just the 4 fill in the blanks please

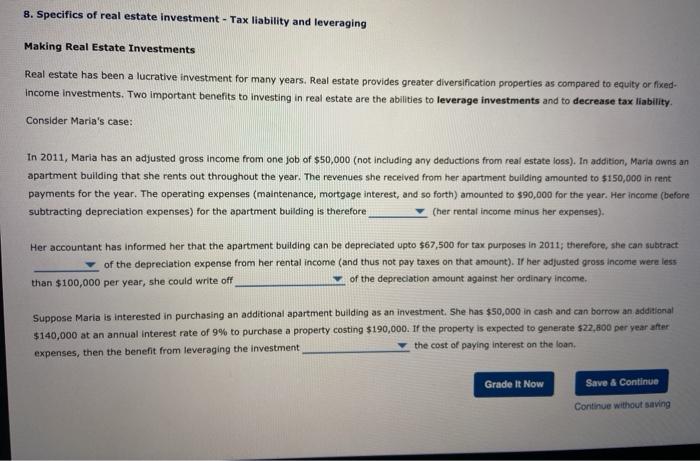

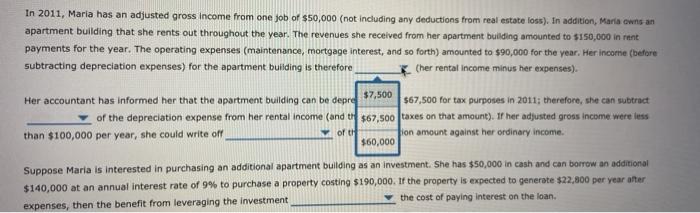

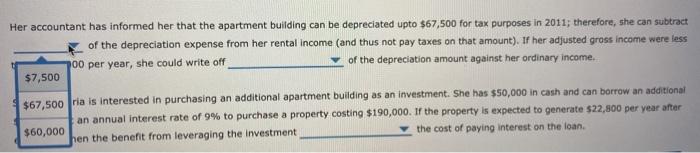

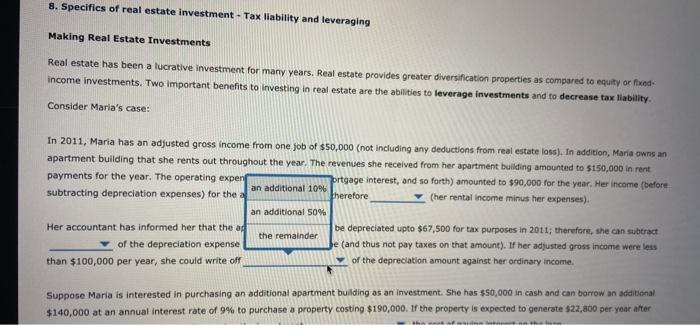

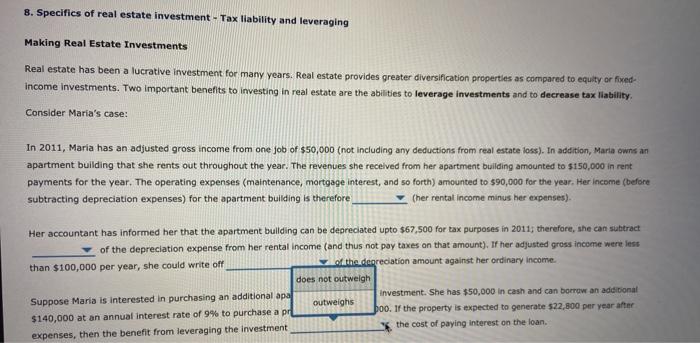

8. Specifics of real estate investment - Tax liability and leveraging Making Real Estate Investments Real estate has been a lucrative investment for many years. Real estate provides greater diversification properties as compared to equity or fixed. income investments. Two important benefits to investing in real estate are the abilities to leverage investments and to decrease tax liability Consider Maria's case: In 2011, Maria has an adjusted gross income from one job of $50,000 (not including any deductions from real estate loss). In addition, Maria owns an apartment building that she rents out throughout the year. The revenues she received from her apartment building amounted to $150,000 in rent payments for the year. The operating expenses (maintenance, mortgage interest, and so forth) amounted to $90,000 for the year. Her income (before subtracting depreciation expenses) for the apartment building is therefore (her rental income minus her expenses). Her accountant has informed her that the apartment building can be depreciated upto $67,500 for tax purposes in 2011; therefore, she can subtract of the depreciation expense from her rental income (and thus not pay taxes on that amount). If her adjusted gross income were less than $100,000 per year, she could write off of the depreciation amount against her ordinary income. Suppose Maria is interested in purchasing an additional apartment building as an investment. She has $50,000 in cash and can borrow an additional $140,000 at an annual interest rate of 9% to purchase a property costing $190,000. If the property is expected to generate $22,800 per year after expenses, then the benefit from leveraging the investment the cost of paying interest on the loan Grade it Now Save & Continue Continue without saving In 2011, Maria has an adjusted gross income from one job of $50,000 (not including any deductions from real estate loss). In addition, Maria owns an apartment building that she rents out throughout the year. The revenues she received from her apartment building amounted to $150,000 in rent payments for the year. The operating expenses (maintenance, mortgage interest, and so forth) amounted to $90,000 for the year. Her income (before subtracting depreciation expenses) for the apartment building is therefore Cher rental income minus her expenses). Her accountant has informed her that the apartment building can be depre $7,500 $67,500 for tax purposes in 2011; therefore, she can subtract of the depreciation expense from her rental income (and try $67,500 taxes on that amount). If her adjusted gross income were less than $100,000 per year, she could write off pion amount against her ordinary income. $60,000 oft Suppose Maria is interested in purchasing an additional apartment building as an investment. She has $50,000 in cash and can borrow an additional $140,000 at an annual interest rate of 9% to purchase a property costing $190,000. If the property is expected to generate $22,800 per year after expenses, then the benefit from leveraging the investment the cost of paying interest on the loan. Her accountant has informed her that the apartment building can be depreciated upto $67,500 for tax purposes in 2011; therefore, she can subtract of the depreciation expense from her rental income (and thus not pay taxes on that amount). If her adjusted gross income were less poo per year, she could write off of the depreciation amount against her ordinary income. $7,500 $67,500 ria is interested in purchasing an additional apartment building as an investment. She has $50,000 in cash and can borrow an additional an annual interest rate of 9% to purchase a property costing $190,000. If the property is expected to generate $22,800 per year after $60,000 hen the benefit from leveraging the investment the cost of paying interest on the loan 8. Specifics of real estate investment - Tax liability and leveraging Making Real Estate Investments Real estate has been a lucrative investment for many years. Real estate provides greater diversification properties as compared to equity or fixed income Investments. Two important benefits to investing in real estate are the abilities to leverage investments and to decrease tax liability Consider Maria's case: In 2011, Maria has an adjusted gross income from one job of $50,000 (not including any deductions from real estate loss). In addition, Maria owns an apartment building that she rents out throughout the year. The revenues she received from her apartment building amounted to $150,000 in rent payments for the year. The operating expen prtgage interest, and