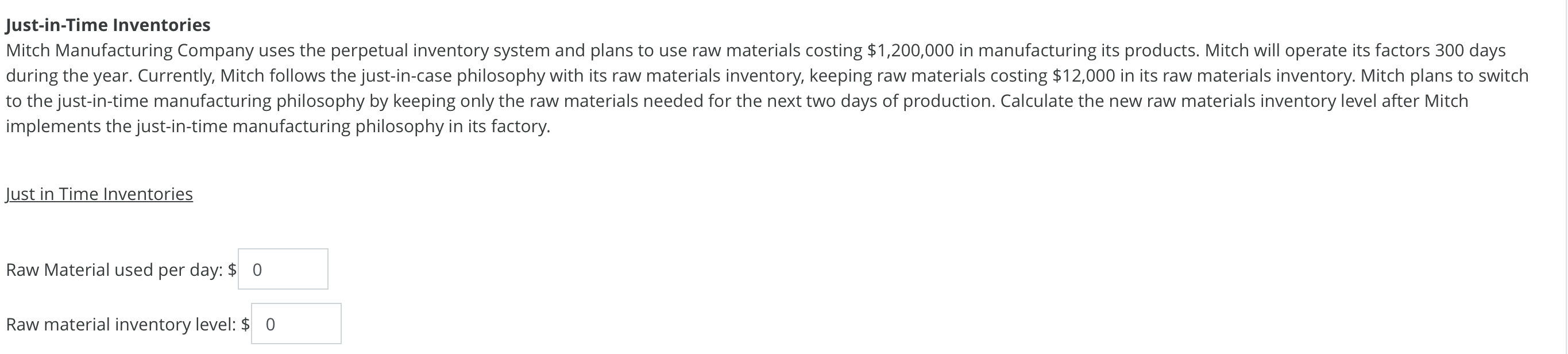

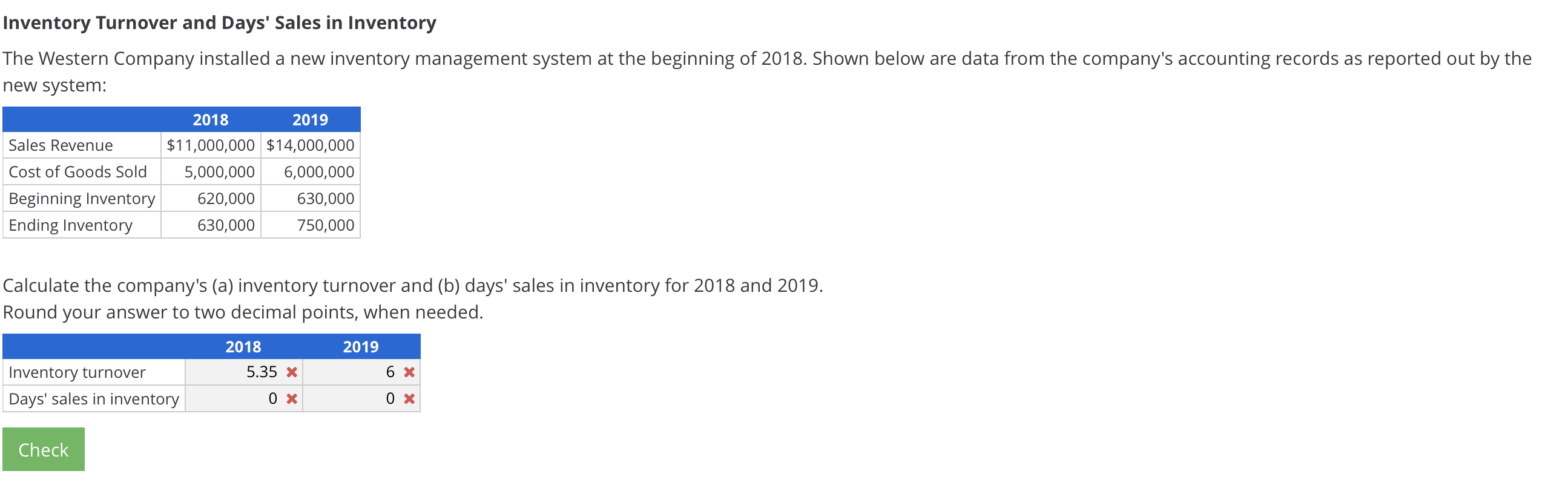

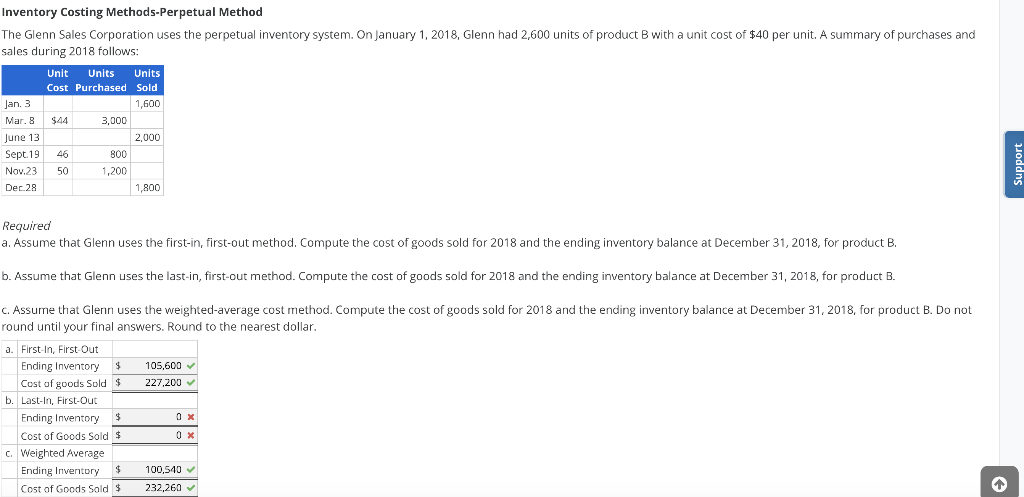

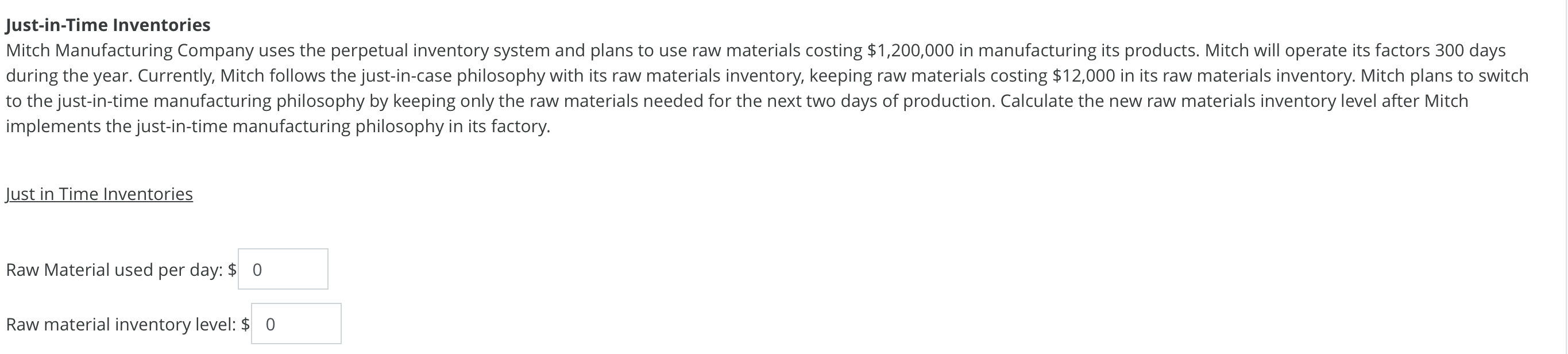

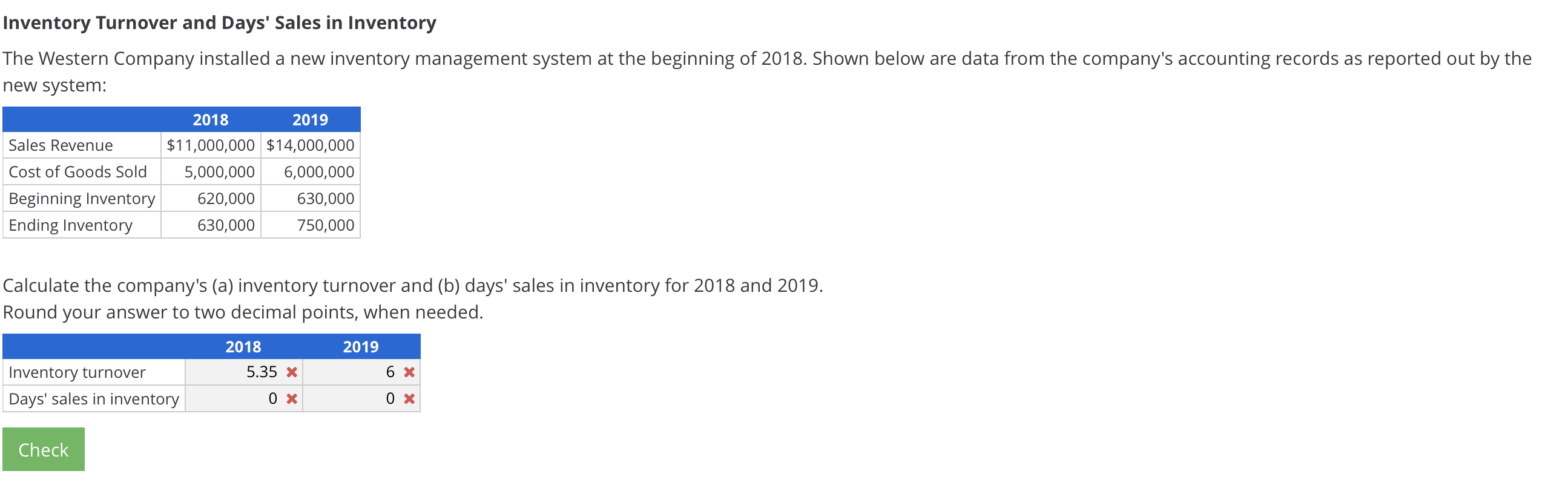

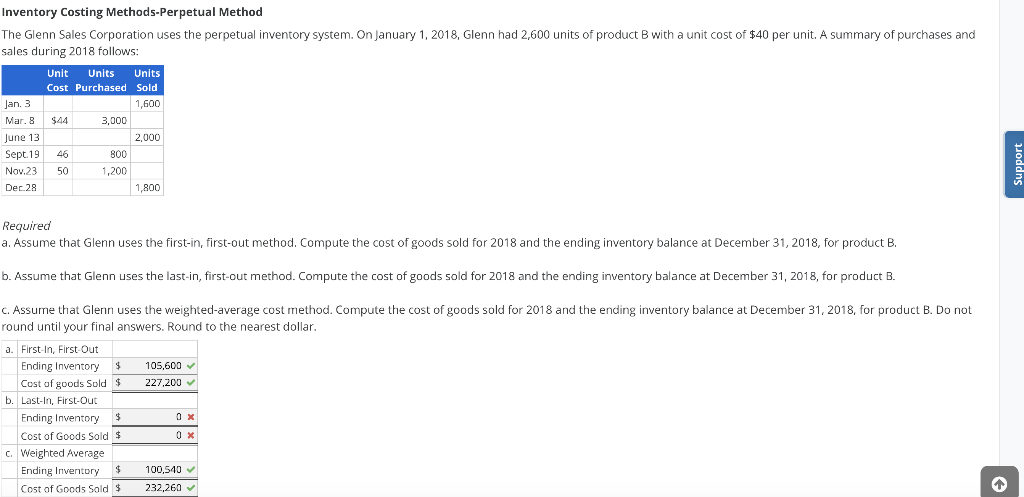

Just-in-Time Inventories Mitch Manufacturing Company uses the perpetual inventory system and plans to use raw materials costing $1,200,000 in manufacturing its products. Mitch will operate its factors 300 days during the year. Currently, Mitch follows the just-in-case philosophy with its raw materials inventory, keeping raw materials costing $12,000 in its raw materials inventory. Mitch plans to switch to the just-in-time manufacturing philosophy by keeping only the raw materials needed for the next two days of production. Calculate the new raw materials inventory level after Mitch implements the just-in-time manufacturing philosophy in its factory. Just in Time Inventories Raw Material used per day: $ 0 Raw material inventory level: $0 Inventory Turnover and Days' Sales in Inventory The Western Company installed a new inventory management system at the beginning of 2018. Shown below are data from the company's accounting records as reported out by the new system: 2018 2019 Sales Revenue $11,000,000 $14,000,000 Cost of Goods Sold 6,000,000 5,000,000 Beginning