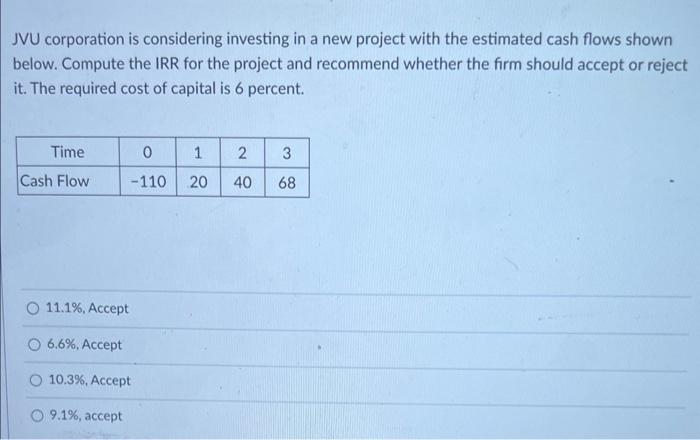

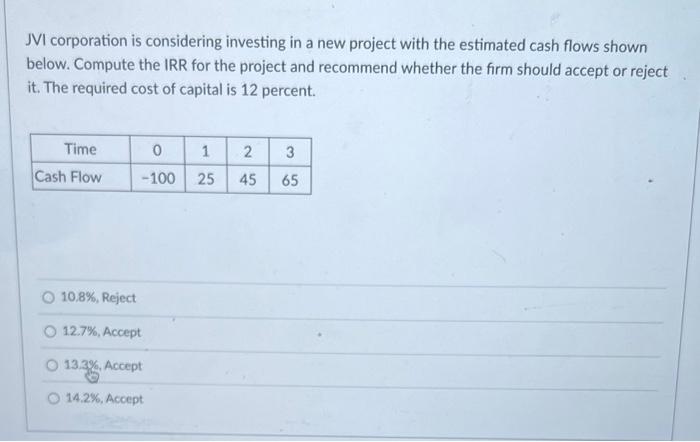

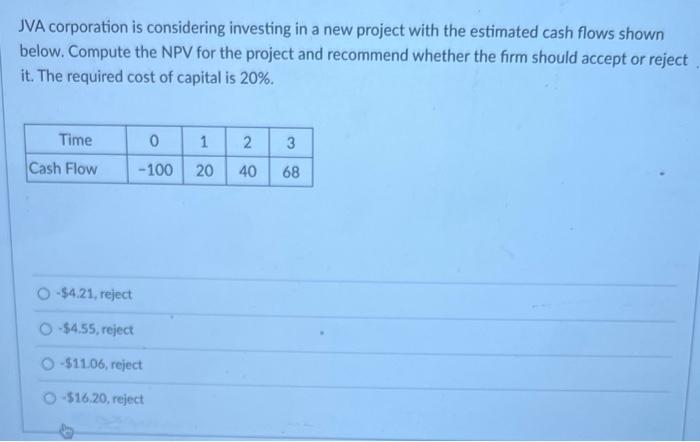

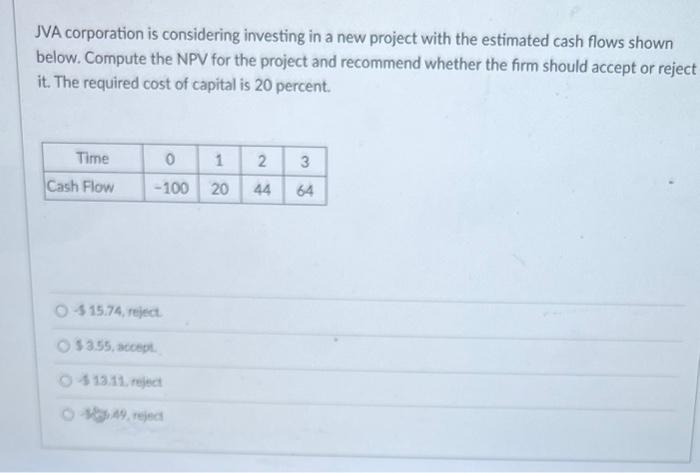

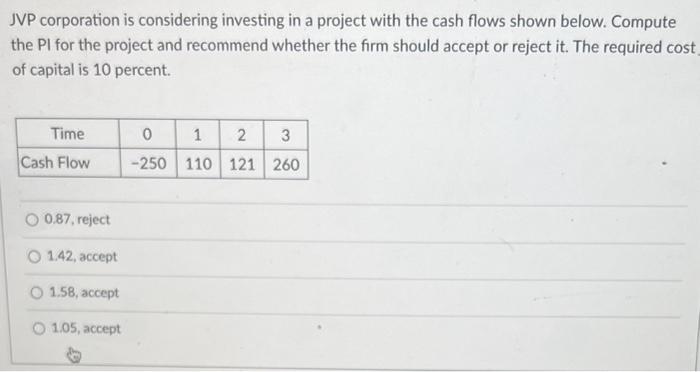

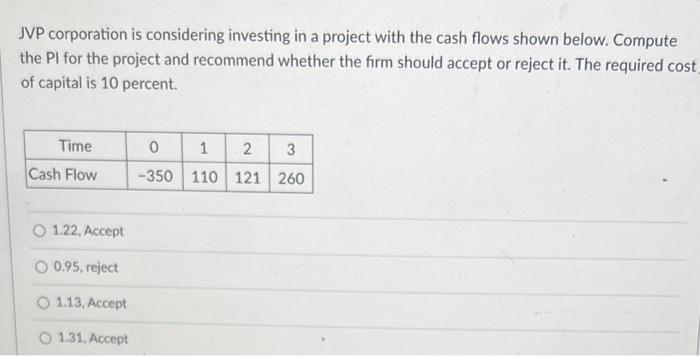

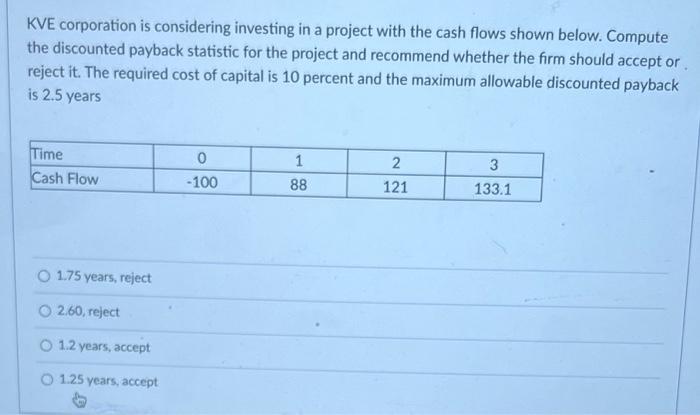

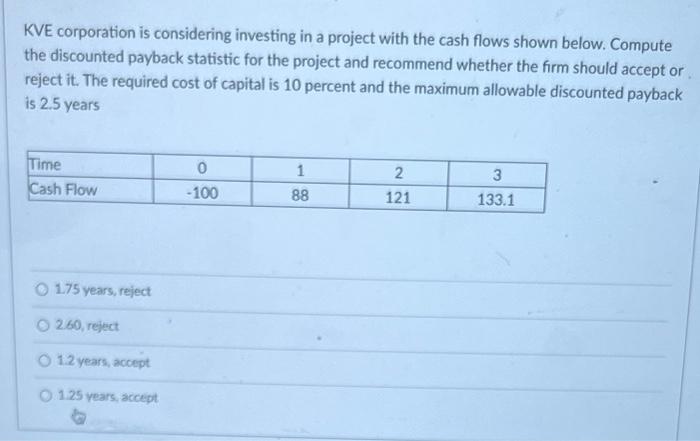

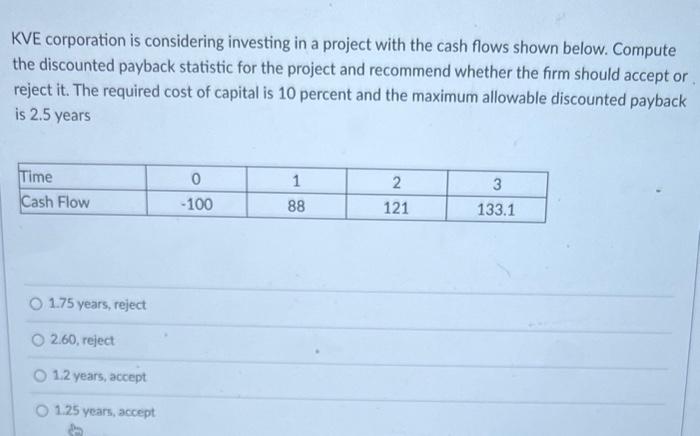

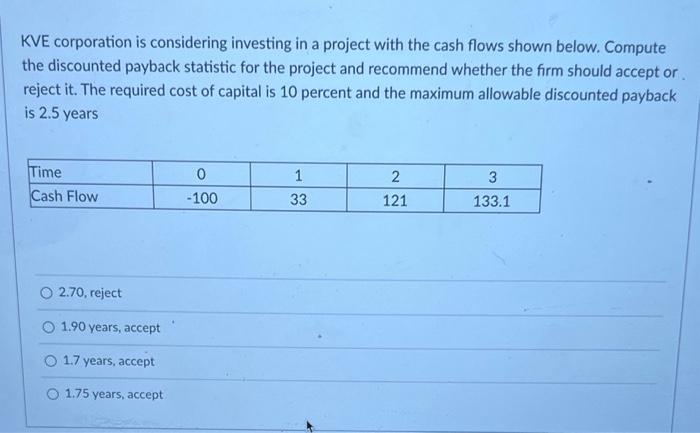

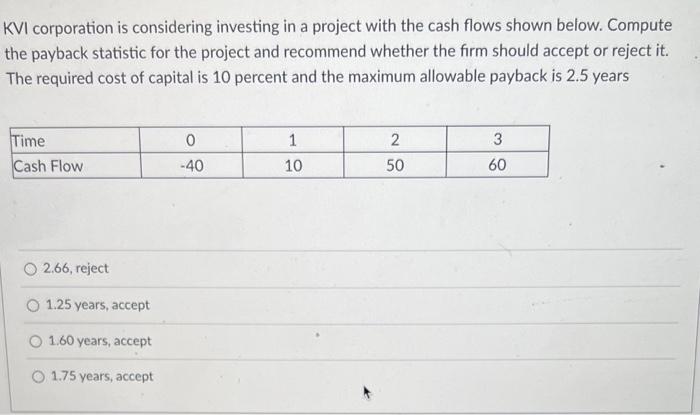

JVU corporation is considering investing in a new project with the estimated cash flows shown below. Compute the IRR for the project and recommend whether the firm should accept or reject it. The required cost of capital is 6 percent. 11.1%, Accept 6.6%, Accept 10.3%, Accept 9.1%, accept JVI corporation is considering investing in a new project with the estimated cash flows shown below. Compute the IRR for the project and recommend whether the firm should accept or reject it. The required cost of capital is 12 percent. 10.8%, Reject 12.7%, Accept 13.3\%, Accept 14.2%, Accept JVA corporation is considering investing in a new project with the estimated cash flows shown below. Compute the NPV for the project and recommend whether the firm should accept or reject it. The required cost of capital is 20%. $4.21, reject $4.55, reject $1106, reject $16.20, reject JVA