so forth) amounted to $90,000 for the year. Her Income (before an additional 10% subtracting depreciation expenses) for the therefore (her rental income minus her expenses). an additional 50% Her accountant has informed her that the ag be depreciated upto $67,500 for tax purposes in 2011; therefore, she can subtract the remainder of the depreciation expense be (and thus not pay taxes on that amount). If her adjusted gross income were less than $100,000 per year, she could write off of the depreciation amount against her ordinary income. Suppose Maria is interested in purchasing an additional apartment building as an investment. She has $50,000 in cash and can borrow an additional $140,000 at an annual interest rate of 9% to purchase a property costing $190,000. If the property is expected to generate 522,800 per year after 8. Specifics of real estate investment - Tax liability and leveraging Making Real Estate Investments Real estate has been a lucrative investment for many years. Real estate provides greater diversification properties as compared to equity or fixed income Investments. Two important benefits to investing in real estate are the abilities to leverage investments and to decrease tax liability Consider Maria's case: In 2011, Maria has an adjusted gross income from one job of $50,000 (not including any deductions from real estate loss). In addition, Marta owns an apartment building that she rents out throughout the year. The revenues she received from her apartment building amounted to $150,000 in rent payments for the year. The operating expenses (maintenance, mortgage interest, and so forth) amounted to $90,000 for the year. Her income (before subtracting depreciation expenses) for the apartment building is therefore (her rental income minus her expenses). Her accountant has informed her that the apartment building can be depreciated upto $67,500 for tax purposes in 2011; therefore, the can subtract of the depreciation expense from her rental income (and thus not pay taxes on that amount). If her adjusted gross income were less than $100,000 per year, she could write off of the degreciation amount against her ordinary income. does not outweigh Suppose Maria is interested in purchasing an additional apa Investment. She has $50,000 in cash and can borrow an additional outweighs $140,000 at an annual interest rate of 9% to purchase a pr poo. If the property is expected to generate 522,800 per year after expenses, then the benefit from leveraging the investment the cost of paying interest on the loan. 8. Specifics of real estate investment - Tax liability and leveraging Making Real Estate Investments Real estate has been a lucrative investment for many years. Real estate provides greater diversification properties as compared to equity or fixed. income investments. Two important benefits to investing in real estate are the abilities to leverage investments and to decrease tax liability Consider Maria's case: In 2011, Maria has an adjusted gross income from one job of $50,000 (not including any deductions from real estate loss). In addition, Maria owns an apartment building that she rents out throughout the year. The revenues she received from her apartment building amounted to $150,000 in rent payments for the year. The operating expenses (maintenance, mortgage interest, and so forth) amounted to $90,000 for the year. Her income (before subtracting depreciation expenses) for the apartment building is therefore (her rental income minus her expenses). Her accountant has informed her that the apartment building can be depreciated upto $67,500 for tax purposes in 2011; therefore, she can subtract of the depreciation expense from her rental income (and thus not pay taxes on that amount). If her adjusted gross income were less than $100,000 per year, she could write off of the depreciation amount against her ordinary income. Suppose Maria is interested in purchasing an additional apartment building as an investment. She has $50,000 in cash and can borrow an additional $140,000 at an annual interest rate of 9% to purchase a property costing $190,000. If the property is expected to generate $22,800 per year after expenses, then the benefit from leveraging the investment the cost of paying interest on the loan Grade it Now Save & Continue Continue without saving In 2011, Maria has an adjusted gross income from one job of $50,000 (not including any deductions from real estate loss). In addition, Maria owns an apartment building that she rents out throughout the year. The revenues she received from her apartment building amounted to $150,000 in rent payments for the year. The operating expenses (maintenance, mortgage interest, and so forth) amounted to $90,000 for the year. Her income (before subtracting depreciation expenses) for the apartment building is therefore Cher