Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just need some help on this figuring out if its strong or weak I will rate! Many thanks and God bless! Northrend Clothiers reported the

Just need some help on this figuring out if its "strong" or "weak"

Just need some help on this figuring out if its "strong" or "weak"

I will rate!

Many thanks and God bless!

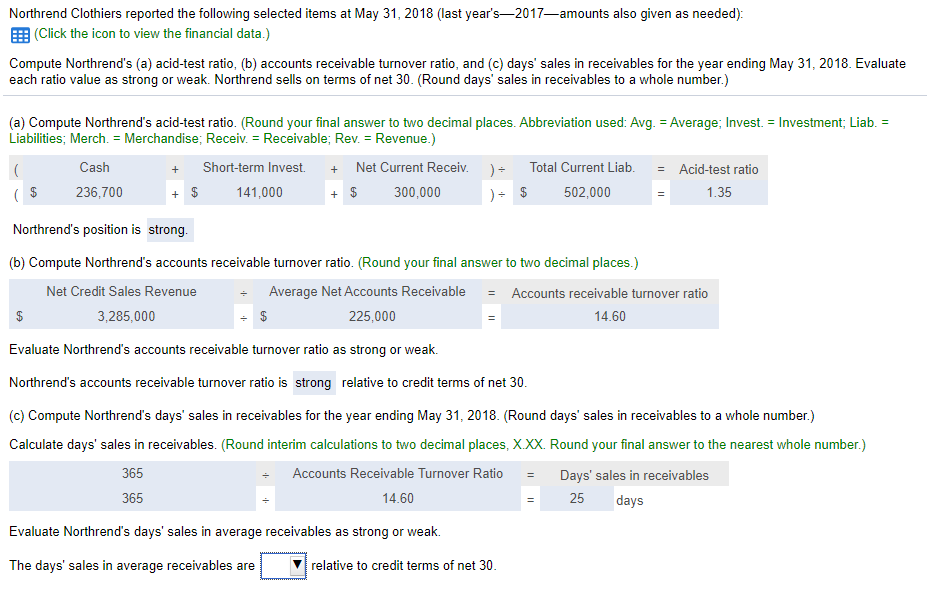

Northrend Clothiers reported the following selected items at May 31, 2018 (last year's2017amounts also given as needed): Click the icon to view the financial data.) Compute Northrend's (a) acid-test ratio, (b) accounts receivable turnover ratio, and (c) days' sales in receivables for the year ending May 31, 2018. Evaluate each ratio value as strong or weak. Northrend sells on terms of net 30. (Round days' sales in receivables to a whole number.) (a) Compute Northrend's acid-test ratio. (Round your final answer to two decimal places. Abbreviation used: Avg. = Average; Invest. = Investment; Liab. = Liabilities; Merch. = Merchandise; Receiv. = Receivable; Rev. = Revenue.) ( Cash Short-term Invest Net Current Receiv.) Total Current Liab. = Acid-test ratio ($ 236,700 + $ 141,000 300,000 502,000 1.35 + $ Northrend's position is rong (b) Compute Northrend's accounts receivable turnover ratio. (Round your final answer to two decimal places.) Net Credit Sales Revenue Average Net Accounts Receivable = Accounts receivable turnover ratio 3,285,000 $ 225,000 14.60 Evaluate Northrend's accounts receivable turnover ratio as strong or weak. Northrend's accounts receivable turnover ratio is strong relative to credit terms of net 30. (c) Compute Northrend's days' sales in receivables for the year ending May 31, 2018. (Round days' sales in receivables to a whole number.) Calculate days' sales in receivables. (Round interim calculations to two decimal places, XXX. Round your final answer to the nearest whole number.) Accounts Receivable Turnover Ratio Days' sales in receivables 365 14.60 25 days Evaluate Northrend's days' sales in average receivables as strong or weak. 365 The days' sales in average receivables are relative to credit terms of net 30Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started