just the balance sheet please:)

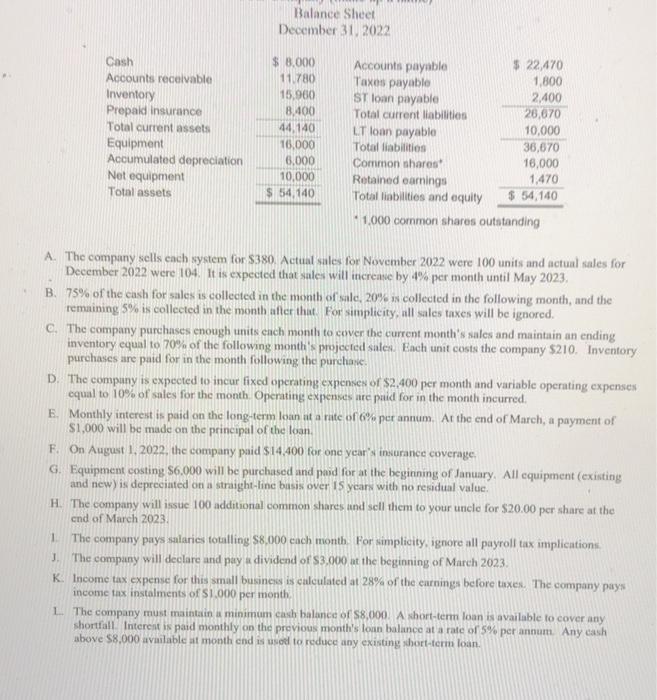

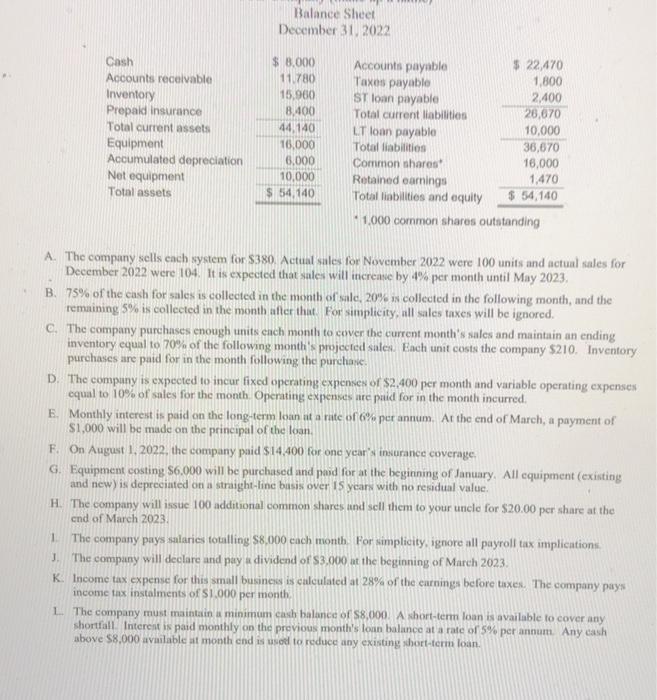

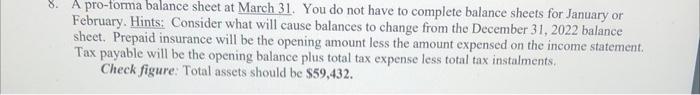

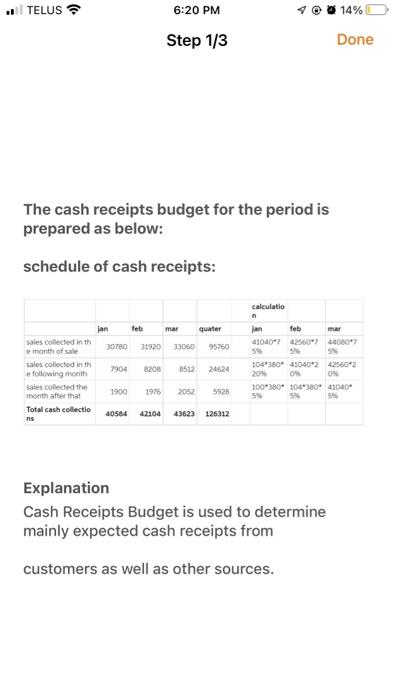

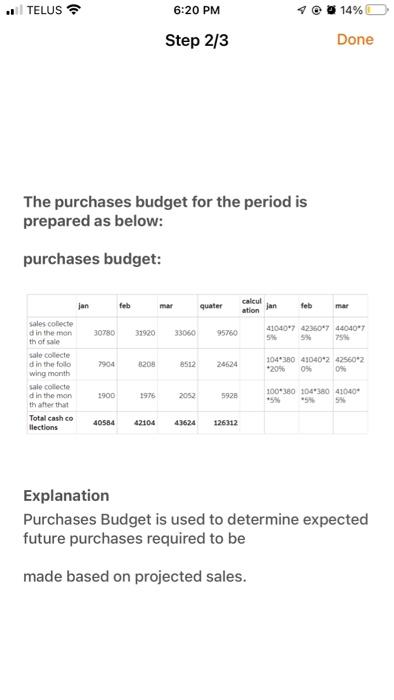

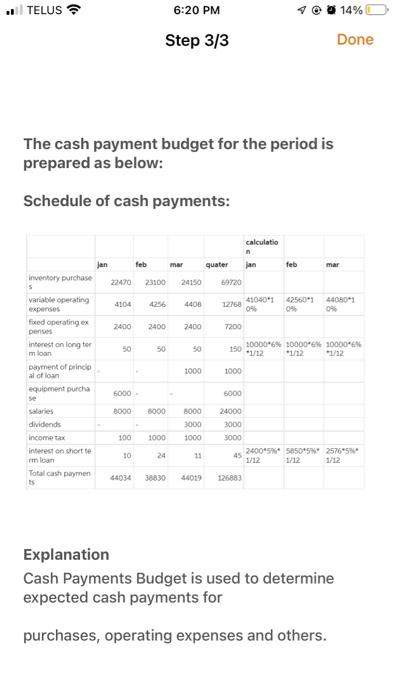

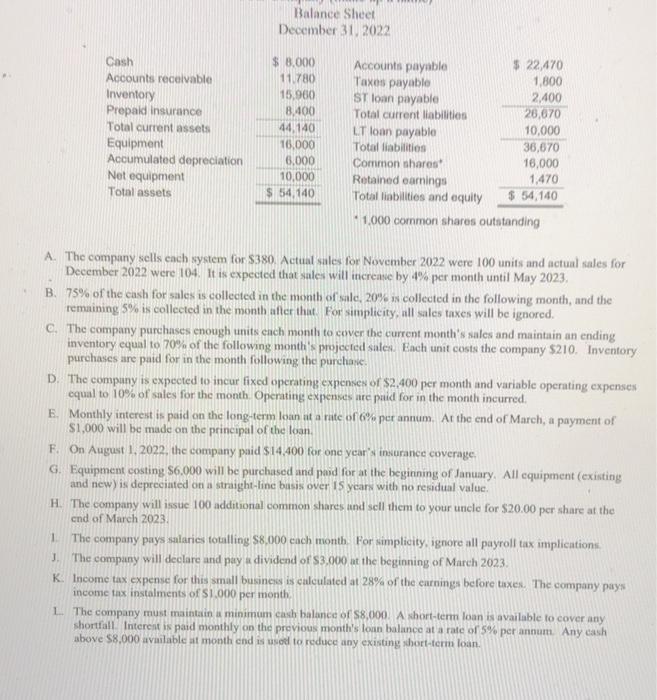

A. The company sells each system for $380. Actual sales for November 2022 were 100 units and actual sales for December 2022 were 104. It is expected that sales will increase by 4 9. per month until May 2023. B. 75% of the cash for sales is collected in the month of sale, 20% is collected in the following month, and the remaining 5% is collected in the month after that. For simplicity, all sales taxes will be ignored. C. The company purchases enough units cach month to cover the current month's sales and maintain an ending inventory equal to 70% of the following month's projected sales. Each unit costs the company $210. Inventory. purchases are paid for in the month following the purchase. D. The company is expected to incur fixed operating expenses of $2.400 per month and variable operating expenses equal to 10% of sales for the month. Operating expenses are paid for in the month incurred. E. Monthly interest is paid on the long-term loan at a rate of 6% per annum. At the end of March, a payment of $1,000 will be made on the principal of the loan. F. On August 1,2022, the company paid \$14,400 for one ycar's insurance coverage. G. Equipment costing $6.000 will be purchased and pad for at the beginning of January. All equipment (existing and new) is depreciated on a straight-line busis over is yearn with no revidual value. H. The company will issue 100 additional common shares itnd scll them to your uncle for $20.00 per share at the end of March 2023. 