corporation is considering investing in a new project with the estimated cash flows shown below. Compute the NPV for the project and recommend whether the firm should accept or reject it. The required cost of capital is 20 percent. $15.74, reject. 53.55, accept. 5 18.11. reject JVP corporation is considering investing in a project with the cash flows shown below. Compute the PI for the project and recommend whether the firm should accept or reject it. The required cost of capital is 10 percent. 0.87, reject 1.42, accept 1.58, accept 1.05, accept JVP corporation is considering investing in a project with the cash flows shown below. Compute the PI for the project and recommend whether the firm should accept or reject it. The required cost of capital is 10 percent. 1.22, Accept 0.95 , reject 1.13, Accept 1.31, Accept KVE corporation is considering investing in a project with the cash flows shown below. Compute the discounted payback statistic for the project and recommend whether the firm should accept or reject it. The required cost of capital is 10 percent and the maximum allowable discounted payback is 2.5 years 1.75 years, reject 2.60, reject 1.2 years, accept 1.25 years, accept KVE corporation is considering investing in a project with the cash flows shown below. Compute the discounted payback statistic for the project and recommend whether the firm should accept or reject it. The required cost of capital is 10 percent and the maximum allowable discounted payback is 2.5 years 1.75 years, reject 260, reject 1.2 years, accept 1.25 vears, accept KVE corporation is considering investing in a project with the cash flows shown below. Compute the discounted payback statistic for the project and recommend whether the firm should accept or reject it. The required cost of capital is 10 percent and the maximum allowable discounted payback is 2.5 years 1.75 years, reject 2.60, reject 1.2 years, accept 1.25 years, accept KVE corporation is considering investing in a project with the cash flows shown below. Compute the discounted payback statistic for the project and recommend whether the firm should accept or reject it. The required cost of capital is 10 percent and the maximum allowable discounted payback is 2.5 years 2.70, reject 1.90 years, accept 1.7 years, accept 1.75 years, accept KVI corporation is considering investing in a project with the cash flows shown below. Compute the payback statistic for the project and recommend whether the firm should accept or reject it. The required cost of capital is 10 percent and the maximum allowable payback is 2.5 years 2.66, reject 1.25 years, accept 1.60 years, accept 1.75 years, accept