\

\

(Just need help with part E & G)

| Company_Return | Market_Return | Treasury_Bill_Return |

| -0.035449 | -0.082619 | 0.005859 |

| -0.002394 | 0.025812 | 0.005859 |

| 0.179976 | 0.012094 | 0.006289 |

| -0.010419 | -0.023591 | 0.006893 |

| 0.058229 | 0.101888 | 0.006479 |

| 0.088803 | -0.010313 | 0.005899 |

| -0.066188 | 0.005712 | 0.006754 |

| -0.109261 | -0.102419 | 0.006177 |

| -0.232636 | -0.043126 | 0.005945 |

| 0.079823 | -0.010859 | 0.006594 |

| 0.195324 | 0.071901 | 0.005632 |

| 0.189786 | 0.045237 | 0.005915 |

| 0.281247 | 0.059515 | 0.004663 |

| 0.028227 | 0.088262 | 0.004741 |

| 0.191063 | 0.026432 | 0.004384 |

| -0.179045 | 0.006896 | 0.005434 |

| -0.154051 | 0.037771 | 0.004378 |

| -0.125742 | -0.049829 | 0.004097 |

| 0.097771 | 0.040955 | 0.004742 |

| 0.164071 | 0.045298 | 0.004689 |

| -0.048706 | -0.002081 | 0.004656 |

| 0.022356 | 0.005901 | 0.004299 |

| -0.015073 | -0.036002 | 0.003817 |

| 0.121696 | 0.114502 | 0.003803 |

| 0.147575 | -0.002113 | 0.003046 |

| 0.047748 | 0.032573 | 0.002861 |

| -0.137981 | -0.033753 | 0.003376 |

| 0.017323 | -0.006558 | 0.003353 |

| -0.010381 | 0.007744 | 0.002717 |

| -0.194235 | -0.035327 | 0.003164 |

| -0.028961 | 0.057279 | 0.002953 |

| -0.003705 | -0.037037 | 0.002583 |

| -0.033759 | 0.020023 | 0.002476 |

| 0.176663 | 0.002729 | 0.002336 |

| 0.096854 | 0.024573 | 0.002322 |

| 0.058481 | 0.020305 | 0.002301 |

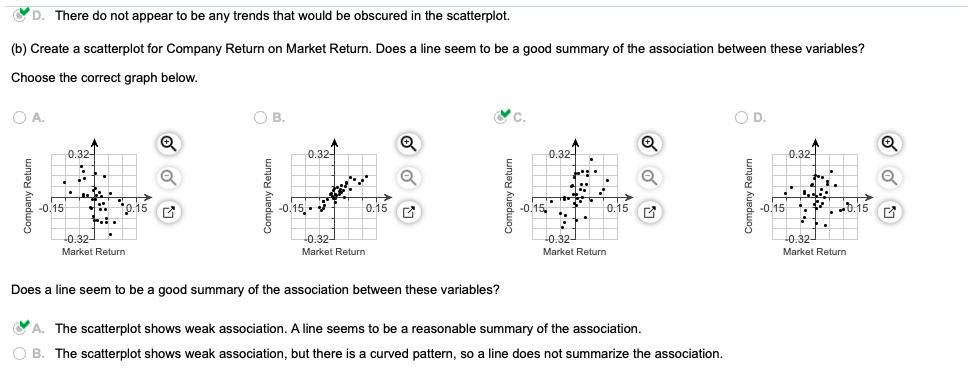

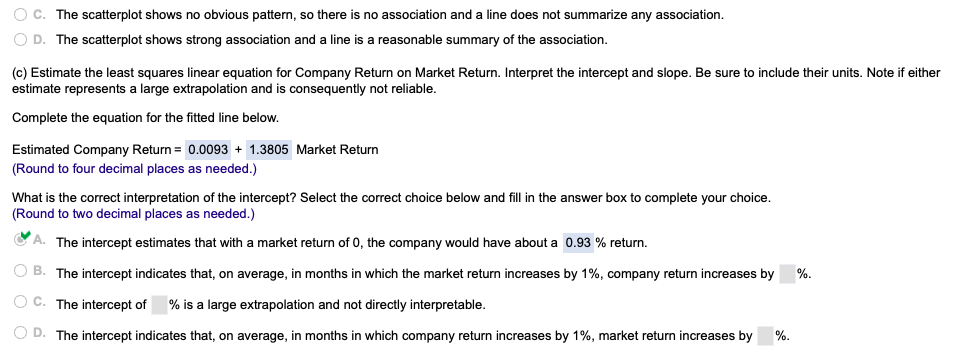

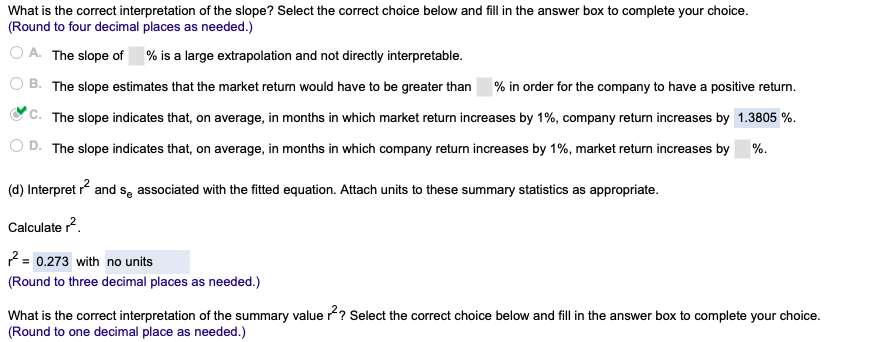

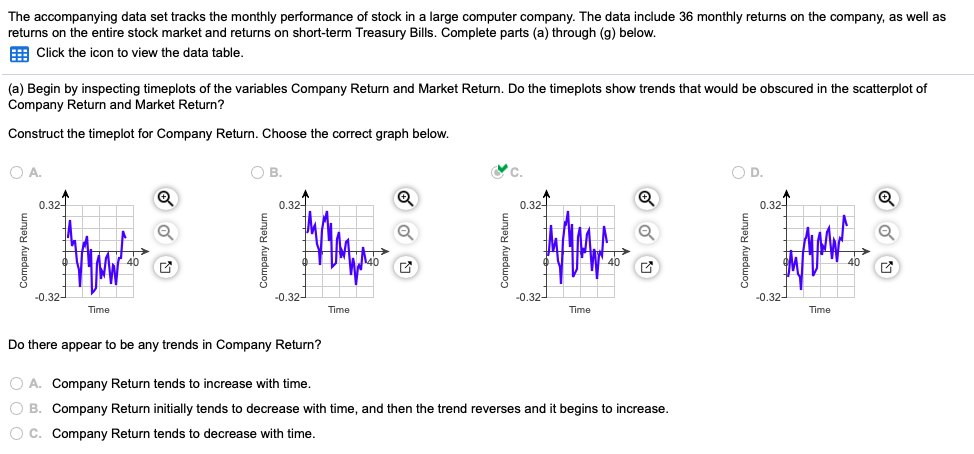

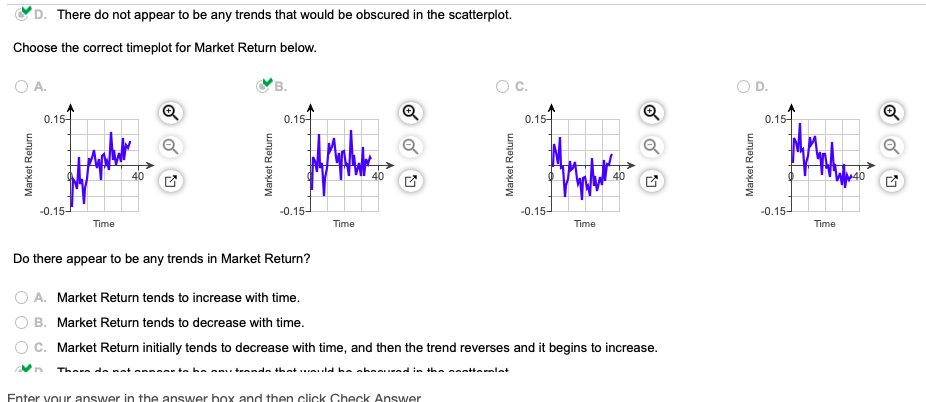

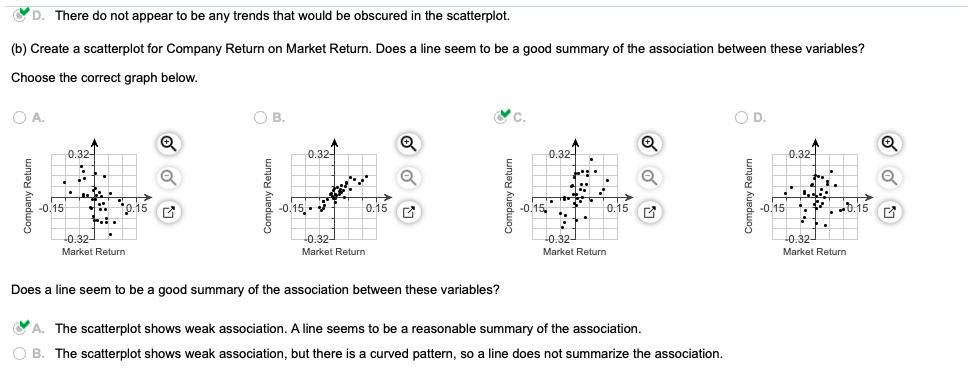

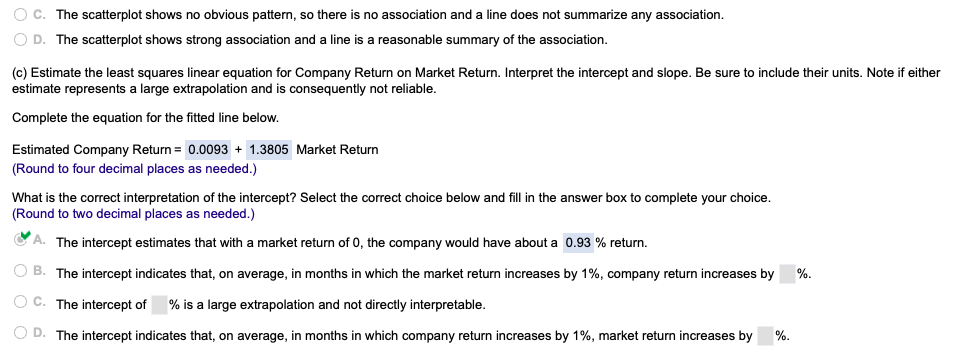

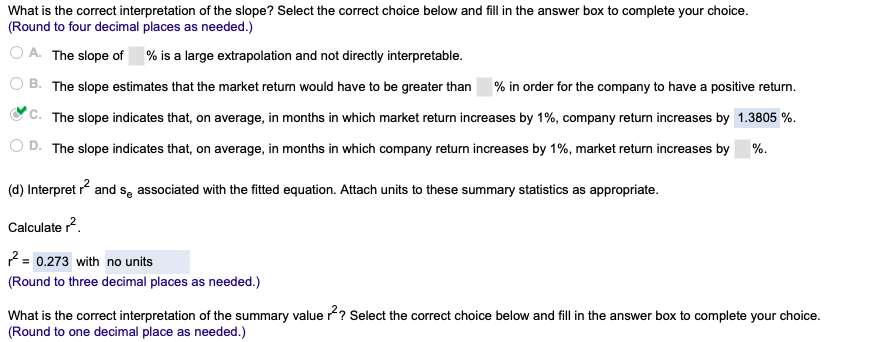

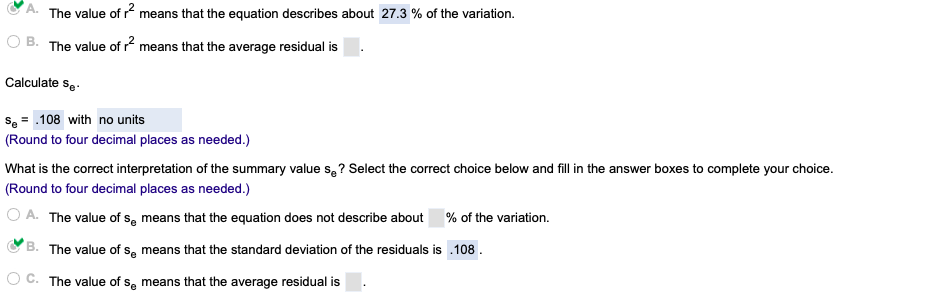

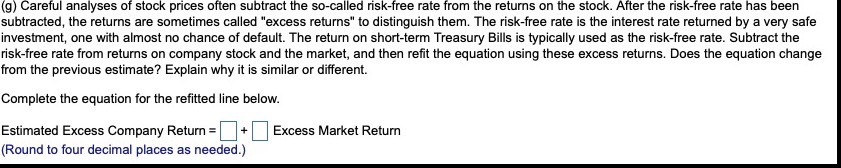

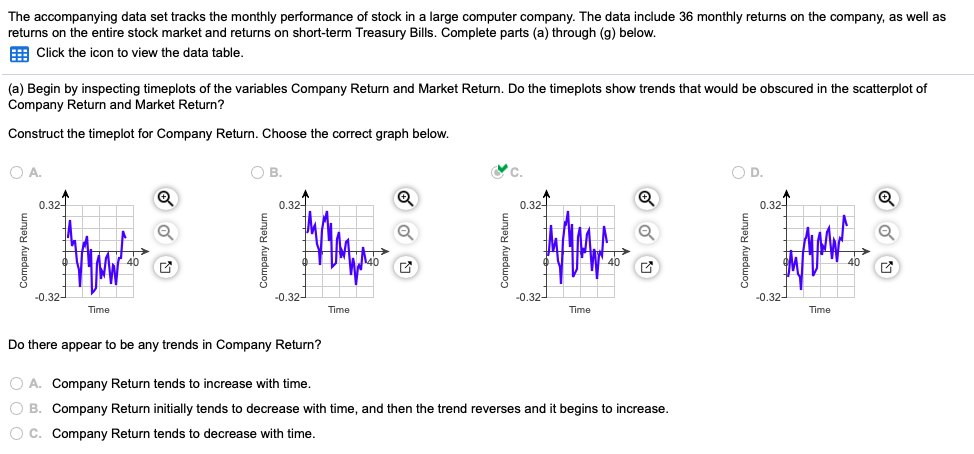

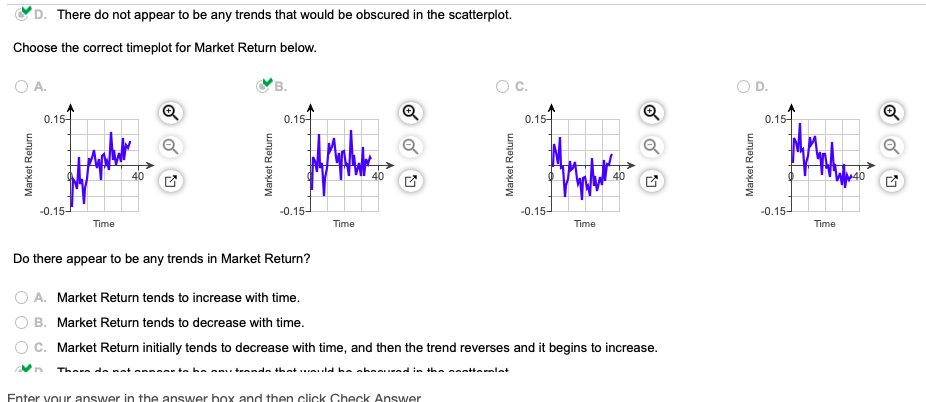

The accompanying data set tracks the monthly performance of stock in a large computer company. The data include 36 monthly returns on the company, as well as returns on the entire stock market and returns on short-term Treasury Bills. Complete parts (a) through (g) below. Click the icon to view the data table. (a) Begin by inspecting timeplots of the variables Company Return and Market Return. Do the timeplots show trends that would be obscured in the scatterplot of Company Return and Market