Answered step by step

Verified Expert Solution

Question

1 Approved Answer

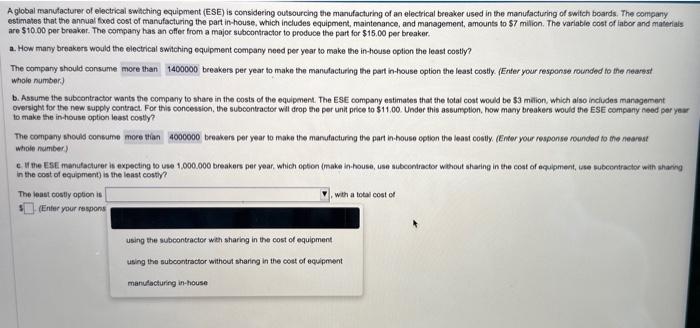

just need help on C A global manufacturer of electrical swathing equipment (ESE) is considering outsourcing the manufacturing of an electrical breaker used in the

just need help on C

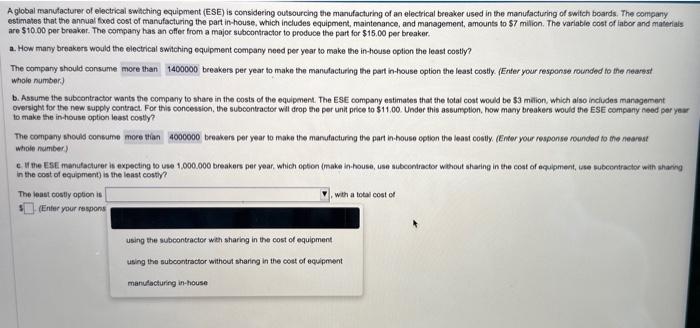

A global manufacturer of electrical swathing equipment (ESE) is considering outsourcing the manufacturing of an electrical breaker used in the manufacturing of switch boards. The company estimates that the annual fwed cost of marufacturing the part in-house, Which ineludes equipment, maintenance, and management, amounts to $7 milion. The variable cost of iabor and materiais are $10.00 per breaker. The company has an offer from a major subcontractor to produce the part for $15.00 per breaker. a. How many breakers would the electrical switching equipment company need per year to make the in-house option the least costly? The compary should consume breakers per year to makn the manulacturing the part in house option the least costly. (Enfer your response rounded to the neavest. whole numberd b. Assume the subcontractor wants the company to share in the costs of the equipenent. The ESE company estimates that the total coat would be $3 mation, which also includes managemant oversigth for the new supply conteact. For this concession, the subcontractor will drop the per unit price to $11.00. Under this assumption, how many breakers would the ESE compary need per year to make the in house option loast costly? The company should coneume 4000000 benakers per year to make the manufacturing the part in-house option the least coelly. (Enter your respanse rounded to the neamst whole number) c. If the ESE manufacturer is expecting to use 1,000.000 breakers per year, which option (make in-house, use subcontractor wethout ahaving in the cost of aquipment, iste pubcentractor with shanng in the cost of equipment) is the lanst costly? The least costly option is with a total cost of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started