just give me question No and its letter

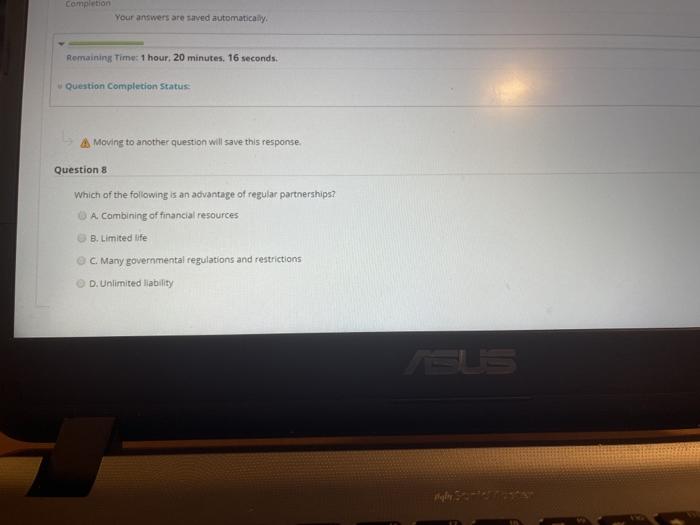

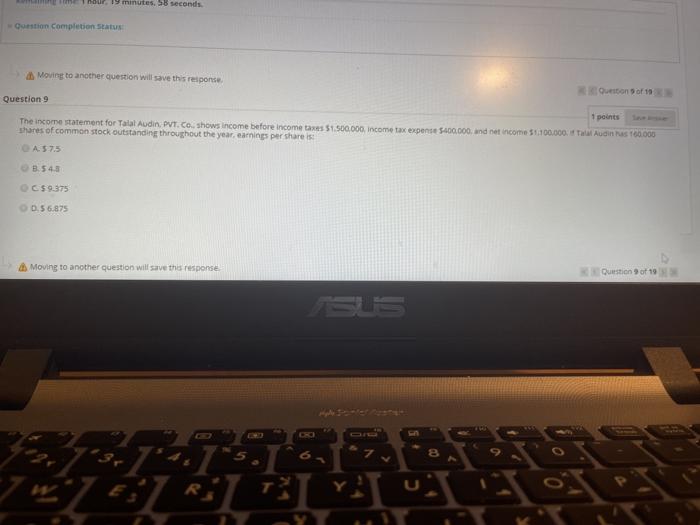

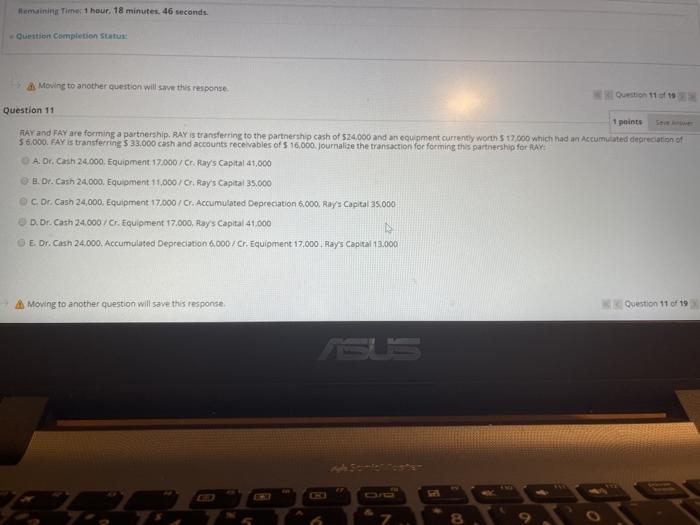

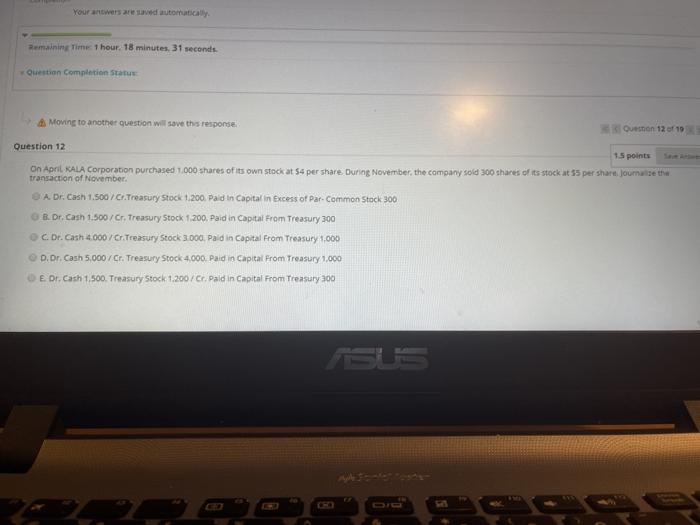

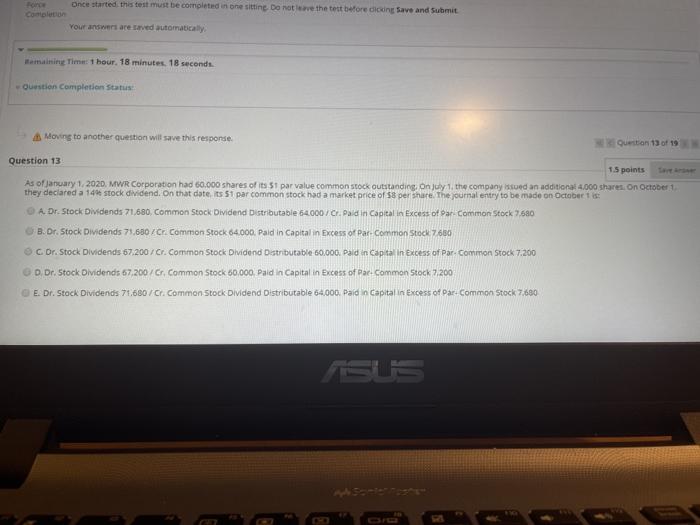

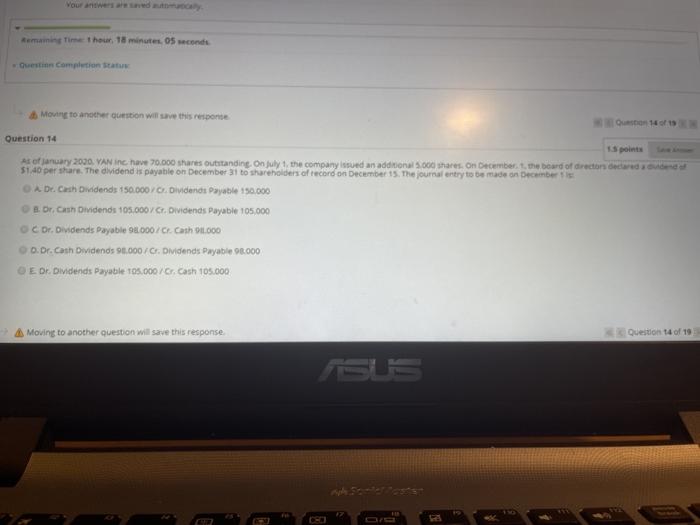

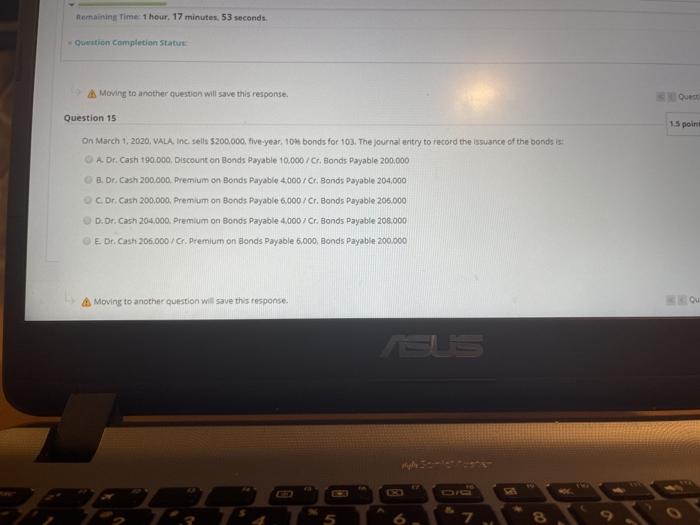

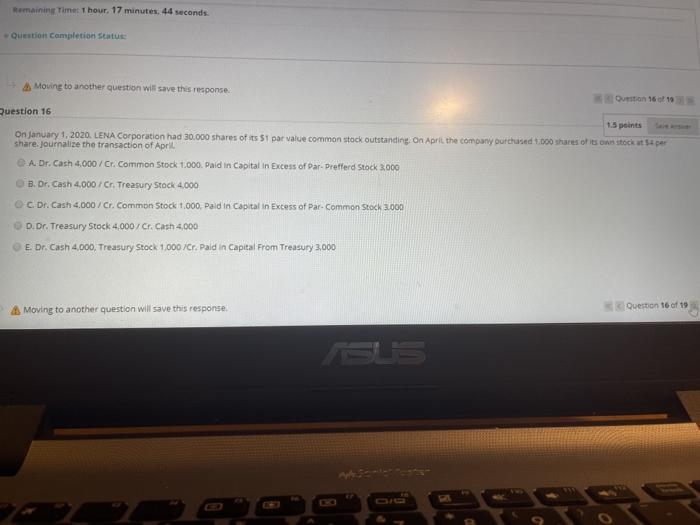

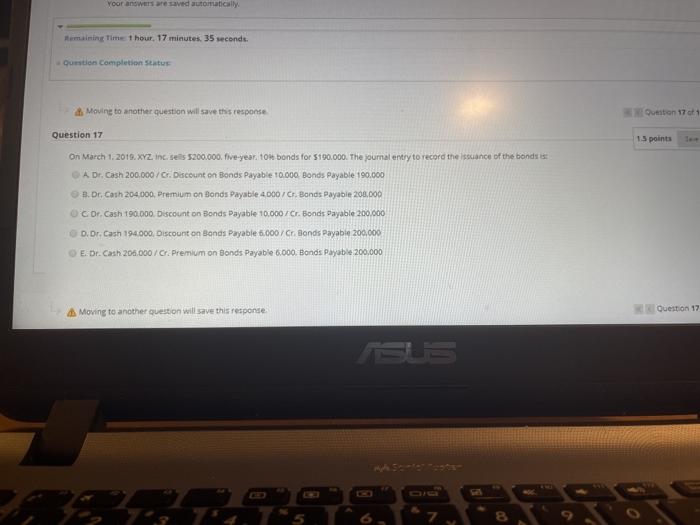

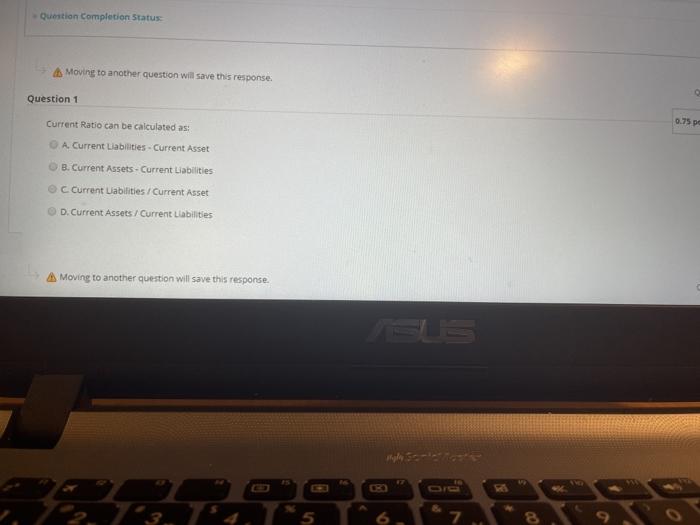

Question Completion Status Moving to another question will save this response. Question 1 Current Ratio can be calculated as: 0.75 p A. Current Liabilities - Current Asset B. Current Assets - Current Liabilities Current Uabilities / Current Asset D. Current Assets / Current Liabilities Moving to another question will save this response. 5 8 9 Remaining Time: 1 hour, 22 minutes, 25 seconds. Question Completion Status Moving to another question will save this response Question 2 0.75 pe Which of the following is an advantage of corporation? A Additional Taxes B. Ability to acquire Capital C. Government Regulations D. Unlimited Liability Montchange Your answers are saved automatically Remaining Time: 1 hour. 22 minutes, 05 seconds. Question Completion Status: Moving to another question will save this response. Question Question 3 0.75 points All but one of the following is reported in a retained earnings statement. The exceptionis DA Sales of treasury stock above cost. 8. Some disposals of treasury stock below cost. C. Net income and net loss D. Cash and stock dividends Moving to another question will save this response. Quest Remaining Time: 1 hour. 21 minutes, 18 seconds. Question Completion Status Moving to another question will save this response Question 4 Each of the following is correct regarding bonds except they are: A Sold in large denominations B. Attractive to many investors. Issued by corporations and governmental agencies. D. A form of