Answered step by step

Verified Expert Solution

Question

1 Approved Answer

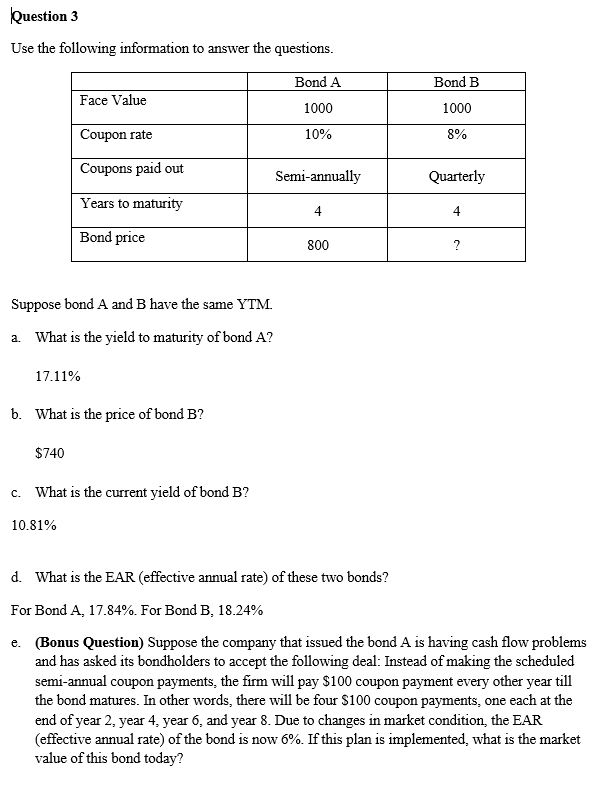

Just need help with question E please! Thank you!! Question 3 Use the following information to answer the questions. Suppose bond A and B have

Just need help with question E please! Thank you!!

Question 3 Use the following information to answer the questions. Suppose bond A and B have the same YTM. a. What is the yield to maturity of bond A ? 17.11% b. What is the price of bond B ? $740 c. What is the current yield of bond B? 10.81% d. What is the EAR (effective annual rate) of these two bonds? For Bond A, 17.84\%. For Bond B, 18.24\% e. (Bonus Question) Suppose the company that issued the bond A is having cash flow problems and has asked its bondholders to accept the following deal: Instead of making the scheduled semi-annual coupon payments, the firm will pay $100 coupon payment every other year till the bond matures. In other words, there will be four $100 coupon payments, one each at the end of year 2, year 4 , year 6 , and year 8 . Due to changes in market condition, the EAR (effective annual rate) of the bond is now 6%. If this plan is implemented, what is the market value of this bond todayStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started