Answered step by step

Verified Expert Solution

Question

1 Approved Answer

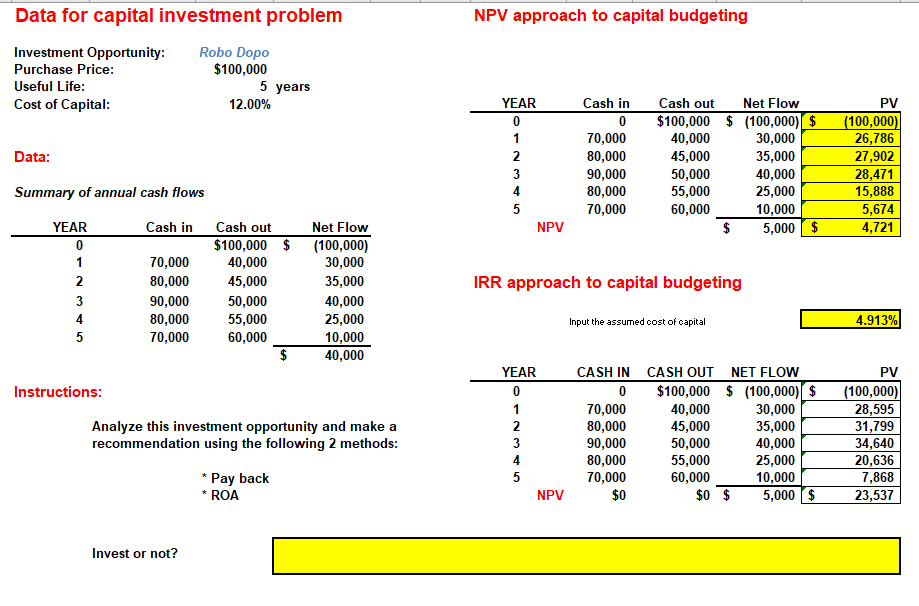

Just need an answer for the invest or not? question based on this data. Data for capital investment problem NPV approach to capital budgeting Investment

Just need an answer for the "invest or not?" question based on this data.

Data for capital investment problem NPV approach to capital budgeting Investment Opportunity: Purchase Price: Useful Life: Cost of Capital: Robo Dopo $100,000 5 years 12.00% YEAR Cash in Data: WN- 70,000 80,000 90,000 80,000 70,000 Cash out $100,000 40,000 45,000 50,000 55,000 60,000 Net Flow $ (100,000) $ 30,000 35,000 40,000 25,000 10,000 5,000 $ PV (100,000) 26,786 27,902 28,471 15,888 5,674 4,721 Summary of annual cash flows YEAR Cash in NPV $ Cash out $100,000 40,000 45,000 50,000 55,000 60,000 70,000 80,000 90,000 80,000 70,000 Net Flow (100,000) 30,000 35,000 40,000 25,000 10,000 40,000 IRR approach to capital budgeting Input the assumed cost of capital 4.913% Instructions: 0 WNO Analyze this investment opportunity and make a recommendation using the following 2 methods: CASH IN CASH OUT NET FLOW $100,000 $ (100,000) $ 70,000 40,000 30,000 80,000 45,000 35,000 90,000 50,000 40,000 80,000 55,000 25,000 70,000 60,000 10,000 $0 $0 $ 5,000$ PV (100,000) 28,595 31,799 34,640 20,636 7,868 23,537 * Pay back * ROA NPV Invest or notStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started