just want to check my answers.

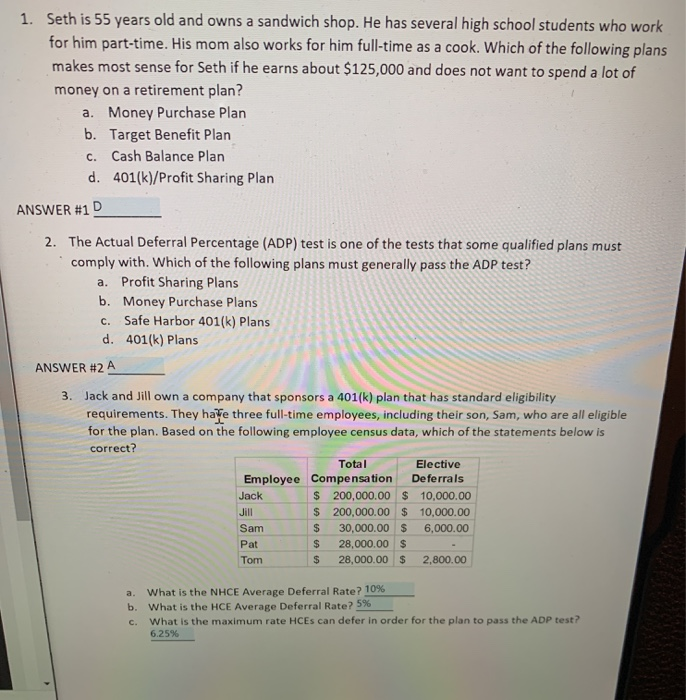

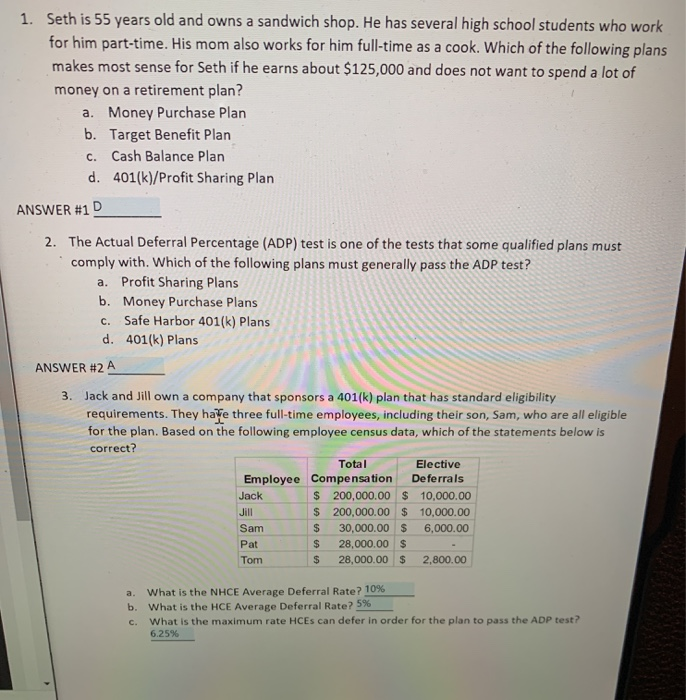

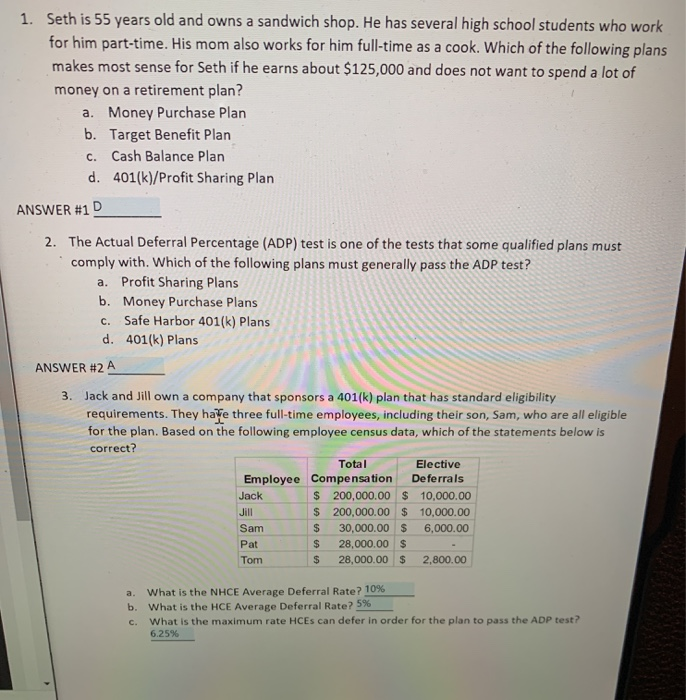

1. Seth is 55 years old and owns a sandwich shop. He has several high school students who work for him part-time. His mom also works for him full-time as a cook. Which of the following plans makes most sense for Seth if he earns about $125,000 and does not want to spend a lot of money on a retirement plan? a. Money Purchase Plan b. Target Benefit Plan C. Cash Balance Plan d. 401(k)/Profit Sharing Plan ANSWER #1 D 2. The Actual Deferral Percentage (ADP) test is one of the tests that some qualified plans must comply with. Which of the following plans must generally pass the ADP test? a. Profit Sharing Plans b. Money Purchase Plans C. Safe Harbor 401(k) Plans d. 401(k) Plans ANSWER #2 A 3. Jack and Jill own a company that sponsors a 401(k) plan that has standard eligibility requirements. They have three full-time employees, including their son, Sam, who are all eligible for the plan. Based on the following employee census data, which of the statements below is correct? Total Elective Employee Compensation Deferrals Jack $ 200,000.00 $ 10,000.00 $ 200,000.00 $ 10,000.00 Sam $ 30,000.00 $ 6,000.00 $ 28,000.00 $ Tom $ 28,000.00 $ 2,800.00 Jul Pat a. What is the NHCE Average Deferral Rate? 10% b. What is the HCE Average Deferral Rate? 5% c. What is the maximum rate HCES can defer in order for the plan to pass the ADP test? 6.25% 1. Seth is 55 years old and owns a sandwich shop. He has several high school students who work for him part-time. His mom also works for him full-time as a cook. Which of the following plans makes most sense for Seth if he earns about $125,000 and does not want to spend a lot of money on a retirement plan? a. Money Purchase Plan b. Target Benefit Plan C. Cash Balance Plan d. 401(k)/Profit Sharing Plan ANSWER #1 D 2. The Actual Deferral Percentage (ADP) test is one of the tests that some qualified plans must comply with. Which of the following plans must generally pass the ADP test? a. Profit Sharing Plans b. Money Purchase Plans C. Safe Harbor 401(k) Plans d. 401(k) Plans ANSWER #2 A 3. Jack and Jill own a company that sponsors a 401(k) plan that has standard eligibility requirements. They have three full-time employees, including their son, Sam, who are all eligible for the plan. Based on the following employee census data, which of the statements below is correct? Total Elective Employee Compensation Deferrals Jack $ 200,000.00 $ 10,000.00 $ 200,000.00 $ 10,000.00 Sam $ 30,000.00 $ 6,000.00 $ 28,000.00 $ Tom $ 28,000.00 $ 2,800.00 Jul Pat a. What is the NHCE Average Deferral Rate? 10% b. What is the HCE Average Deferral Rate? 5% c. What is the maximum rate HCES can defer in order for the plan to pass the ADP test? 6.25%