interest-bearing notes payable Moving to another question will save this response Force Once started this test must be completed in one sitting Do not leave the test before doing Save and Submit Compton Your answers are saved automatically Remaining Time: 1 hour, 20 minutes, 42 seconds. Question Completion Status: A Moving to another question will save this response Question 6 0.7 which one of the following items is NOT generally used in preparing a statement of cash flows A Comparative balance sheets 8. Current income statement Adjusted trial balance D. Additional information Moving to another question will save this response Remaining Time: 1 hour, 20 minutes, 26 seconds. Question Completion Status: A Moving to another question will save this response. Question 7 The date on which a cash dividend becomes a binding legal obligation is on the A. Declaration date. 8. Last day of the fiscal year-end. C Payment date. D. Date of record 6 7 8 9 Completion Your answers are saved automatically Remaining Time: 1 hour, 20 minutes. 16 seconds. Question Completion Status Moving to another question will save this response Question 8 Which of the following is an advantage of regular partnerships? A. Combining of financial resources B. Limited life C. Many governmental regulations and restrictions D. Unlimited liability hour 19 minutes, 56 seconds Question Completion Status Moving to another question will save this response Question 9 1 points The income statement for Talat Audin PVT. Co shows income before income taxes $1.500.000 income tax expense $400.000, and net income $100.000 Audi 100.000 shares of common stock outstanding throughout the year, earnings per share is OA.375 3.543 C$ 9-375 0.56.875 Moving to another question will save the response Question 9 of 19 TOT I emaining Time 1 hour 18 minutes. 