Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just problem2 Problem 1 (Cash Flow Homework). Market price of Declan's is $5.00 per share and Brayden's market Calculate all the ratios you have learned

Just problem2

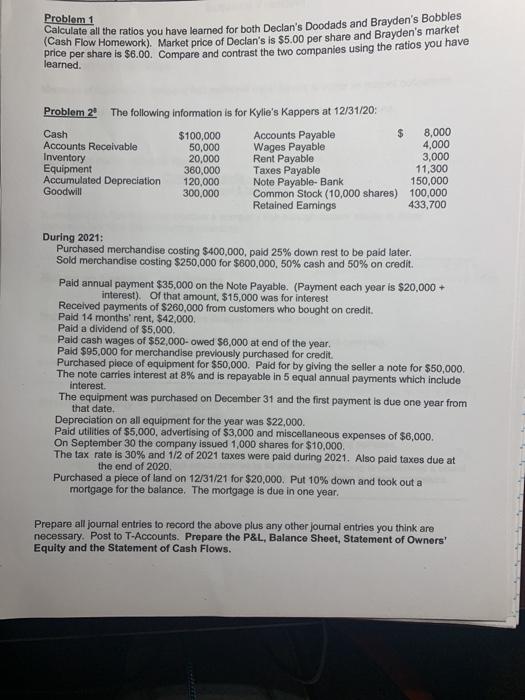

Problem 1 (Cash Flow Homework). Market price of Declan's is $5.00 per share and Brayden's market Calculate all the ratios you have learned for both Declan's Doodads and Brayden's Bobbles price per share is $6.00. Compare and contrast the two companies using the ratios you have Problem 2. The following information is for Kyle's Kappers at 12/31/20 Cash $100,000 Accounts Payable $ 8,000 Accounts Receivable 50,000 Wages Payable 4,000 Inventory 20,000 Rent Payable 3,000 Equipment 360,000 Taxes Payable 11,300 Accumulated Depreciation 120,000 Note Payable-Bank 150,000 Goodwill 300.000 Common Stock (10,000 shares) 100,000 Retained Earings 433,700 During 2021: Purchased merchandise costing $400,000, paid 25% down rest to be paid later. Sold merchandise costing $250,000 for $600,000, 50% cash and 50% on credit. Paid annual payment $35,000 on the Note Payable. (Payment each year is $20,000 + interest). Of that amount. $15,000 was for interest Received payments of S260,000 from customers who bought on credit. Paid 14 months' rent, $42,000. Paid a dividend of $5,000. Paid cash wages of $62,000- owed $6,000 at end of the year. Paid $95.000 for merchandise previously purchased for credit. Purchased piece of equipment for $50,000. Paid for by giving the seller a note for $50,000 The note carries interest at 8% and is repayable in 5 equal annual payments which include interest The equipment was purchased on December 31 and the first payment is due one year from Depreciation on all equipment for the year was $22,000. Paid utilities of $5,000, advertising of $3,000 and miscellaneous expenses of $6,000. On September 30 the company issued 1,000 shares for $10,000 The tax rate is 30% and 1/2 of 2021 taxes were paid during 2021. Also paid taxes due at the end of 2020 Purchased a piece of land on 12/31/21 for $20,000. Put 10% down and took out a mortgage for the balance. The mortgage is due in one year. that date. Prepare all journal entries to record the above plus any other joumal entries you think are necessary. Post to T-Accounts. Prepare the P&L, Balance Sheet, Statement of Owners' Equity and the Statement of Cash Flows. Problem 1 (Cash Flow Homework). Market price of Declan's is $5.00 per share and Brayden's market Calculate all the ratios you have learned for both Declan's Doodads and Brayden's Bobbles price per share is $6.00. Compare and contrast the two companies using the ratios you have Problem 2. The following information is for Kyle's Kappers at 12/31/20 Cash $100,000 Accounts Payable $ 8,000 Accounts Receivable 50,000 Wages Payable 4,000 Inventory 20,000 Rent Payable 3,000 Equipment 360,000 Taxes Payable 11,300 Accumulated Depreciation 120,000 Note Payable-Bank 150,000 Goodwill 300.000 Common Stock (10,000 shares) 100,000 Retained Earings 433,700 During 2021: Purchased merchandise costing $400,000, paid 25% down rest to be paid later. Sold merchandise costing $250,000 for $600,000, 50% cash and 50% on credit. Paid annual payment $35,000 on the Note Payable. (Payment each year is $20,000 + interest). Of that amount. $15,000 was for interest Received payments of S260,000 from customers who bought on credit. Paid 14 months' rent, $42,000. Paid a dividend of $5,000. Paid cash wages of $62,000- owed $6,000 at end of the year. Paid $95.000 for merchandise previously purchased for credit. Purchased piece of equipment for $50,000. Paid for by giving the seller a note for $50,000 The note carries interest at 8% and is repayable in 5 equal annual payments which include interest The equipment was purchased on December 31 and the first payment is due one year from Depreciation on all equipment for the year was $22,000. Paid utilities of $5,000, advertising of $3,000 and miscellaneous expenses of $6,000. On September 30 the company issued 1,000 shares for $10,000 The tax rate is 30% and 1/2 of 2021 taxes were paid during 2021. Also paid taxes due at the end of 2020 Purchased a piece of land on 12/31/21 for $20,000. Put 10% down and took out a mortgage for the balance. The mortgage is due in one year. that date. Prepare all journal entries to record the above plus any other joumal entries you think are necessary. Post to T-Accounts. Prepare the P&L, Balance Sheet, Statement of Owners' Equity and the Statement of Cash Flows Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started