Return? Construct the timeplot for Company Return. Choose the correct graph below. OA. . o Company Return Company Return Company Return Company Return s -0.32 -0.321 -0.32] -0.321_1 Time Time Time Time Do there appear to be any trends in Company Return? O A. Company Return tends to increase with time. OB. Company Return initially tends to decrease with time, and then the trend reverses and it begins to increase. OC. Company Return tends to decrease with time. D. There do not appear to be any trends that would be obscured in the scatterplot. Choose the correct timeplot for Market Return below. B. Oc. OD OA. 0.154Q 0.151 Market Return Market Return Market Return O OG Market Return 40 -0.15- -0.157 -0.15 Time Time Time Time Do there appear to be any trends in Market Return? O A. Market Return tends to increase with time. O B. Market Return tends to decrease with time. OC. Market Return initially tends to decrease with time, and then the trend reverses and it begins to increase. Theredematen the standa that ... haha..ed in the rantalet Enter your answer in the answer box and then click Check Answer D. There do not appear to be any trends that would be obscured in the scatterplot. (b) Create a scatterplot for Company Return on Market Return. Does a line seem to be a good summary of the association between these variables? Choose the correct graph below. OA. . Company Return 0.15 Company Return Company Return -0.15 . ..0.15 0.32 . -0.32 -0.32 Market Return -0.32 Market Return Market Return Market Return Does a line seem to be a good summary of the association between these variables? A. The scatterplot shows weak association. A line seems to be a reasonable summary of the association OB. The scatterplot shows weak association, but there is a curved pattern, so a line does not summarize the association. O C. The scatterplot shows no obvious pattern, so there is no association and a line does not summarize any association. OD. The scatterplot shows strong association and a line is a reasonable summary of the association. (c) Estimate the least squares linear equation for Company Return on Market Return. Interpret the intercept and slope. Be sure to include their units. Note if either estimate represents a large extrapolation and is consequently not reliable. Complete the equation for the fitted line below. Estimated Company Return = 0.0093 + 1.3805 Market Return (Round to four decimal