rental income minus her expenses). Her accountant has informed her that the apartment building can be depre $7,500 $67,500 for tax purposes in 2011; therefore, she can subtract of the depreciation expense from her rental income (and try $67,500 taxes on that amount). If her adjusted gross income were less than $100,000 per year, she could write off pion amount against her ordinary income. $60,000 oft Suppose Maria is interested in purchasing an additional apartment building as an investment. She has $50,000 in cash and can borrow an additional $140,000 at an annual interest rate of 9% to purchase a property costing $190,000. If the property is expected to generate $22,800 per year after expenses, then the benefit from leveraging the investment the cost of paying interest on the loan. Her accountant has informed her that the apartment building can be depreciated upto $67,500 for tax purposes in 2011; therefore, she can subtract of the depreciation expense from her rental income (and thus not pay taxes on that amount). If her adjusted gross income were less poo per year, she could write off of the depreciation amount against her ordinary income. $7,500 $67,500 ria is interested in purchasing an additional apartment building as an investment. She has $50,000 in cash and can borrow an additional an annual interest rate of 9% to purchase a property costing $190,000. If the property is expected to generate $22,800 per year after $60,000 hen the benefit from leveraging the investment the cost of paying interest on the loan 8. Specifics of real estate investment - Tax liability and leveraging Making Real Estate Investments Real estate has been a lucrative investment for many years. Real estate provides greater diversification properties as compared to equity or fixed income Investments. Two important benefits to investing in real estate are the abilities to leverage investments and to decrease tax liability Consider Maria's case: In 2011, Maria has an adjusted gross income from one job of $50,000 (not including any deductions from real estate loss). In addition, Maria owns an apartment building that she rents out throughout the year. The revenues she received from her apartment building amounted to $150,000 in rent payments for the year. The operating expen prtgage interest, and so forth) amounted to $90,000 for the year. Her Income (before an additional 10% subtracting depreciation expenses) for the therefore (her rental income minus her expenses). an additional 50% Her accountant has informed her that the ag be depreciated upto $67,500 for tax purposes in 2011; therefore, she can subtract the remainder of the depreciation expense be (and thus not pay taxes on that amount). If her adjusted gross income were less than $100,000 per year, she could write off of the depreciation amount against her ordinary income. Suppose Maria is interested in purchasing an additional apartment building as an investment. She has $50,000 in cash and can borrow an additional $140,000 at an annual interest rate of 9% to purchase a property costing $190,000. If the property is expected to generate 522,800 per year after 8. Specifics of real estate investment - Tax liability and leveraging Making Real Estate Investments Real estate has been a lucrative investment for many years. Real estate provides greater diversification properties as compared to equity or fixed income Investments. Two important benefits to investing in real estate are the abilities to leverage investments and to decrease tax liability Consider Maria's case: In 2011, Maria has an adjusted gross income from one job of $50,000 (not including any deductions from real estate loss). In addition, Marta owns an apartment building that she rents out throughout the year. The revenues she received from her apartment building amounted to $150,000 in rent payments for the year. The operating expenses (maintenance, mortgage interest, and so forth) amounted to $90,000 for the year. Her income (before subtracting depreciation expenses) for the apartment building is therefore (her rental income minus her expenses). Her accountant has informed her that the apartment building can be depreciated upto $67,500 for tax purposes in 2011; therefore, the can subtract of the depreciation expense from her rental income (and thus not pay taxes on that amount). If her adjusted gross income were less than $100,000 per year, she could write off of the degreciation amount against her ordinary income. does not outweigh Suppose Maria is interested in purchasing an additional apa Investment. She has $50,000 in cash and can borrow an additional outweighs $140,000 at an annual interest rate of 9% to purchase a pr poo. If the property is expected to generate 522,800 per year after expenses, then the benefit from leveraging the investment the cost of paying interest on the loan