46 seconds. Question Completion Status: Moving to another question will save this response Question 11 Question 11 1 points FAY and FAY are forming a partnership. RAY is transferring to the partnership cash of 524.000 and an equipment currently worth $17.000 which had an Accumulated depreciation of 56.000. FAY is transferring $ 33.000 cash and accounts receivables of $ 16,000. Journalize the transaction for forming this partnership for RAY A. Dr. Cash 24.000. Equipment 17.000 / C. Ray's Capital 41,000 B. Dr. Cash 24.000. Equipment 11,000 1 Ray's Capital 35.000 Dr. Cash 24,000. Equipment 17.000 / C. Accumulated Depreciation 6.000. Ray Capital 35.000 D. Dr. Cash 24.000/Cr. Equipment 17.000, Ray's Capital 41.000 E Dr. Cash 24.000. Accumulated Depreciation 6.000 / Cr. Equipment 17,000, Ray's Capital 13.000 A Moving to another question will save this response Question 11 of 19 Your newers are saved automatically Remaining Time 1 hour. 18 minutes, 31 seconds Question Completion Status Moving to another question will save this response Question 12 0 10 Question 12 1.5 points On April. KALA Corporation purchased 1.000 shares of its own stock at 54 per share During November, the company Sold 300 shares of its stock at 55 per share journaise the transaction of November DA Dr. Cash 1.500 / C Treasury Stock 1.200. Paid in Capital in Excess of Par. Common Stock 300 B. Dr. Cash 1.500 / Cr. Treasury Stock 1.200. Paid in Capital From Treasury 300 Dr. Cash 4.000/Cr Treasury Stock 3.000. Paid in Capital From Treasury 1.000 D. Dr. Cash 5,000/Cr. Treasury Stock 4.000. Pald in Capital From Treasury 1.000 E. Dr. Cash 1.500 Treasury Stock 1.200 / C. Paldin Capital From Treasury 300 Die Once started this test must be completed in one sitting Do notice the test before didn Save and Submit Your answers are saved automatically emaining Time: 1 hour 18 minutes, 18 seconds. Question completion Status: Moving to another question will save this responde Question 13 of 19 Question 13 1.5 points As of January 1, 2020. MWR Corporation had 60.000 