Inventory 620,000 630,000 Ending Inventory 630,000 750,000 Calculate the company's (a) inventory turnover and (b) days' sales in inventory for 2018 and 2019. Round your answer to two decimal points, when needed. 2018 2019 5.35 Inventory turnover 6 Days' sales in inventory 0 X 0 x Check Inventory Costing Methods-Perpetual Method The Glenn Sales Corporation uses the perpetual inventory system. On January 1, 2018, Glenn had 2,600 units of product B with a unit cost of $40 per unit. A summary of purchases and sales during 2018 follows: Units Unit Units Cost Purchased Sold Jan. 3 1,600 $44 Mar. 8 3,000 June 13 2,000 Sept.19 46 800 Nov.23 50 1,200 Dec 28 1,800 Required a. Assume that Glenn uses the first-in, first-out method. Compute the cost of goods sold for 2018 and the ending inventory balance at December 31, 2018, for product B b. Assume that Glenn uses the last-in, first-out method. Compute the cost of goods sold for 2018 and the ending inventory balance at December 31, 2018, for product B c. Assume that Glenn uses the weighted-average cost method. Compute the cost of goods sold for 2018 and the ending inventory balance at December 31, 2018, for product B. Do not round until your final answers. Round to the nearest dollar a First-In, First Out Ending Inventory 105,600 Cost of goods Sold 227,200 