Answered step by step

Verified Expert Solution

Question

1 Approved Answer

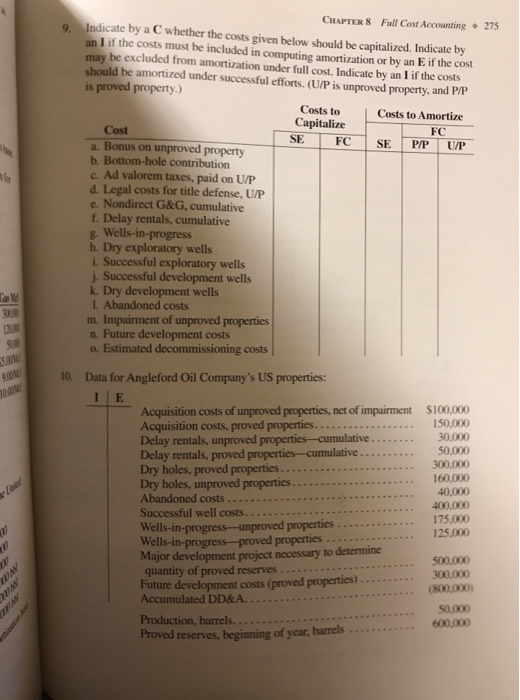

just number 9 CHAPTER 8 Full Cost Accounting 275 9. Indicate by a C whether the costs given below should be capitalized. Indicate by an

just number 9

CHAPTER 8 Full Cost Accounting 275 9. Indicate by a C whether the costs given below should be capitalized. Indicate by an l if the costs must be included in computing amortization or by an E if the cost may be excluded from amortization under full cost. Indicate by an Iif the costs should be amortized under successful efforts. (U/P is unproved property, and P/P is proved property.) Costs to Costs to Amortize Capitalize FC Cost SE FC SE a. Bonus on unproved property P/P U/P b. Bottom-hole contribution c. Ad valorem taxes, paid on U/P d. Legal costs for title defense, U/P e. Nondirect G&G, cumulative f. Delay rentals, cumulative g. Wells-in-progress h. Dry exploratory wells i. Successful exploratory wells j. Successful development wells k. Dry development wells 1. Abandoned costs m. Impairment of unproved properties n. Future development costs o. Estimated decommissioning costs 2 10. Data for Angleford Oil Company's US properties: I E Acquisition costs of unproved properties, net of impairment $100,000 Acquisition costs, proved properties.. 150.000 Delay rentals, unproved properties-cumulative 30.000 Delay rentals, proved properties-cumulative. 50,000 Dry holes, proved properties.. 300,000 Dry holes, unproved properties. 160,000 Abandoned costs.. 40.000 Successful well costs. 400.000 175.000 Wells-in-progress-unproved properties 125.000 Wells-in-progress-proved properties Major development project necessary to determine 500.000 quantity of proved reserves 300.000 Future development costs (proved properties) (800,000) Accumulated DD&A.. 50.000 Production, barrels 600.000 Proved reserves, beginning of year, burrels CHAPTER 8 Full Cost Accounting 275 9. Indicate by a C whether the costs given below should be capitalized. Indicate by an l if the costs must be included in computing amortization or by an E if the cost may be excluded from amortization under full cost. Indicate by an Iif the costs should be amortized under successful efforts. (U/P is unproved property, and P/P is proved property.) Costs to Costs to Amortize Capitalize FC Cost SE FC SE a. Bonus on unproved property P/P U/P b. Bottom-hole contribution c. Ad valorem taxes, paid on U/P d. Legal costs for title defense, U/P e. Nondirect G&G, cumulative f. Delay rentals, cumulative g. Wells-in-progress h. Dry exploratory wells i. Successful exploratory wells j. Successful development wells k. Dry development wells 1. Abandoned costs m. Impairment of unproved properties n. Future development costs o. Estimated decommissioning costs 2 10. Data for Angleford Oil Company's US properties: I E Acquisition costs of unproved properties, net of impairment $100,000 Acquisition costs, proved properties.. 150.000 Delay rentals, unproved properties-cumulative 30.000 Delay rentals, proved properties-cumulative. 50,000 Dry holes, proved properties.. 300,000 Dry holes, unproved properties. 160,000 Abandoned costs.. 40.000 Successful well costs. 400.000 175.000 Wells-in-progress-unproved properties 125.000 Wells-in-progress-proved properties Major development project necessary to determine 500.000 quantity of proved reserves 300.000 Future development costs (proved properties) (800,000) Accumulated DD&A.. 50.000 Production, barrels 600.000 Proved reserves, beginning of year, burrels Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started