places as needed.) What is the correct interpretation of the intercept? Select the correct choice below and fill in the answer box to complete your choice. (Round to two decimal places as needed.) CA. The intercept estimates that with a market return of O, the company would have about a 0.93 % return. OB. The intercept indicates that, on average, in months in which the market return increases by 1%, company return increases by %. OC. The intercept of % is a large extrapolation and not directly interpretable. OD. The intercept indicates that, on average, in months in which company return increases by 1%, market return increases by %. What is the correct interpretation of the slope? Select the correct choice below and fill in the answer box to complete your choice. (Round to four decimal places as needed.) O A. The slope of % is a large extrapolation and not directly interpretable. O B. The slope estimates that the market return would have to be greater than % in order for the company to have a positive return. C. The slope indicates that, on average, in months in which market return increases by 1%, company return increases by 1.3805 %. OD. The slope indicates that, on average, in months in which company return increases by 1%, market return increases by % (d) Interpret and Se associated with the fitted equation. Attach units to these summary statistics as appropriate. Calculate 2 = 0.273 with no units (Round to three decimal places as needed.) What is the correct interpretation of the summary value (Round to one decimal place as needed.) ? Select the correct choice below and fill in the answer box to complete your choice. CA. The value of 2 means that the equation describes about 27.3 % of the variation. OB. The value of r2 means that the average residual is . Calculate se Se = .108 with no units (Round to four decimal places as needed.) What is the correct interpretation of the summary value se? Select the correct choice below and fill in the answer boxes to complete your choice. (Round to four decimal places as needed.) O A. The value of s, means that the equation does not describe about % of the variation. CB. The value of s, means that the standard deviation of the residuals is 108. OC. The value of se means that the average residual is . (e) If months in which the market return went down by 4% were compared to months in which the market return went up by 4%, how would this equation