Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just please do question 1 Just please do question 1 1 The following table shows the cost allocation bases used to distribute various costs among

Just please do question 1

Just please do question 1

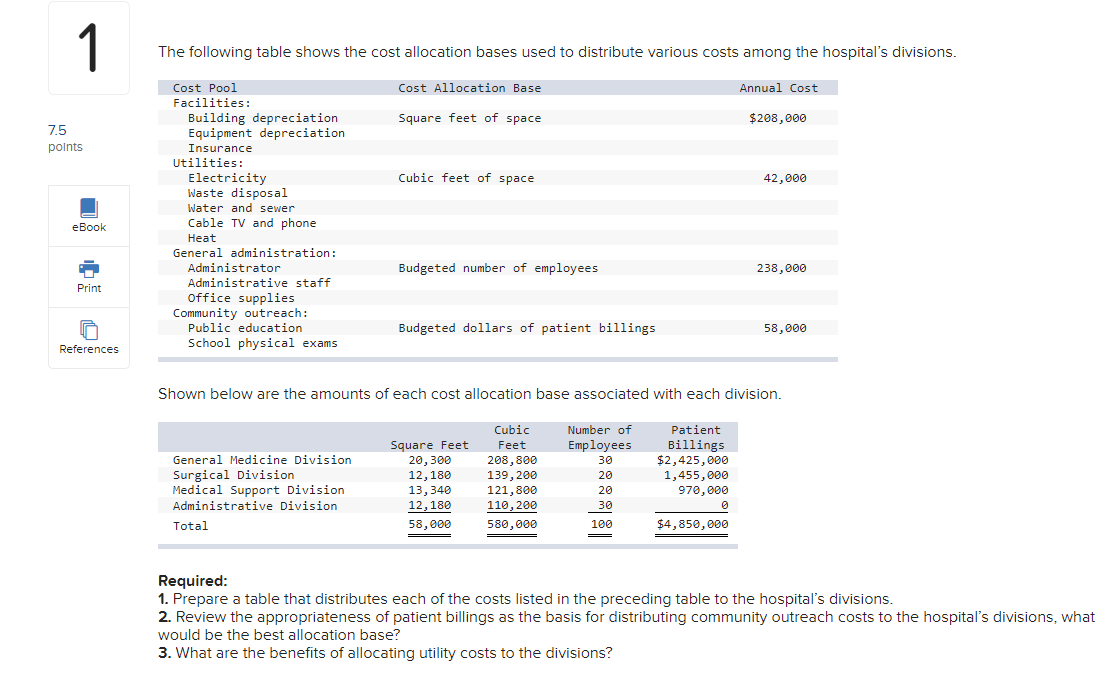

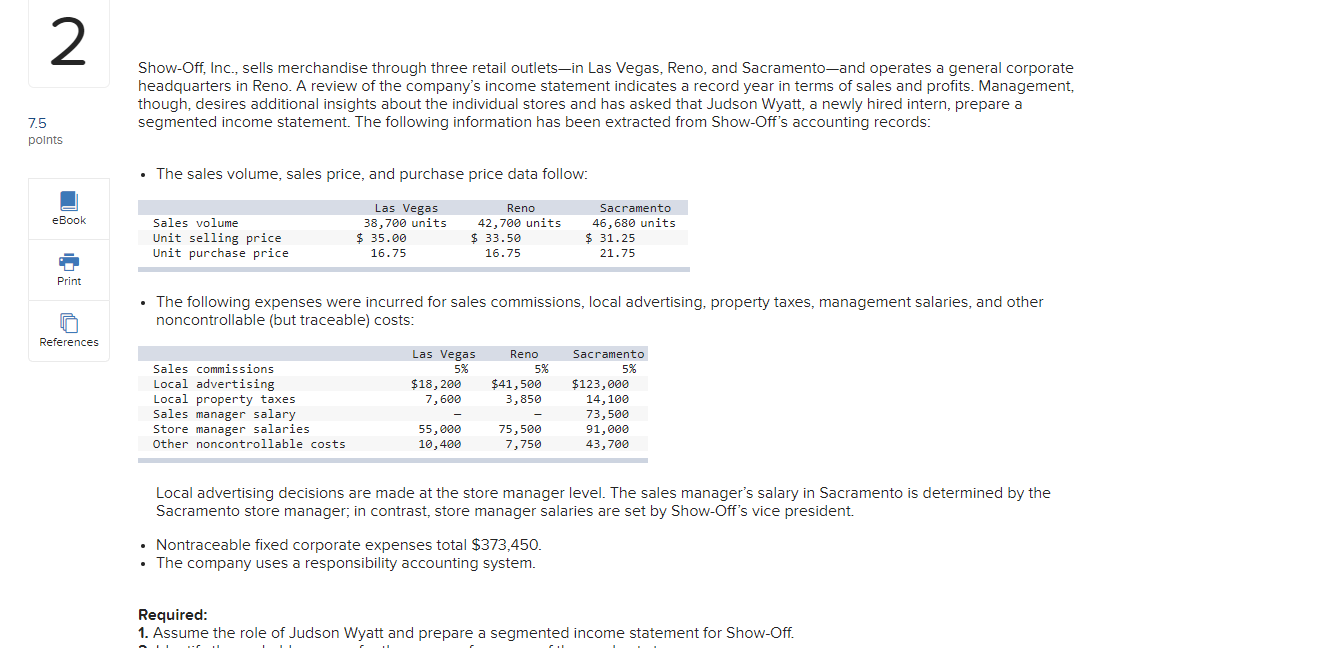

1 The following table shows the cost allocation bases used to distribute various costs among the hospital's divisions. Cost Allocation Base Annual Cost Square feet of space $208,000 7.5 points Cubic feet of space 42,000 Cost Pool Facilities: Building depreciation Equipment depreciation Insurance Utilities: Electricity Waste disposal Water and sewer Cable TV and phone Heat General administration: Administrator Administrative staff Office supplies Community Outreach: Public education School physical exams eBook Budgeted number of employees 238,000 Print Budgeted dollars of patient billings 58,000 References Shown below are the amounts of each cost allocation base associated with each division. General Medicine Division Surgical Division Medical Support Division Administrative Division Total Square Feet 20,300 12,180 13, 340 12,180 58,000 Cubic Feet 208,800 139,200 121,800 110,200 580,000 Number of Employees 30 20 20 30 Patient Billings $2,425,000 1,455,000 970,000 100 $4,850,000 Required: 1. Prepare a table that distributes each of the costs listed in the preceding table to the hospital's divisions. 2. Review the appropriateness of patient billings as the basis for distributing community Outreach costs to the hospital's divisions, what would be the best allocation base? 3. What are the benefits of allocating utility costs to the divisions? 