Question

Justin Beaver (JB) is evaluating 2 investment options, project 1 (P1) or project 2 (P2), both giving the same amount of positive NPV. The

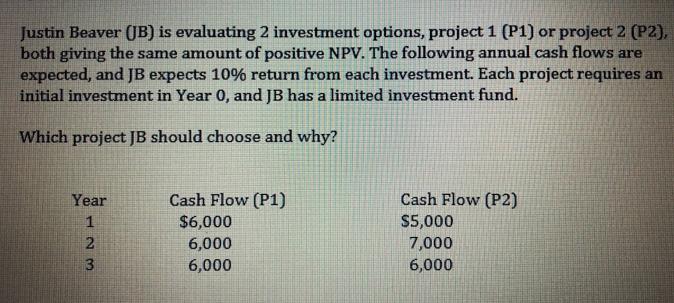

Justin Beaver (JB) is evaluating 2 investment options, project 1 (P1) or project 2 (P2), both giving the same amount of positive NPV. The following annual cash flows are expected, and JB expects 10% return from each investment. Each project requires an initial investment in Year 0, and JB has a limited investment fund. Which project JB should choose and why? Year 123 Cash Flow (P1) $6,000 6,000 6,000 Cash Flow (P2) $5,000 7,000 6,000

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided both project 1 P1 and project 2 P2 are expected to generate a posi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Precalculus

Authors: Jay Abramson

1st Edition

1938168348, 978-1938168345

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App