Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just need some help on this please! I will rate!!! Many thanks and God bless! calculate the depreciation for the first year ane using the

Just need some help on this please!

I will rate!!!

Many thanks and God bless!

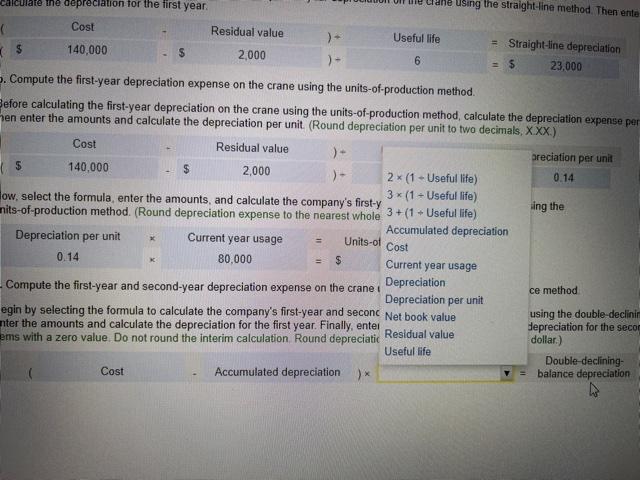

calculate the depreciation for the first year ane using the straight-line method Then ente Cost Residual value ) Useful life = Straight-line depreciation 5 140,000 2,000 6 23,000 5. Compute the first-year depreciation expense on the crane using the units of production method. Before calculating the first-year depreciation on the crane using the units-of-production method, calculate the depreciation expense per en enter the amounts and calculate the depreciation per unit (Round depreciation per unit to two decimals, X.XX.) Cost Residual value ) - preciation per unit $ 140,000 $ 2,000 - 2* (1 - Useful life) 0.14 How, select the formula, enter the amounts, and calculate the company's first-y 3x (1 Useful life) nits-of-production method. (Round depreciation expense to the nearest whole 3+(1 + Useful life) Accumulated depreciation Depreciation per unit Current year usage Units-ot Cost 0.14 80,000 $ Current year usage Depreciation Compute the first-year and second-year depreciation expense on the crane ce method Depreciation egin by selecting the formula to calculate the company's first-year and seconc Net book value using the double-declinin enter the amounts and calculate the depreciation for the first year. Finally, enter depreciation for the seco Residual value ems with a zero value. Do not round the interim calculation Round depreciatic dollar) Useful life Double declining- Cost Accumulated depreciation ) balance depreciation ing the per unitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started