2 Show-Off, Inc., sells merchandise through three retail outletsin Las Vegas, Reno, and Sacramento-and operates a general corporate headquarters in Reno. A review of the company's income statement indicates a record year in terms of sales and profits. Management, though, desires additional insights about the individual stores and has asked that Judson Wyatt, a newly hired intern, prepare a segmented income statement. The following information has been extracted from Show-Off's accounting records: 7.5 points The sales volume, sales price, and purchase price data follow: eBook Sales volume Unit selling price Unit purchase price Las Vegas 38,700 units $ 35.00 16.75 Reno 42,700 units $ 33.50 16.75 Sacramento 46,680 units $ 31.25 21.75 Print The following expenses were incurred for sales commissions, local advertising, property taxes, management salaries, and other noncontrollable (but traceable) costs: References Las Vegas 5% $18,200 Sales commissions Local advertising Local property taxes Sales manager salary Store manager salaries Other noncontrollable costs Reno 5% $41,500 3,850 7,600 Sacramento 5% $123,000 14,100 73,500 91,000 43,700 55,000 10,400 75,500 7,750 Local advertising decisions are made at the store manager level. The sales manager's salary in Sacramento is determined by the Sacramento store manager, in contrast, store manager salaries are set by Show-Off's vice president. Nontraceable fixed corporate expenses total $373,450. The company uses a responsibility accounting system. Required: 1. Assume the role of Judson Wyatt and prepare a segmented income statement for Show-OffStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started