Answered step by step

Verified Expert Solution

Question

1 Approved Answer

just the answers pls D) increase, increase = 1. In Keynes's liquidity preference framework, as the expected return on bonds increases (holding everything else unchanged),

just the answers pls

D) increase, increase

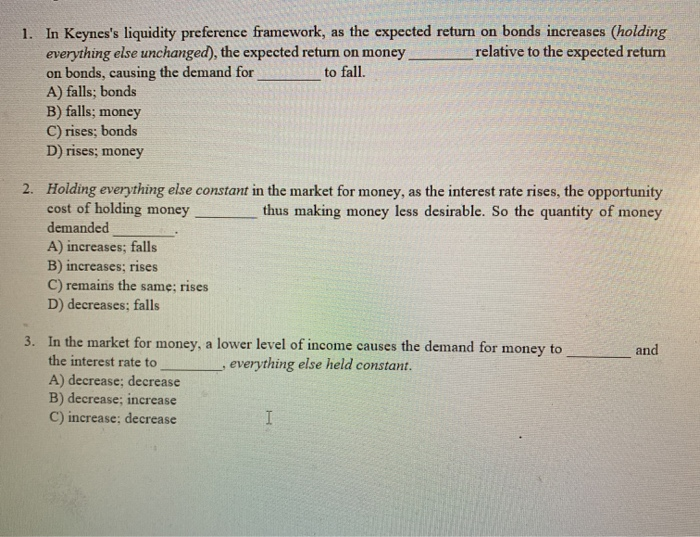

= 1. In Keynes's liquidity preference framework, as the expected return on bonds increases (holding everything else unchanged), the expected return on money relative to the expected return on bonds, causing the demand for to fall. A) falls; bonds B) falls; money C) rises; bonds D) rises; money 2. Holding everything else constant in the market for money, as the interest rate rises, the opportunity cost of holding money thus making money less desirable. So the quantity of money demanded A) increases; falls B) increases; rises C) remains the same; rises D) decreases; falls and 3. In the market for money, a lower level of income causes the demand for money to the interest rate to , everything else held constant. A) decrease; decrease B) decrease; increase C) increase: decrease Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started