Answered step by step

Verified Expert Solution

Question

1 Approved Answer

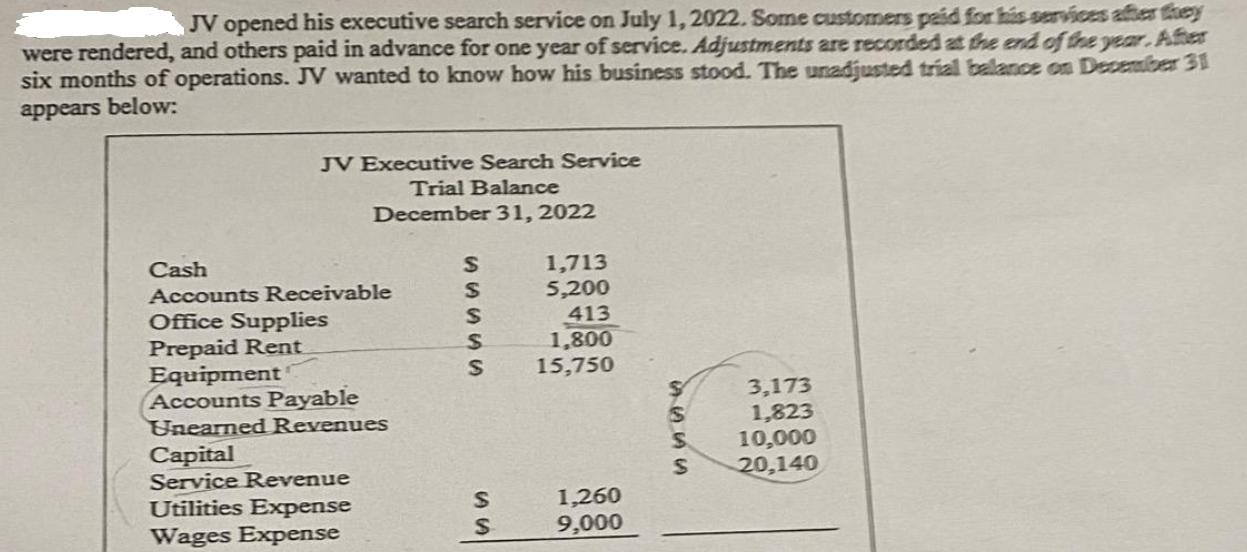

JV opened his executive search service on July 1, 2022. Some customers paid for his services after they were rendered, and others paid in

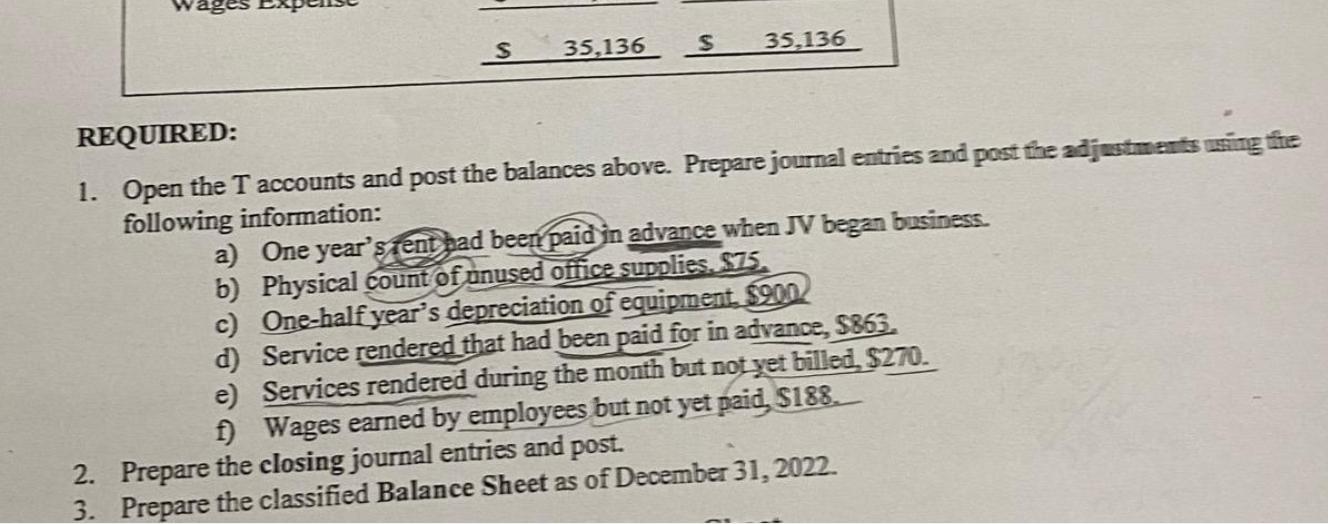

JV opened his executive search service on July 1, 2022. Some customers paid for his services after they were rendered, and others paid in advance for one year of service. Adjustments are recorded at the end of the year. After six months of operations. JV wanted to know how his business stood. The unadjusted trial balance on December 31 appears below: JV Executive Search Service Trial Balance December 31, 2022 Cash Accounts Receivable Office Supplies Prepaid Rent Equipment Accounts Payable Unearned Revenues Capital Service Revenue Utilities Expense Wages Expense SSSSS SS 1,713 5,200 413 1,800 15,750 1,260 9,000 5555 S 3,173 1,823 10,000 20,140 S 35,136 $ 35,136 REQUIRED: 1. Open the T accounts and post the balances above. Prepare journal entries and post the adjustments using the following information: a) One year's fent had been paid in advance when JV began business. b) Physical count of unused office supplies. $75. c) One-half year's depreciation of equipment, $900 d) Service rendered that had been paid for in advance, $863. e) Services rendered during the month but not yet billed, $270. f) Wages earned by employees but not yet paid, $188. 2. Prepare the closing journal entries and post. 3. Prepare the classified Balance Sheet as of December 31, 2022.

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 Opening Taccounts and Posting Balances Account Debit Credit Cash 1713 Accounts Receivable 5200 Office Supplies 413 Prepaid Rent 1800 Equipment 15750 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started