just need to correct my answers in the red box. Thanks!

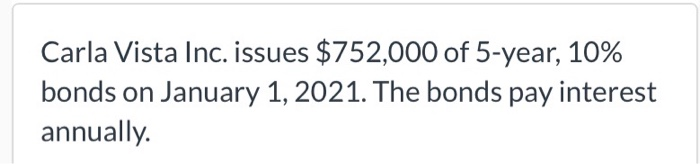

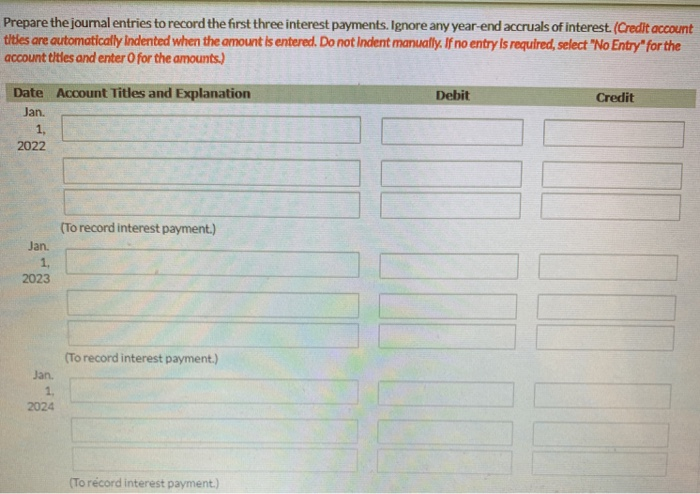

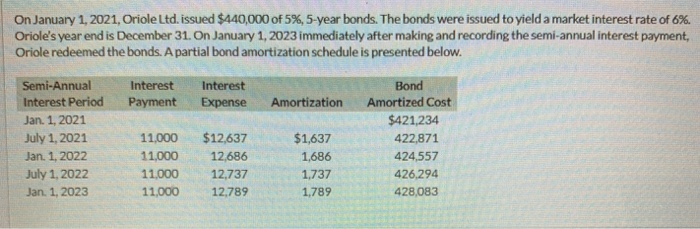

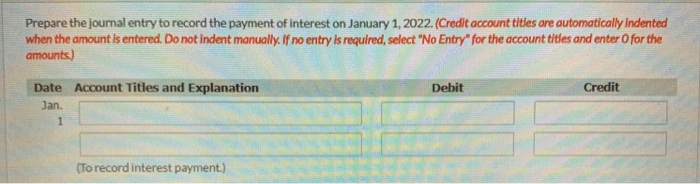

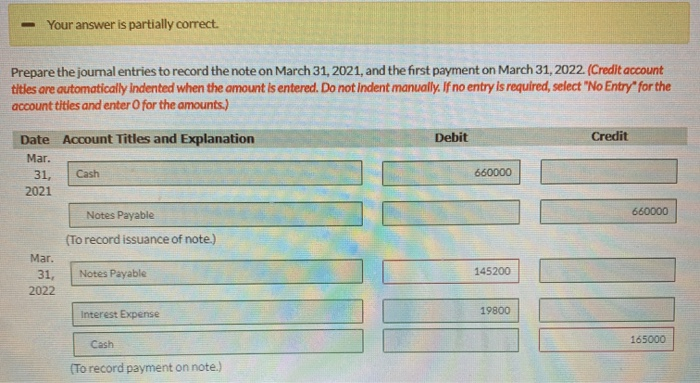

Carla Vista Inc. issues $752,000 of 5-year, 10% bonds on January 1, 2021. The bonds pay interest annually. Prepare the journal entries to record the first three interest payments. Ignore any year-end accruals of interest. (Credit account titles are automatically Indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation Jan. 1, 2022 (To record interest payment.) Jan. 1. 2023 (To record interest payment.) Jan. 1. 2024 (To rcord interest payment.) On January 1, 2021, Oriole Ltd. issued $440,000 of 5%, 5-year bonds. The bonds were issued to yield a market interest rate of 6%. Oriole's year end is December 31. On January 1, 2023 immediately after making and recording the semi-annual interest payment, Oriole redeemed the bonds. A partial bond amortization schedule is presented below. Interest Payment Interest Expense Amortization Semi-Annual Interest Period Jan 1, 2021 July 1, 2021 Jan 1, 2022 July 1, 2022 Jan 1, 2023 11,000 11,000 11,000 11,000 $12,637 12,686 12,737 12,789 $1,637 1,686 1,737 1,789 Bond Amortized Cost $421,234 422,871 424,557 426,294 428,083 Prepare the journal entry to record the payment of interest on January 1, 2022. (Credit account titles are automatically Indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts) Debit Credit Date Account Titles and Explanation Jan. 1 (To record interest payment) Blossom Lake Corp. issues a $660,000, 4-year, 3% note payable on March 31, 2021. The terms provide for fixed principal payments annually of $165,000. - Your answer is partially correct. Prepare the journal entries to record the note on March 31, 2021, and the first payment on March 31, 2022 (Credit account titles are automatically Indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation Mar. 31, Cash 2021 660000 Notes Payable 660000 (To record issuance of note.) Mar. 31, 2022 Notes Payable 145200 Interest Expense 19800 165000 Cash (To record payment on note.)