Answered step by step

Verified Expert Solution

Question

1 Approved Answer

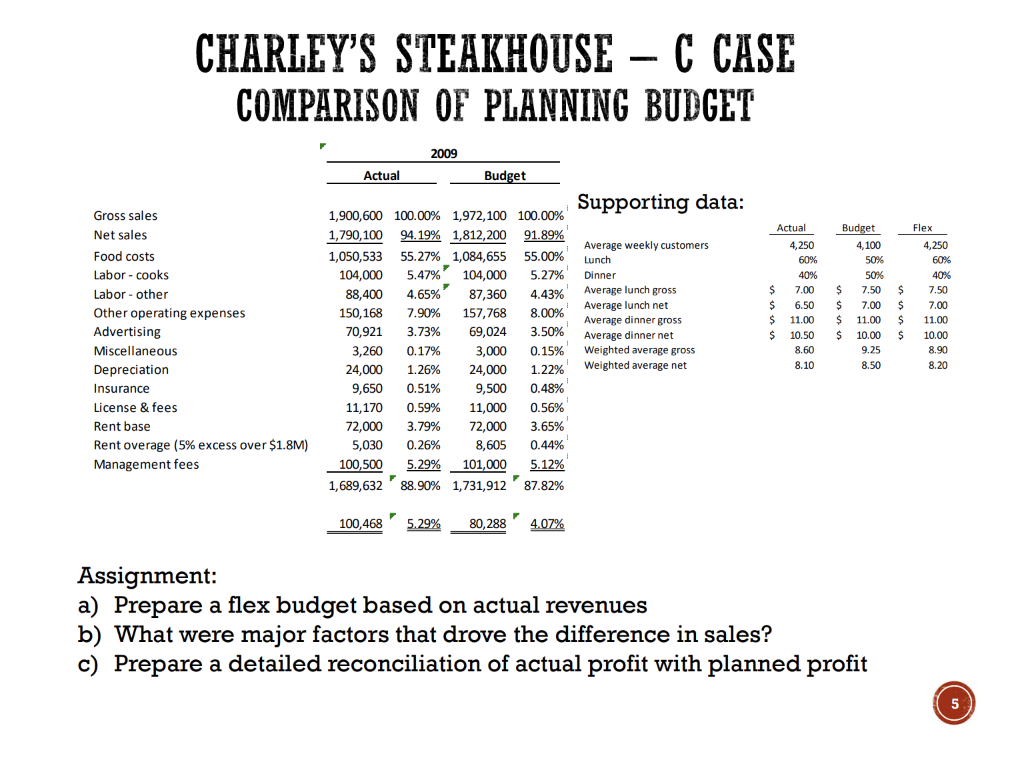

Just need C! CHARLEY'S STEAKHOUSE - C CASE COMPARISON OF PLANNING BUDGET 2009 Actual Budget Supporting data: 1,900,600 100.00% 1,972,100 100.00 % 94.19% 1,812,200 Gross

Just need C!

CHARLEY'S STEAKHOUSE - C CASE COMPARISON OF PLANNING BUDGET 2009 Actual Budget Supporting data: 1,900,600 100.00% 1,972,100 100.00 % 94.19% 1,812,200 Gross sales Actual Budget Flex Net sales 1,790,100 1,050,533 91.89% Average weekly customers 4,250 4,100 4,250 55.00% Food costs 55.27% 1,084,655 60 % 40 % Lunch 60% 50% 5.47% Labor-cooks 104,000 104,000 5.27% Dinner 40% 50% Average lunch gross Average lunch net Average dinner gross 7.00 7.50 7.50 Labor-other 88,400 4.65% 87,360 4.43% 6.50 7.00 7.00 Other operating expenses 150,168 7.90% 157,768 8.00% $ 11.00 $ $ 10.50 $ S 11.00 11.00 Advertising 70,921 3.73% 69,024 3.50% Average dinner net Weighted average gross Weighted average net 10.00 10.00 Miscellaneous 3,260 0.17% 3,000 0.15% 8.60 9.25 8.90 8.10 8.50 8.20 1.22% Depreciation 24,000 1.26% 24,000 9,650 0.51% 9,500 0.48% Insurance License & fees 11,170 0.59% 11,000 0.56% 72,000 Rent base 72,000 3.79% 3.65% Rent overage (5% excess over $1.8M) 5,030 0.26% 8,605 0.44% 5.12% Management fees 100,500 1,689,632 101,000 88.90% 1,731,912 87.82% 5.29% 4.07% 5.29% 100,468 80,288 Assignment: a) Prepare a flex budget based on actual revenues b) What were major factors that drove the difference in sales? c) Prepare a detailed reconciliation of actual profit with planned profit 5 CHARLEY'S STEAKHOUSE - C CASE COMPARISON OF PLANNING BUDGET 2009 Actual Budget Supporting data: 1,900,600 100.00% 1,972,100 100.00 % 94.19% 1,812,200 Gross sales Actual Budget Flex Net sales 1,790,100 1,050,533 91.89% Average weekly customers 4,250 4,100 4,250 55.00% Food costs 55.27% 1,084,655 60 % 40 % Lunch 60% 50% 5.47% Labor-cooks 104,000 104,000 5.27% Dinner 40% 50% Average lunch gross Average lunch net Average dinner gross 7.00 7.50 7.50 Labor-other 88,400 4.65% 87,360 4.43% 6.50 7.00 7.00 Other operating expenses 150,168 7.90% 157,768 8.00% $ 11.00 $ $ 10.50 $ S 11.00 11.00 Advertising 70,921 3.73% 69,024 3.50% Average dinner net Weighted average gross Weighted average net 10.00 10.00 Miscellaneous 3,260 0.17% 3,000 0.15% 8.60 9.25 8.90 8.10 8.50 8.20 1.22% Depreciation 24,000 1.26% 24,000 9,650 0.51% 9,500 0.48% Insurance License & fees 11,170 0.59% 11,000 0.56% 72,000 Rent base 72,000 3.79% 3.65% Rent overage (5% excess over $1.8M) 5,030 0.26% 8,605 0.44% 5.12% Management fees 100,500 1,689,632 101,000 88.90% 1,731,912 87.82% 5.29% 4.07% 5.29% 100,468 80,288 Assignment: a) Prepare a flex budget based on actual revenues b) What were major factors that drove the difference in sales? c) Prepare a detailed reconciliation of actual profit with planned profit 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started