Question

Just what makes a CEO worthy of his or her seven-figure compensation package? Is it the ability to inspire with bold visions of future growth?

Just what makes a CEO worthy of his or her seven-figure compensation package? Is it the ability to inspire with bold visions of future growth? Is it the financial acumen to ruthlessly go where others fear to go, cutting budgets and downsizing a bloated workforce? There is no single measure for executive greatness, although one would expect there to be some criteria by which a CEO should be judged.

Review the article, "The CEO Stats that Matter" (found in the Resources). After your review, draft a proposal for evaluating the CEO of a large multi-national company. In your proposal, identify the financial and non-financial measures that you believe would cut to the heart of evaluating a CEO's performance. Put your proposal in the form of a one-page memo to the board of directors. Make sure you justify each measure you list in your memo.

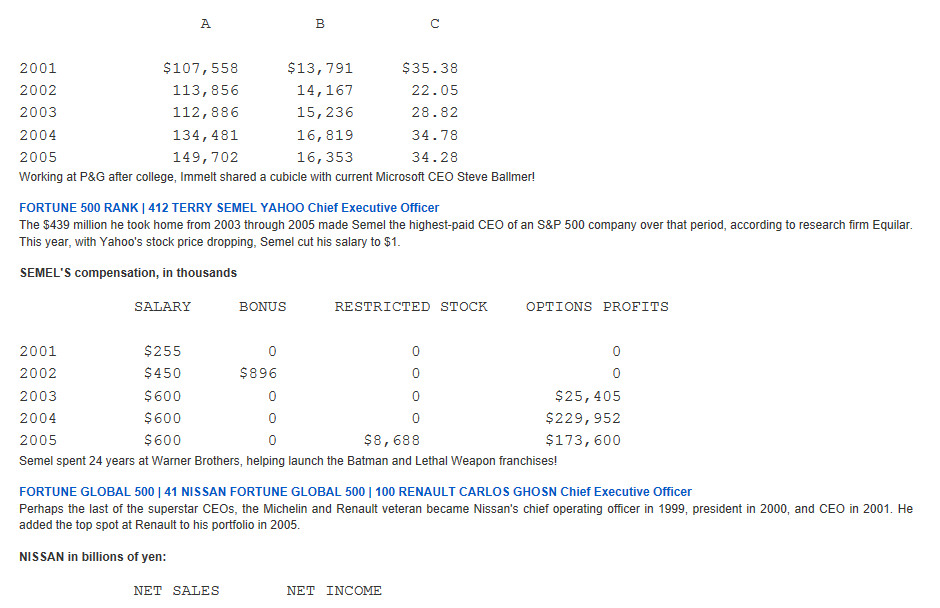

Just what makes a CEO great? Is it the ability to YAHOO Chief Amazon back in the day.) Or is it the resolve to cut ruthlessly away at divisions and people that aren't performing? (Like Jack Welch in the Executive Officer 1980s at General Electric.) FORTUNE GLOBAL 500 l 41 NISSAN Perhaps it's the financial acumen t see which measures of performance truly matter. (Alfred P. Sloan at GM, or Roberto Goizueta at FORTUNE GLOBAL Coca-Cola.) Then again, maybe it's the ability to know when to ignore financial measures to define what's really special about a company. 500 l 100 RENAULT CARLOS GHOSN Steve Jobs in his second coming at Apple. Chief Executive Officer s it the discipline to hun empire building and instead focus on making your core business great? (Katharine Graham at the Washington Post Co. in the 1970s.) Or the vision to move into a new business with greater growth potential? (Katharine Graham again, buying test TIP SHEET prep pioneer Kaplan in 1984.) No, no, here's what it is: the unique leadership ability to drive a company forward as no other manager JUDGING CEO could. NThink Stanley Gault of Rubbermaid, which soared under him then foundered when he retired.) On second thought, maybe it's the PERFORMANCE ability to pick successors who are better than you. (Reginald Jones, Welch's predecessor at GE Okay, you get it There is no single recipe for executive greatness. Still, you'd there think would at least be a reliable way to measure whether a CEO is doing an excellent job. There's certainly enough at stake: the economy, our jobs, those mind-boggling CEO paychecks. So how do we tell if a chi ef executive is any good? To help answer that question et's take a brief detour nto basebal the field of human endeavor in which performance is measured in its most reliable, bounteous excruciating detail. The sports hierarchy of statistics has been upended in recent years by a handful of mavericks and outsiders personified by a former night watchman at a baked-beans cannery named Bill James and brought to the attention of the non-baseball-fanatic public by Michael Lewis's 2003 bestseller oneyball (see "The Best Offense Is a Stubborn Contrarian on page 138). Academics have joined in too n an article published this summer in the Journal of Economic Perspectives, two scholars concluded that baseball teams had until recently persistently undervalued hitters who walked a lot. Yet another trio of economists has written a book reassessing the use of basketball statistics hen it comes to CEOs, there's a strong argument to be made that we have similarly been paying attention to the wrong performance indicators--short-term stock price movements, quarterly earnings, press clippings. So can we fix executive evaluation by choosing a few new stats? It may be harder than that. loved "I Moneybal says Alfred Rappaport, the fo rmer Northwestern University accounting professor who has been among the most influential students of corporate performance over the past half-century. "But I don't think we're talking about quite the same animals her One obvious problem is that with corporations only team statistics are readily available, not individual ones. But the most important difference, Rappaport says s this: "Baseball performance statistics, once they're recorded, don't change. (Corporate performance statistics are nothing more than tentative indicators in a game n progress. n other words, you can't really judge a CEO's tenure until years after he has left office. That's fine for business historians but no help at all to board members trying to decide if a CEO deserves to stay, investors judging a company's prospects, or executives themselves. Which is why right now, in business-school ivory towers and corporate boardrooms, there's a lot of talk--and even some action--about nuanced new ways to assess company leaders in real time It was in the 1950s th at the idea of treating management as something that could be measured and quantified first came into vogue. Key works of the new management literature included Chester Barnard's Function of the Executive (which was first published in 1938 but took a while to catch on), Peter Drucker's The Practice of Management, and Sloan's My Years With General Motors

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started