Answered step by step

Verified Expert Solution

Question

1 Approved Answer

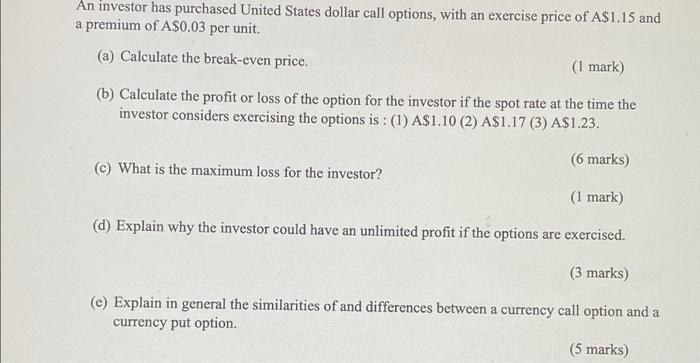

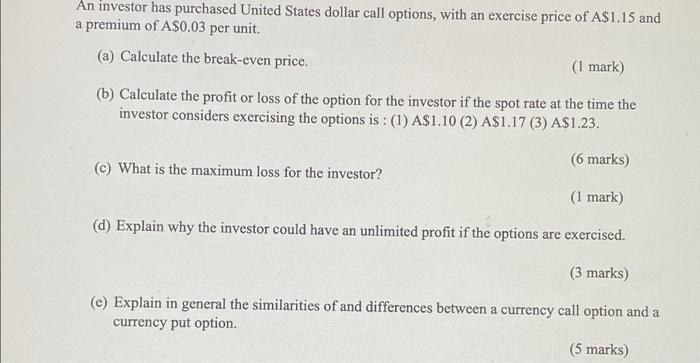

just need some help thank you An investor has purchased United States dollar call options, with an exercise price of A$1.15 and a premium of

just need some help thank you

An investor has purchased United States dollar call options, with an exercise price of A$1.15 and a premium of A$0.03 per unit. (a) Calculate the break-even price. (1 mark) (b) Calculate the profit or loss of the option for the investor if the spot rate at the time the investor considers exercising the options is : (1) A$1.10 (2) A$1.17 (3) A$1.23. (c) What is the maximum loss for the investor? (6 marks) (1 mark) (d) Explain why the investor could have an unlimited profit if the options are exercised. (3 marks) (e) Explain in general the similarities of and differences between a currency call option and a currency put option

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started