Answered step by step

Verified Expert Solution

Question

1 Approved Answer

JUST POST ANSWER DONT NEED STEPS (This will be faster and ill give thumbsup) You currently hold a 4-year fixed rate bond paying 3% annually.

JUST POST ANSWER DONT NEED STEPS (This will be faster and ill give thumbsup)

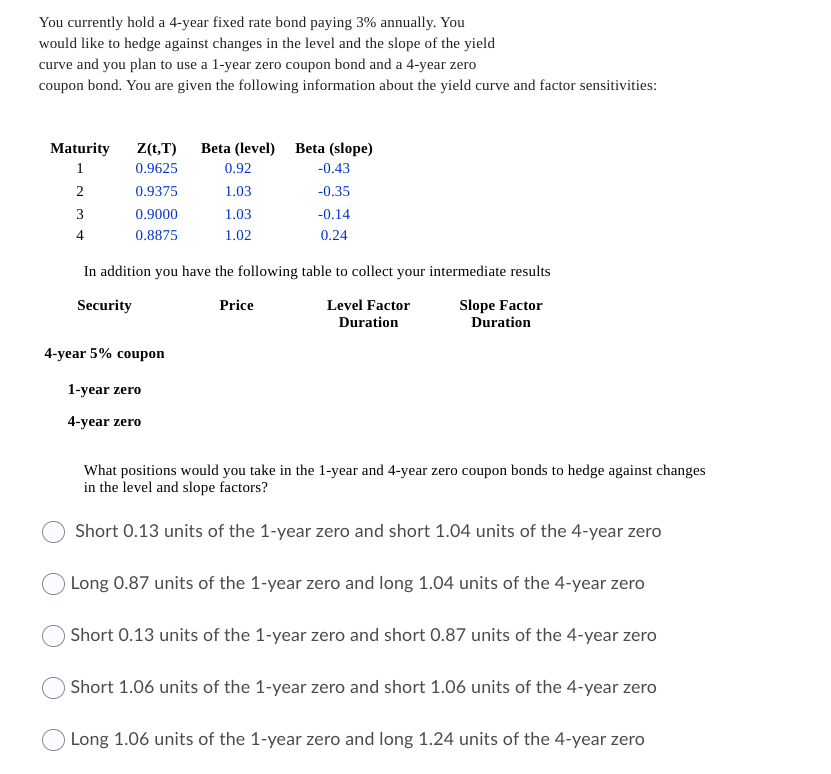

You currently hold a 4-year fixed rate bond paying 3% annually. You would like to hedge against changes in the level and the slope of the yield curve and you plan to use a 1-year zero coupon bond and a 4-year zero coupon bond. You are given the following information about the yield curve and factor sensitivities: Maturity 1 2 3 4 Z(t,T) Beta (level) Beta (slope) 0.9625 0.92 -0.43 0.9375 1.03 -0.35 0.9000 1.03 -0.14 0.8875 1.02 0.24 In addition you have the following table to collect your intermediate results Security Price Level Factor Duration Slope Factor Duration 4-year 5% coupon 1-year zero 4-year zero What positions would you take in the 1-year and 4-year zero coupon bonds to hedge against changes in the level and slope factors? Short 0.13 units of the 1-year zero and short 1.04 units of the 4-year zero Long 0.87 units of the 1-year zero and long 1.04 units of the 4-year zero Short 0.13 units of the 1-year zero and short 0.87 units of the 4-year zero Short 1.06 units of the 1-year zero and short 1.06 units of the 4-year zero Long 1.06 units of the 1-year zero and long 1.24 units of the 4-year zero You currently hold a 4-year fixed rate bond paying 3% annually. You would like to hedge against changes in the level and the slope of the yield curve and you plan to use a 1-year zero coupon bond and a 4-year zero coupon bond. You are given the following information about the yield curve and factor sensitivities: Maturity 1 2 3 4 Z(t,T) Beta (level) Beta (slope) 0.9625 0.92 -0.43 0.9375 1.03 -0.35 0.9000 1.03 -0.14 0.8875 1.02 0.24 In addition you have the following table to collect your intermediate results Security Price Level Factor Duration Slope Factor Duration 4-year 5% coupon 1-year zero 4-year zero What positions would you take in the 1-year and 4-year zero coupon bonds to hedge against changes in the level and slope factors? Short 0.13 units of the 1-year zero and short 1.04 units of the 4-year zero Long 0.87 units of the 1-year zero and long 1.04 units of the 4-year zero Short 0.13 units of the 1-year zero and short 0.87 units of the 4-year zero Short 1.06 units of the 1-year zero and short 1.06 units of the 4-year zero Long 1.06 units of the 1-year zero and long 1.24 units of the 4-year zeroStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started