Answered step by step

Verified Expert Solution

Question

1 Approved Answer

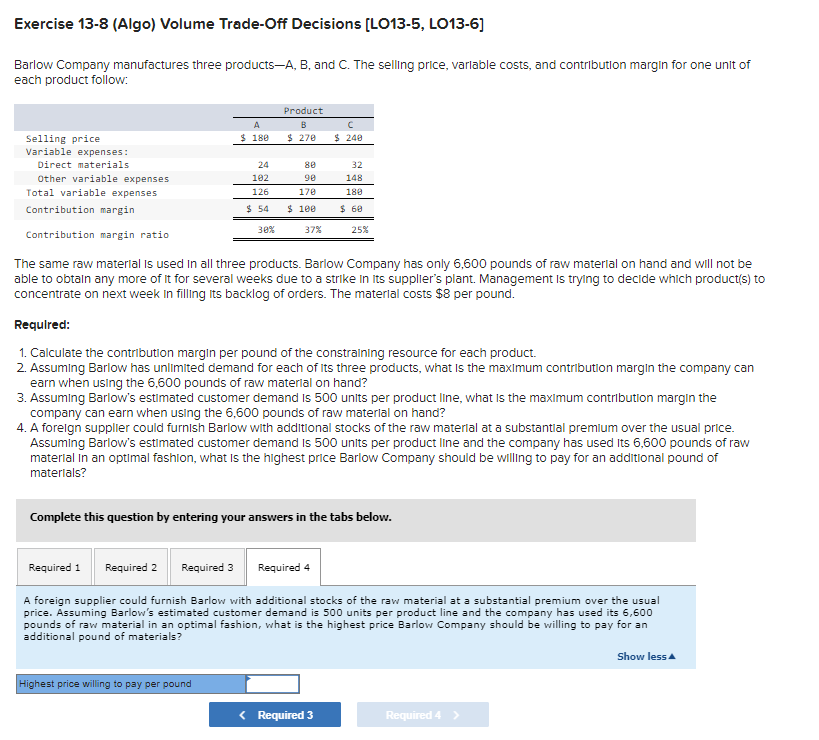

Just need help with Question#4 only, please. Exercise 13-8 (Algo) Volume Trade-Off Decisions [LO13-5, LO13-6] Barlow Company manufactures three products-A, B, and C. The selling

Just need help with Question#4 only, please.

Exercise 13-8 (Algo) Volume Trade-Off Decisions [LO13-5, LO13-6] Barlow Company manufactures three products-A, B, and C. The selling price, varlable costs, and contribution margin for one unlt of each product follow: The same raw materlal is used In all three products. Barlow Company has only 6,600 pounds of raw materlal on hand and will not be able to obtain any more of It for several weeks due to a strlke in Its supplier's plant. Management is trying to decide which product(s) to concentrate on next week In filling its backlog of orders. The materlal costs $8 per pound. Required: 1. Calculate the contribution margin per pound of the constraining resource for each product. 2. Assuming Barlow has unlimited demand for each of Its three products, what is the maximum contribution margin the company can earn when using the 6,600 pounds of raw materlal on hand? 3. Assuming Barlow's estlmated customer demand is 500 unlts per product line, what is the maximum contribution margin the company can earn when using the 6,600 pounds of raw materlal on hand? 4. A forelgn supplier could furnish Barlow with additional stocks of the raw materlal at a substantlal premlum over the usual price. Assuming Barlow's estimated customer demand is 500 unlts per product line and the company has used Its 6,600 pounds of raw materlal In an optimal fashion, what is the highest price Barlow Company should be willing to pay for an additional pound of materlals? Complete this question by entering your answers in the tabs below. A foreign supplier could furnish Barlow with additional stocks of the raw material at a substantial premium over the usual price. Assuming Barlow's estimated customer demand is 500 units per product line and the company has used its 6,600 pounds of raw material in an optimal fashion, what is the highest price Barlow Company should be willing to pay for an additional pound of materials? Exercise 13-8 (Algo) Volume Trade-Off Decisions [LO13-5, LO13-6] Barlow Company manufactures three products-A, B, and C. The selling price, varlable costs, and contribution margin for one unlt of each product follow: The same raw materlal is used In all three products. Barlow Company has only 6,600 pounds of raw materlal on hand and will not be able to obtain any more of It for several weeks due to a strlke in Its supplier's plant. Management is trying to decide which product(s) to concentrate on next week In filling its backlog of orders. The materlal costs $8 per pound. Required: 1. Calculate the contribution margin per pound of the constraining resource for each product. 2. Assuming Barlow has unlimited demand for each of Its three products, what is the maximum contribution margin the company can earn when using the 6,600 pounds of raw materlal on hand? 3. Assuming Barlow's estlmated customer demand is 500 unlts per product line, what is the maximum contribution margin the company can earn when using the 6,600 pounds of raw materlal on hand? 4. A forelgn supplier could furnish Barlow with additional stocks of the raw materlal at a substantlal premlum over the usual price. Assuming Barlow's estimated customer demand is 500 unlts per product line and the company has used Its 6,600 pounds of raw materlal In an optimal fashion, what is the highest price Barlow Company should be willing to pay for an additional pound of materlals? Complete this question by entering your answers in the tabs below. A foreign supplier could furnish Barlow with additional stocks of the raw material at a substantial premium over the usual price. Assuming Barlow's estimated customer demand is 500 units per product line and the company has used its 6,600 pounds of raw material in an optimal fashion, what is the highest price Barlow Company should be willing to pay for an additional pound of materialsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started