Answered step by step

Verified Expert Solution

Question

1 Approved Answer

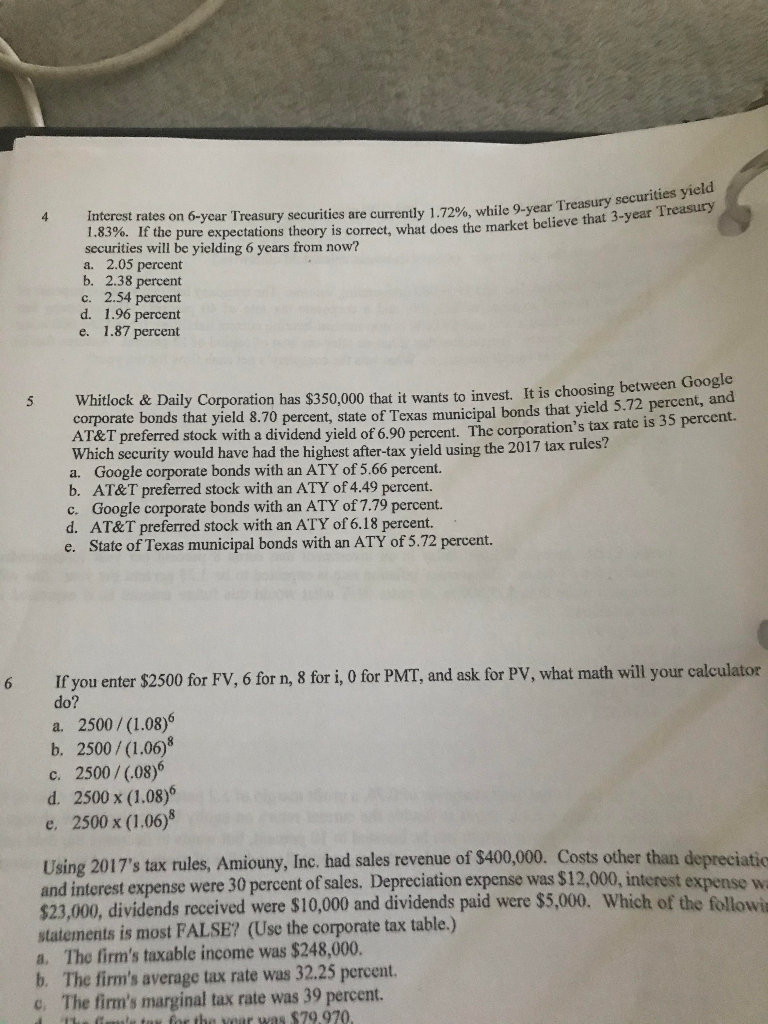

Just Question 5 needed 4 Interest rates on 6-year Treasury securities are currently 1.72%, while 9-year Treasury securities yield 1.83%. If the pure expectations theory

Just Question 5 needed

4 Interest rates on 6-year Treasury securities are currently 1.72%, while 9-year Treasury securities yield 1.83%. If the pure expectations theory is correct, what does the market believe that 3-year Treasury securities will be yielding 6 years from now? a. 2.05 percent b. 2.38 percent c. 2.54 percent d. 1.96 percent e. 1.87 percent 5 Whitlock & Daily Corporation has $350,000 that it wants to invest. It is choosing between Google corporate bonds that yield 8.70 percent, state of Texas municipal bonds that yield 5.72 percent, and AT&T preferred stock with a dividend yield of 6.90 percent. The corporation's tax rate is 35 percent. Which security would have had the highest after-tax yield using the 2017 tax rules? a. Google corporate bonds with an ATY of 5.66 percent. b. AT&T preferred stock with an ATY of 4.49 percent. c. Google corporate bonds with an ATY of 7.79 percent. d. AT&T preferred stock with an ATY of 6.18 percent. e. State of Texas municipal bonds with an ATY of 5.72 percent. 6 If you enter $2500 for FV, 6 for n, 8 for i, 0 for PMT, and ask for PV, what math will your calculator do? a. 2500 / (1.08) b. 2500/(1.06) c. 2500/(.08) d. 2500 x (1.08) e, 2500 x (1.06) Using 2017's tax rules, Amiouny, Inc. had sales revenue of $400,000. Costs other than depreciatic and interest expense were 30 percent of sales. Depreciation expense was $12,000, interest expense wa $23,000, dividends received were $10,000 and dividends paid were $5,000. Which of the followie statements is most FALSE? (Use the corporate tax table.) a. The firm's taxable income was $248,000. b. The firm's average tax rate was 32.25 percent. c. The firm's marginal tax rate was 39 percent. Tietox for the year was $79.970Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started