Answered step by step

Verified Expert Solution

Question

1 Approved Answer

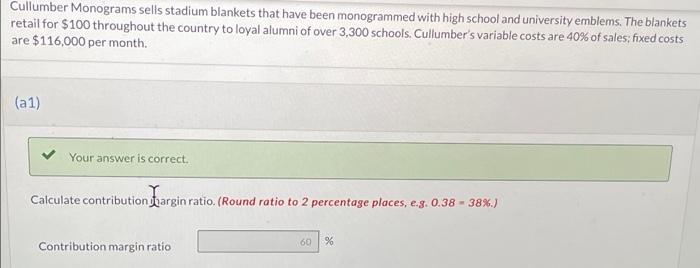

just need (d) solved Cullumber Monograms sells stadium blankets that have been monogrammed with high school and university emblems. The blankets retail for $100 throughout

just need (d) solved

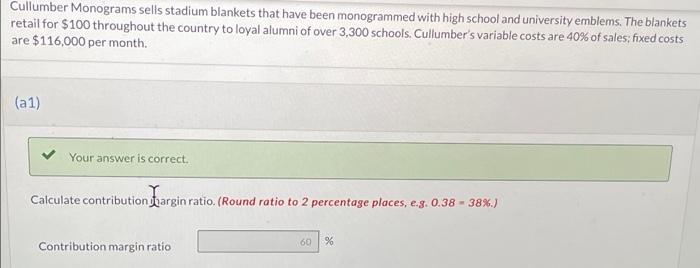

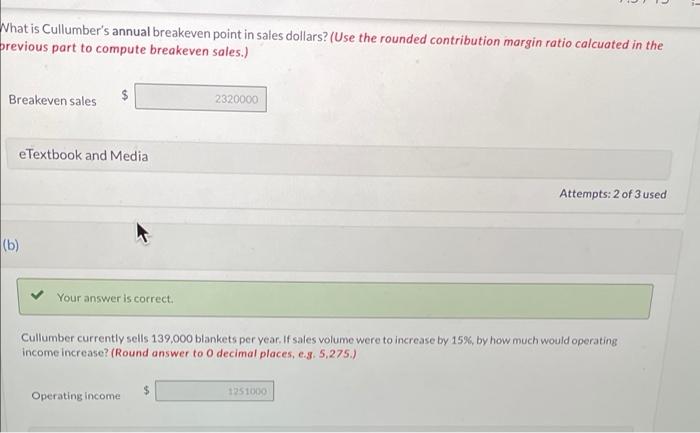

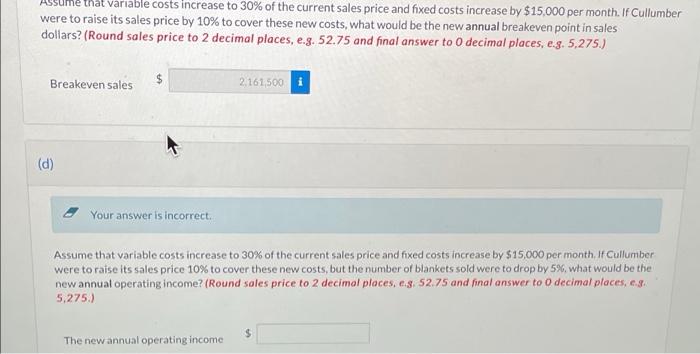

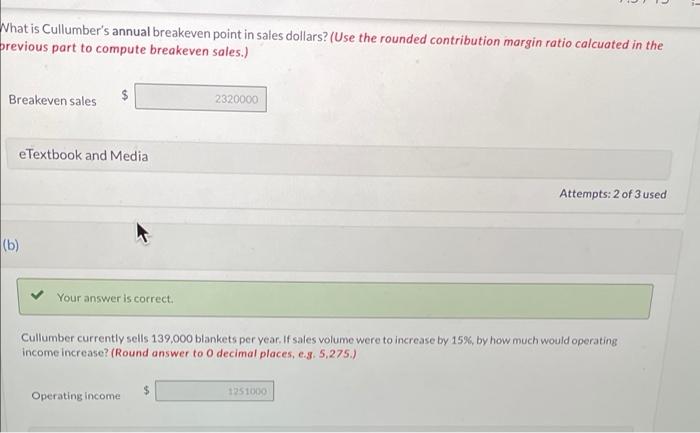

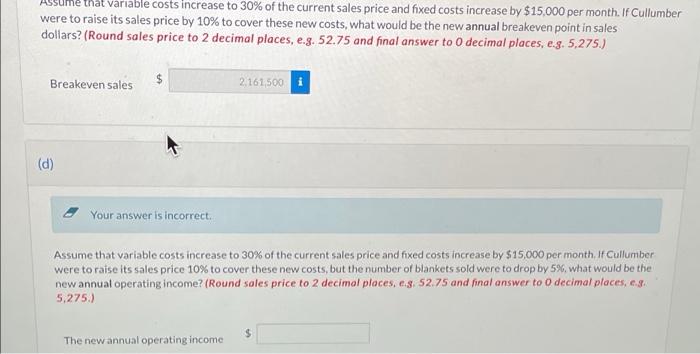

Cullumber Monograms sells stadium blankets that have been monogrammed with high school and university emblems. The blankets retail for $100 throughout the country to loyal alumni of over 3,300 schools. Cullumber's variable costs are 40% of sales; fixed costs are $116,000 per month. (a1) Your answer is correct. Calculate contribution targin ratio. (Round ratio to 2 percentage places, eg. 0.38 - 38%.) Contribution margin ratio 60 % What is Cullumber's annual breakeven point in sales dollars? (Use the rounded contribution margin ratio calcuated in the previous part to compute breakeven sales.) Breakeven sales $ 2320000 eTextbook and Media Attempts: 2 of 3 used (b) Your answer is correct. Cullumber currently sells 139,000 blankets per year. If sales volume were to increase by 15%, by how much would operating income increase? (Round answer to 0 decimal places, e.g. 5,275.) $ Operating income 1351000 that variable costs increase to 30% of the current sales price and fixed costs increase by $15,000 per month. If Cullumber were to raise its sales price by 10% to cover these new costs, what would be the new annual breakeven point in sales dollars? (Round sales price to 2 decimal places, e.g. 52.75 and final answer to o decimal places, e.g. 5,275.) Breakeven sales $ 2,161,500 i (d) Your answer is incorrect Assume that variable costs increase to 30% of the current sales price and fixed costs increase by $15,000 per month of Cullumber were to raise its sales price 10% to cover these new costs, but the number of blankets sold were to drop by 5%, what would be the new annual operating income? (Round sales price to 2 decimal places, es 52.75 and final answer to o decimal places, s. 5,275.) $ The new annual operating income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started