shares of its 51 par value common stock outstanding. On joy the company issued an additional 4.000 shares. On October they declared a 14 stock dividend. On that date its 51 par common stock had a market price of 58 per share. The Journal entry to be made on October A Dr. Stock Dividends 71,680. Common Stock Dividend Distributable 64000/Cr. Paldin Capital in excess of Par Common Stock 7.680 B. Dr. Stock Dividends 71.630/Cr. Common Stock 64.000. Pald in Capital in Excess of Par. Common Stock 7660 Dr. Stock Dividends 67.200/Cr. Common Stock Dividend Distributable 60.000. Paid in Capital in excess of Par. Common Stock 7.200 3D Dr. Stock Dividends 57,200/Cr. Common Stock 60.000 Paid in Capital in Excess of Par. Common Stock 7.200 E Dr. Stock Dividends 71,680/Cr. Common Stock Dividend Distributable 64,000. Paid in Capital in excess of Par. Common Stock 7.680 Remaining in the 18 minutes. 05 seconds Moving to another question will save this response Question 14 Afanuary 2000 VAN I have 70.000 shares outstanding on July 1, the company issued an additionat 5.000 shares on December the board of director decades $1.40 per share. The dividend is payable on December 31 to shareholders of record on December 15. The journal entry to be made on December A De Cash Dividends 150.000 / Dividends Payable 150.000 B. Dr. Cash Dividends 105.000/C. Dividends Payable 105,000 Dr. Dividends Payable 9.000 / C Cash 1.000 D. Dr. Cash Dividends 98.000/. Dividends Payable 8.000 E Dr. Dividends Payable 105.000/Cr. Cash 105.000 A Moving to another question will save this response Question 14 of 19 Remaining Time: 1 hour. 17 minutes, 53 seconds. -Question completion Status Moving to another question will save this response. Question 15 15 point On March 1, 2020. VALA. Inc. sells $200.000, tive-year, 10% bonds for 103. The journal entry to record the issuance of the bonds A. Dr. Cash 190.000, Discount on Bonds Payable 10.000 /Cr. Bonds