suggest company return would differ between these periods? %. The company return between these periods would differ by (Round to three decimal places as needed.) (g) Careful analyses of stock prices often subtract the so-called risk-free rate from the returns on the stock. After the risk-free rate has been subtracted, the returns are sometimes called "excess returns" to distinguish them. The risk-free rate is the interest rate returned by a very safe investment, one with almost no chance of default. The return on short-term Treasury Bills is typically used as the risk-free rate. Subtract the risk-free rate from returns on company stock and the market, and then refit the equation using these excess returns. Does the equation change from the previous estimate? Explain why it is similar or different. Complete the equation for the refitted line below. Excess Market Return Estimated Excess Company Return = + (Round to four decimal places as needed.) The accompanying data set tracks the monthly performance of stock in a large computer company. The data include 36 monthly returns on the company, as well as returns on the entire stock market and returns on short-term Treasury Bills. Complete parts (a) through (g) below. Click the icon to view the data table. (a) Begin by inspecting timeplots of the variables Company Return and Market Return. Do the timeplots show trends that would be obscured in the scatterplot of Company Return and Market Return? Construct the timeplot for Company Return. Choose the correct graph below. OA. . o Company Return Company Return Company Return Company Return s -0.32 -0.321 -0.32] -0.321_1 Time Time Time Time Do there appear to be any trends in Company Return? O A. Company Return tends to increase with time. OB. Company Return initially tends to decrease with time, and then the trend reverses and it begins to increase. OC. Company Return tends to decrease with time. D. There do not appear to be any trends that would be obscured in the scatterplot. Choose the correct timeplot for Market Return below. B. Oc. OD OA. 0.154Q 0.151 Market Return Market Return Market Return O OG Market Return 40 -0.15- -0.157 -0.15 Time Time Time Time Do there appear to be any trends in Market Return? O A. Market Return tends to increase with time. O B. Market Return tends to decrease with time. OC. Market Return initially tends to decrease with time, and then the trend reverses