Answered step by step

Verified Expert Solution

Question

1 Approved Answer

just the correct one without explaining itu 4 Ps Aa w (A) (B) (D) (E) (F) (C) 2 Best: 1 1 2 3 3 Second

just the correct one without explaining

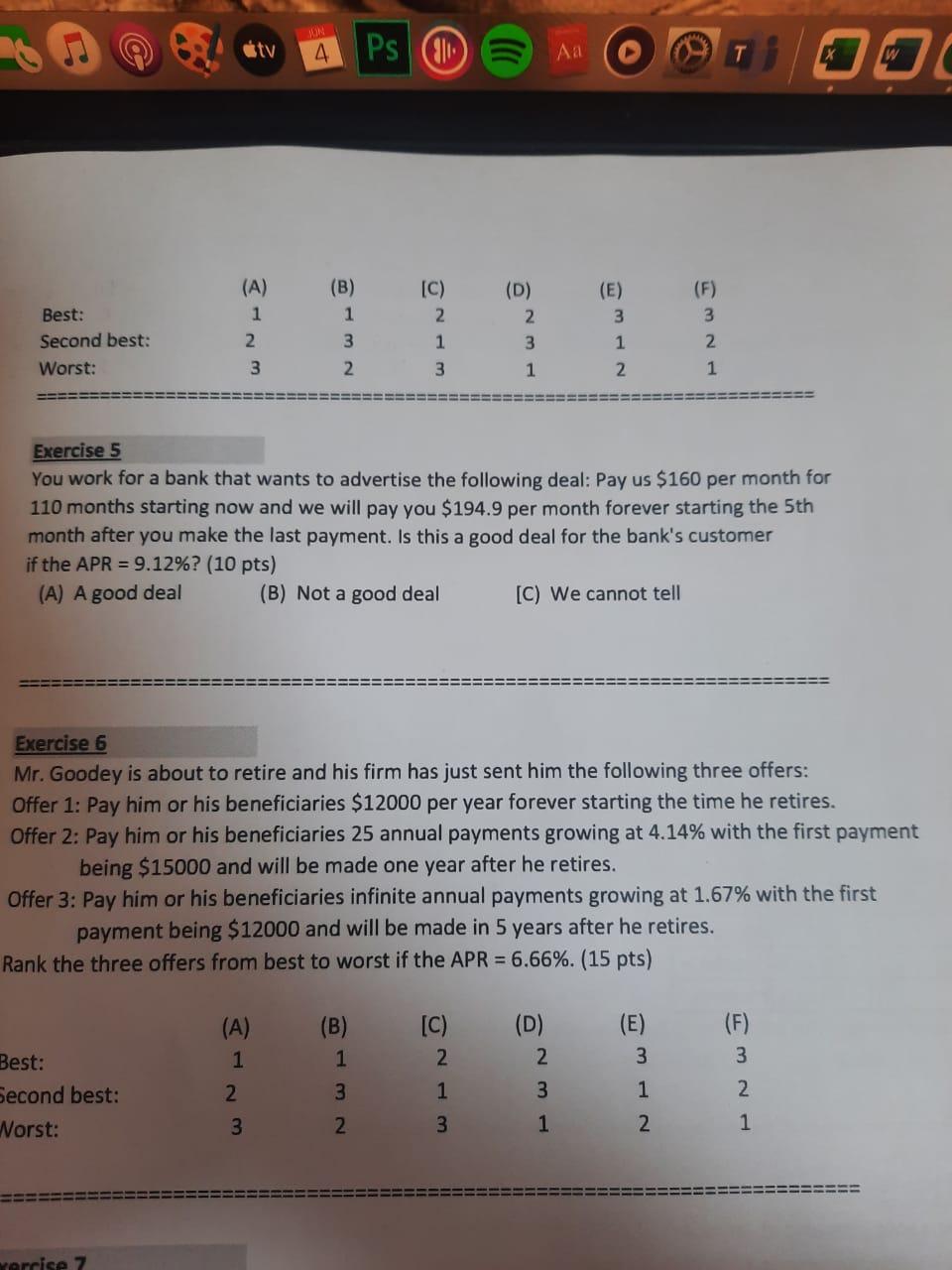

itu 4 Ps Aa w (A) (B) (D) (E) (F) (C) 2 Best: 1 1 2 3 3 Second best: 2 3 1 3 1 2 Worst: 3 2 3 1 2 1 Exercise 5 You work for a bank that wants to advertise the following deal: Pay us $160 per month for 110 months starting now and we will pay you $194.9 per month forever starting the 5th month after you make the last payment. Is this a good deal for the bank's customer if the APR = 9.12%? (10 pts) (A) A good deal (B) Not a good deal [C) We cannot tell Exercise 6 Mr. Goodey is about to retire and his firm has just sent him the following three offers: Offer 1: Pay him or his beneficiaries $12000 per year forever starting the time he retires. Offer 2: Pay him or his beneficiaries 25 annual payments growing at 4.14% with the first payment being $15000 and will be made one year after he retires. Offer 3: Pay him or his beneficiaries infinite annual payments growing at 1.67% with the first payment being $12000 and will be made in 5 years after he retires. Rank the three offers from best to worst if the APR = 6.66%. (15 pts) (C) (F) (A) 1 (B) 1 (D) 2 (E) 3 Best: 2 3 Second best: 2 3 1 3 1 2 Worst: 3 2 3 1 2 1 Yercise 7Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started