Payable 200.000 a. Dr. Cash 200.000 Premium on Bonds Payable 4000/Cr. Bonds Payable 204.000 Dr. Cash 200.000 Premium on Bonds Payable 6.000/Cr. Bonds Payable 206.000 D. Dt.Cash 204.000. Premium on Bonds Payable 4.0007 Cr. Bonds Payable 208.000 E Dr. Cash: 205.000/6. Premium on Bonds Payable 5,000. Bonds Payable 200.000 A Moving to another question will save this response. 8 9 Remaining Timer 1 hour17 minutes, 44 seconds. Question Completion Status Moving to another question will save this response Question 16 13 points On January 1, 2020. LENA Corporation had 30.000 shares of its 51 par value common stock outstanding on April the company purchased 1. shares of its own stock taper share. Journalize the transaction of April G A Dr. Cash 4.000 / Cr. Common Stock 1.000. Paid in Capital in Excess of Par-Prefferd Stock 3.000 B. Dr. Cash 4.000/Cr. Treasury Stock 4.000 O Dr. Cash 4,000 / Cr. Common Stock 1.000. Pald in Capital in excess of Par. Common Stock 3.000 D. Dr. Treasury Stock 4.000 / Cr. Cash 4,000 E Dr. Cash 4,000. Treasury Stock 1.000 /Cr. Paid in Capital From Treasury 3,000 A Moving to another question will save this response Question 16 of 19 So your answers are ved automatically Remaining Time 1 hour, 17 minutes. 35 seconds. Question completion Status Moving to another question will save this response Question 17 Question 17 1.5 points On March 1. 2019. XYZ. Inc. seis 5200.000. five-year. 10 bonds for $190.000. The journal entry to record the lance of the bonds A Dr. Cash 200.000 /. Discount on Bonds Payable 10.000 Bonds Payable 190.000 B. Dr. Cash 204.000 Premium on Bonds Payable 4000/Cr. Bonds Payable 200.000 Dr. Cash 190.000, Discount on Bonds Payable 10.0007r. Boods Payable 200.000 D. Dr. Cash 194000, Discount on Bonds Payable 6.000/Cr. Bonds Payable 200.000 E.Dr.Cash 206.000 / Cr. Premium on Bonds Payable 6.000. Bonds Payable 200.000 Moving to another question will save this response Question 17