and it begins to increase. Theredematen the standa that ... haha..ed in the rantalet Enter your answer in the answer box and then click Check Answer D. There do not appear to be any trends that would be obscured in the scatterplot. (b) Create a scatterplot for Company Return on Market Return. Does a line seem to be a good summary of the association between these variables? Choose the correct graph below. OA. . Company Return 0.15 Company Return Company Return -0.15 . ..0.15 0.32 . -0.32 -0.32 Market Return -0.32 Market Return Market Return Market Return Does a line seem to be a good summary of the association between these variables? A. The scatterplot shows weak association. A line seems to be a reasonable summary of the association OB. The scatterplot shows weak association, but there is a curved pattern, so a line does not summarize the association. O C. The scatterplot shows no obvious pattern, so there is no association and a line does not summarize any association. OD. The scatterplot shows strong association and a line is a reasonable summary of the association. (c) Estimate the least squares linear equation for Company Return on Market Return. Interpret the intercept and slope. Be sure to include their units. Note if either estimate represents a large extrapolation and is consequently not reliable. Complete the equation for the fitted line below. Estimated Company Return = 0.0093 + 1.3805 Market Return (Round to four decimal places as needed.) What is the correct interpretation of the intercept? Select the correct choice below and fill in the answer box to complete your choice. (Round to two decimal places as needed.) CA. The intercept estimates that with a market return of O, the company would have about a 0.93 % return. OB. The intercept indicates that, on average, in months in which the market return increases by 1%, company return increases by %. OC. The intercept of % is a large extrapolation and not directly interpretable. OD. The intercept indicates that, on average, in months in which company return increases by 1%, market return increases by %. What is the correct interpretation of the slope? Select the correct choice below and fill in the answer box to complete your choice. (Round to four decimal places as needed.) O A. The slope of % is a large extrapolation and not directly interpretable. O B. The slope estimates that the market return would have to be greater than % in order for the company to have a positive return. C. The slope indicates that, on average, in months in which market return increases by 1%, company return increases by 1.3805 %. OD. The slope indicates that, on average, in months in which company return increases by 1%, market return increases by % (d) Interpret and Se associated with the fitted equation. Attach units to these summary statistics as appropriate. Calculate 2 = 0.273 with no units (Round to three decimal places as needed.) What is the correct interpretation of the summary value (Round to one decimal place as needed.) ? Select the correct choice below and fill in the answer box to complete your choice. CA. The value of 2 means that the equation describes about 27.3 % of the variation. OB. The value of r2 means that the average residual is . Calculate se Se = .108 with no units (Round to four decimal places as needed.) What is the correct interpretation of the summary value se? Select the correct choice below and fill in the answer boxes to complete your choice. (Round to four decimal places as needed.) O A. The value of s, means that the equation does not describe about % of the variation. CB. The value of s, means that the standard deviation of the residuals is 108. OC. The value of se means that the average residual is . (e) If months in which the market return went down by 4% were compared to months in which the market return went up by 4%, how would this equation suggest company return would differ between these periods? %. The company return between these periods would differ by (Round to three decimal places as needed.) (g) Careful analyses of stock prices often subtract the so-called risk-free rate from the returns on the stock. After the risk-free rate has been subtracted, the returns are sometimes called "excess returns" to distinguish them. The risk-free rate is the interest rate returned by a very safe investment, one with almost no chance of default. The return on short-term Treasury Bills is typically used as the risk-free rate. Subtract the risk-free rate from returns on company stock and the market, and then refit the equation using these excess returns. Does the equation change from the previous estimate? Explain why it is similar or different. Complete the equation for the refitted line below. Excess Market Return Estimated Excess Company Return = + (Round to four decimal places as needed.)

\

\