b. Last-In, First-Out $ Ending Inventory Cost of Goods Sold 0 x c. Weighted Average 100,540 Ending Inventory Cost of Goods Sald 232,260 Just-in-Time Inventories Mitch Manufacturing Company uses the perpetual inventory system and plans to use raw materials costing $1,200,000 in manufacturing its products. Mitch will operate its factors 300 days during the year. Currently, Mitch follows the just-in-case philosophy with its raw materials inventory, keeping raw materials costing $12,000 in its raw materials inventory. Mitch plans to switch to the just-in-time manufacturing philosophy by keeping only the raw materials needed for the next two days of production. Calculate the new raw materials inventory level after Mitch implements the just-in-time manufacturing philosophy in its factory. Just in Time Inventories Raw Material used per day: $ 0 Raw material inventory level: $0 Inventory Turnover and Days' Sales in Inventory The Western Company installed a new inventory management system at the beginning of 2018. Shown below are data from the company's accounting records as reported out by the new system: 2018 2019 Sales Revenue $11,000,000 $14,000,000 Cost of Goods Sold 6,000,000 5,000,000 Beginning Inventory 620,000 630,000 Ending Inventory 630,000 750,000 Calculate the company's (a) inventory turnover and (b) days' sales in inventory for 2018 and 2019. Round your answer to two decimal points, when needed. 