Answered step by step

Verified Expert Solution

Question

1 Approved Answer

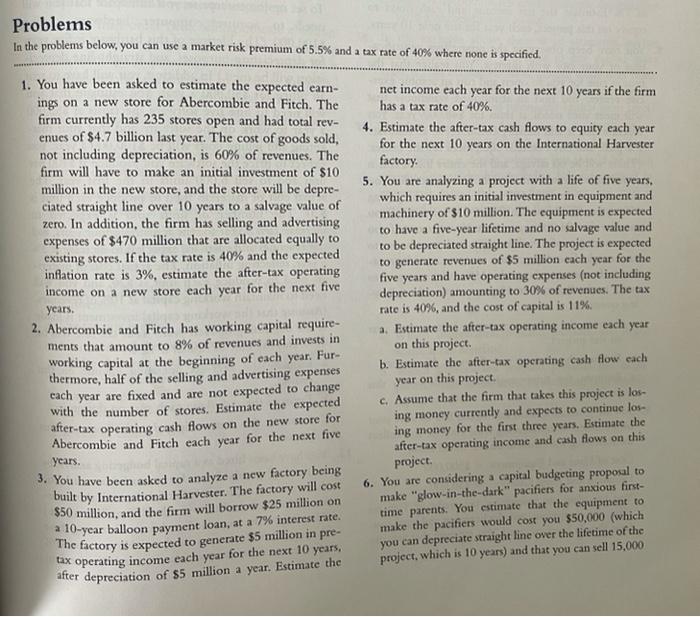

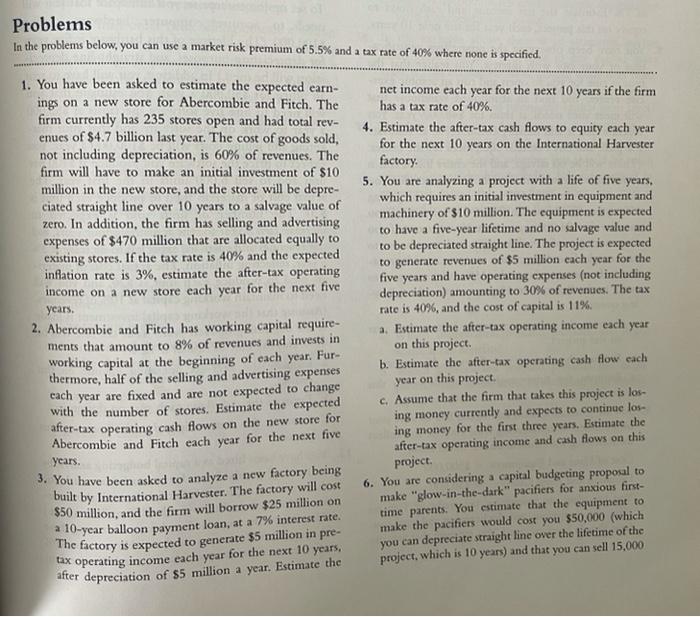

Just problem #5 Problems In the problems below, you can use a market risk premium of 5.5% and a tax rate of 40% where none

Just problem #5

Problems In the problems below, you can use a market risk premium of 5.5% and a tax rate of 40% where none is specified. 1. You have been asked to estimate the expected earn- ings on a new store for Abercombic and Fitch. The firm currently has 235 stores open and had total rev- enues of $4.7 billion last year. The cost of goods sold, not including depreciation, is 60% of revenues. The firm will have to make an initial investment of $10 million in the new store, and the store will be depre- ciated straight line over 10 years to a salvage value of zero. In addition, the firm has selling and advertising expenses of $470 million that are allocated equally to existing stores. If the tax rate is 40% and the expected inflation rate is 3%, estimate the after-tax operating income on a new store each year for the next five years. 2. Abercombic and Fitch has working capital require- ments that amount to 8% of revenues and invests in working capital at the beginning of each year. Fur- thermore, half of the selling and advertising expenses each year are fixed and are not expected to change with the number of stores. Estimate the expected after-tax operating cash flows on the new store for Abercombie and Fitch each year for the next five years. 3. You have been asked to analyze a new factory being built by International Harvester. The factory will cost $50 million, and the firm will borrow $25 million on a 10-year balloon payment loan, at a 7% interest rate. The factory is expected to generate $5 million in pre- tax operating income each year for the next 10 years, after depreciation of $5 million a year. Estimate the net income each year for the next 10 years if the firm has a tax rate of 40%. 4. Estimate the after-tax cash flows to equity cach year for the next 10 years on the International Harvester factory 5. You are analyzing a project with a life of five years, which requires an initial investment in equipment and machinery of $10 million. The equipment is expected to have a five-year lifetime and no salvage value and to be depreciated straight line. The project is expected to generate revenues of $5 million cach year for the five years and have operating expenses (not including depreciation) amounting to 30% of revenues. The tax rate is 40%, and the cost of capital is 11% a. Estimate the after-tax operating income each year on this project. b. Estimate the after-tax operating cash flow each year on this project c. Assume that the firm that takes this project is los- ing money currently and expects to continue los ing money for the first three years. Estimate the after-tax operating income and cash flows on this project. 6. You are considering a capital budgeting proposal to make "glow-in-the-dark" pacifiers for anxious first- time parents. You estimate that the equipment to make the pacifiers would cost you $50,000 (which you can depreciate straight line over the lifetime of the project, which is 10 years) and that you can sell 15.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started