1. The company pays salaries totalling $8,000 cach month. For simplicity, ignore all payroll tax implications. J. The company will declare and pay a dividend of $3,000 at the beginning of March 2023. K. Income tax expense for this small busines is calculated at 28% of the carnings before tirxes. The company pays income tax instalments of 51.000 per month. 1. The company must maintain a minimum cash balance of $8,000. A whort-term loan is available to cover any shortfall. Interent is paid monthly on the previous month's lown balance at a rate of 5% per annum. Any eash above 58,000 available at month end is usod to reduce any existing thort-term loan. A pro-forma balance sheet at March 31. You do not have to complete balance sheets for January or February. Hints: Consider what will cause balances to change from the December 31, 2022 balance sheet. Prepaid insurance will be the opening amount less the amount expensed on the income statement. Tax payable will be the opening balance plus total tax expense less total tax instalments. Check figure: Total assets should be $59,432. The cash receipts budget for the period is prepared as below: schedule of cash receipts: Explanation Cash Receipts Budget is used to determine mainly expected cash receipts from customers as well as other sources. The purchases budget for the period is prepared as below: purchases budget: Explanation Purchases Budget is used to determine expected future purchases required to be made based on projected sales. The cash payment budget for the period is prepared as below: Schedule of cash payments: Explanation Cash Payments Budget is used to determine expected cash payments for purchases, operating expenses and others