t+2 = 2613

NI t+3 = 3204

Equity t+3 = 3765+0.4(2131+2613+3204)+5000=11944

NI t+4 = 6760

Could you help me find out how to get these nunbers?

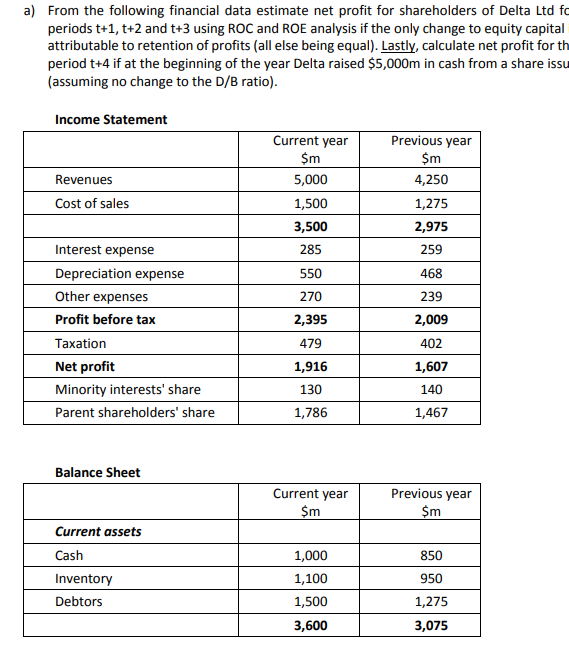

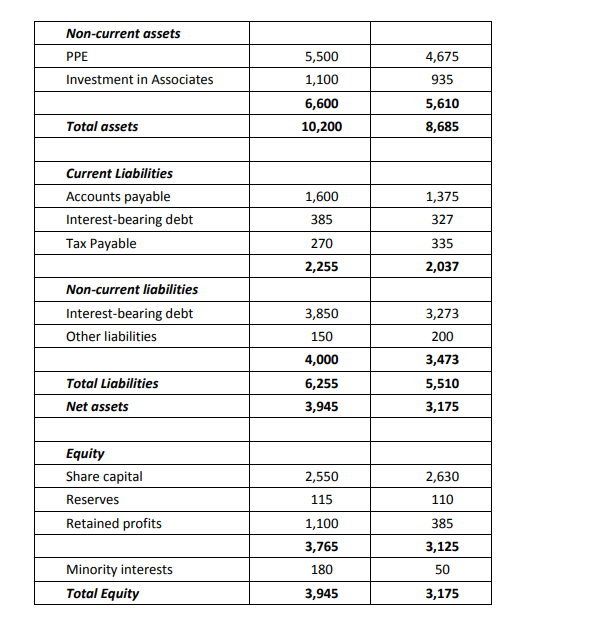

a) From the following financial data estimate net profit for shareholders of Delta Ltd fo periods t+1, t+2 and t+3 using ROC and ROE analysis if the only change to equity capital attributable to retention of profits (all else being equal). Lastly, calculate net profit for th period t+4 if at the beginning of the year Delta raised $5,000m in cash from a share issu (assuming no change to the D/B ratio). Income Statement Revenues Cost of sales Current year $m 5,000 1,500 3,500 285 Previous year $m 4,250 1,275 2,975 259 550 468 270 239 2,395 2,009 Interest expense Depreciation expense Other expenses Profit before tax Taxation Net profit Minority interests' share Parent shareholders' share 479 402 1,607 1,916 130 140 1,786 1,467 Balance Sheet Current year $m Previous year $m 850 Current assets Cash Inventory Debtors 950 1,000 1,100 1,500 3,600 1,275 3,075 Non-current assets PPE Investment in Associates 4,675 935 5,500 1,100 6,600 10,200 5,610 8,685 Total assets Current Liabilities Accounts payable Interest-bearing debt Tax Payable 1,600 385 1,375 327 270 335 2,037 2,255 Non-current liabilities Interest-bearing debt Other liabilities 3,850 150 3,273 200 3,473 5,510 3,175 4,000 6,255 3,945 Total Liabilities Net assets 2,550 2,630 Equity Share capital Reserves Retained profits 115 110 385 1,100 3,765 3,125 180 50 Minority interests Total Equity 3,945 3,175 a) From the following financial data estimate net profit for shareholders of Delta Ltd fo periods t+1, t+2 and t+3 using ROC and ROE analysis if the only change to equity capital attributable to retention of profits (all else being equal). Lastly, calculate net profit for th period t+4 if at the beginning of the year Delta raised $5,000m in cash from a share issu (assuming no change to the D/B ratio). Income Statement Revenues Cost of sales Current year $m 5,000 1,500 3,500 285 Previous year $m 4,250 1,275 2,975 259 550 468 270 239 2,395 2,009 Interest expense Depreciation expense Other expenses Profit before tax Taxation Net profit Minority interests' share Parent shareholders' share 479 402 1,607 1,916 130 140 1,786 1,467 Balance Sheet Current year $m Previous year $m 850 Current assets Cash Inventory Debtors 950 1,000 1,100 1,500 3,600 1,275 3,075 Non-current assets PPE Investment in Associates 4,675 935 5,500 1,100 6,600 10,200 5,610 8,685 Total assets Current Liabilities Accounts payable Interest-bearing debt Tax Payable 1,600 385 1,375 327 270 335 2,037 2,255 Non-current liabilities Interest-bearing debt Other liabilities 3,850 150 3,273 200 3,473 5,510 3,175 4,000 6,255 3,945 Total Liabilities Net assets 2,550 2,630 Equity Share capital Reserves Retained profits 115 110 385 1,100 3,765 3,125 180 50 Minority interests Total Equity 3,945 3,175Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started