Answered step by step

Verified Expert Solution

Question

1 Approved Answer

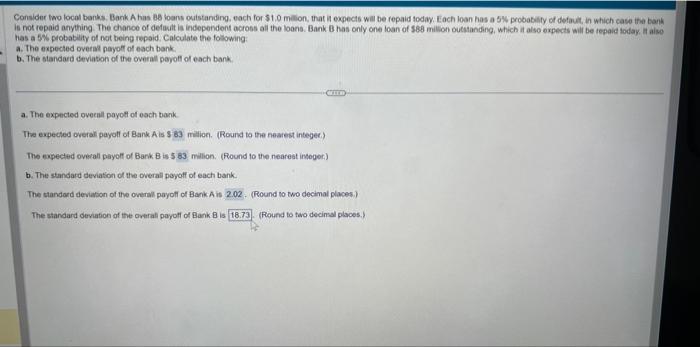

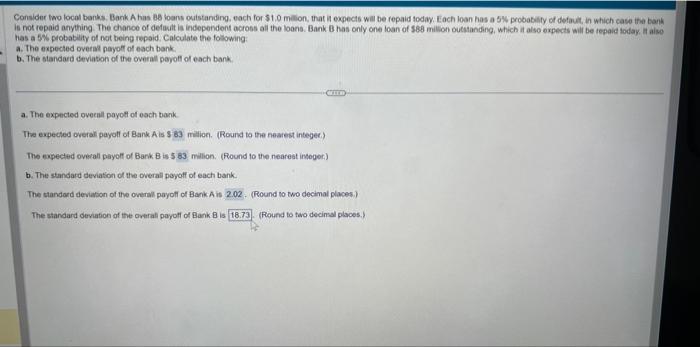

just the last question thank you Consider two local banks. Bank A has B8 loans ouistanding, each for $1,0 mition. that in expects will be

just the last question thank you

Consider two local banks. Bank A has B8 loans ouistanding, each for $1,0 mition. that in expects will be repaid today. Each loan has a 5% probabilty of defaut, in which case iha bank is not repaid anything. The chance of defoult is independent acrobs all the loons. Bank B has only one loan of sesf millon outatanding, which it also expects aill be tepaid foday. It aise has a 5% probability of not being repaid. Calculate the folowing: a. The expected overat payoff of each bank. b. The standard deviation of the overall payoff of each bank. a. The expected ovecnil payott of each banik The expected overal payotf of Bank A is $83 milion. (Rocnd to the nearest integec.) The expected overall payolf of Bank B is 5 millon. (Round to the neareat inseger.) b. The standard deviation of the overall payoff of each bank. The standord deviason of the overal payolf of Bark A is (Round wo two decimal places) The standard deriation of the everal payoff of Bank 8 is (Fiound to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started