2018 2019 5.35 Inventory turnover 6 Days' sales in inventory 0 X 0 x Check Inventory Costing Methods-Perpetual Method The Glenn Sales Corporation uses the perpetual inventory system. On January 1, 2018, Glenn had 2,600 units of product B with a unit cost of $40 per unit. A summary of purchases and sales during 2018 follows: Units Unit Units Cost Purchased Sold Jan. 3 1,600 $44 Mar. 8 3,000 June 13 2,000 Sept.19 46 800 Nov.23 50 1,200 Dec 28 1,800 Required a. Assume that Glenn uses the first-in, first-out method. Compute the cost of goods sold for 2018 and the ending inventory balance at December 31, 2018, for product B b. Assume that Glenn uses the last-in, first-out method. Compute the cost of goods sold for 2018 and the ending inventory balance at December 31, 2018, for product B c. Assume that Glenn uses the weighted-average cost method. Compute the cost of goods sold for 2018 and the ending inventory balance at December 31, 2018, for product B. Do not round until your final answers. Round to the nearest dollar a First-In, First Out Ending Inventory 105,600 Cost of goods Sold 227,200 b. Last-In, First-Out $ Ending Inventory Cost of Goods Sold 0 x c. Weighted Average 100,540 Ending Inventory Cost of Goods Sald 232,260