JWS Company produces footballs used in the Auburn University games. The footballs sell for $1,800 because the company recognized an opportunity to capitalize on

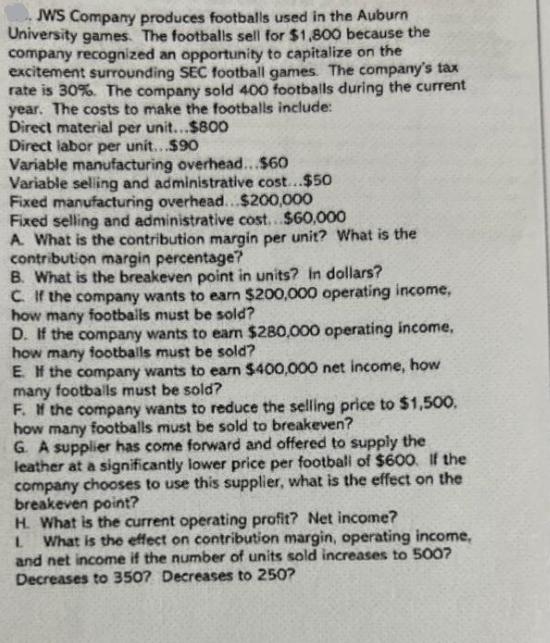

JWS Company produces footballs used in the Auburn University games. The footballs sell for $1,800 because the company recognized an opportunity to capitalize on the excitement surrounding SEC football games. The company's tax rate is 30%. The company sold 400 footballs during the current year. The costs to make the footballs include: Direct material per unit...$800 Direct labor per unit...$90 Variable manufacturing overhead...$60 Variable selling and administrative cost...$50 Fixed manufacturing overhead...$200,000 Fixed selling and administrative cost...$60,000 A. What is the contribution margin per unit? What is the contribution margin percentage? B. What is the breakeven point in units? In dollars? C. If the company wants to earn $200,000 operating income, how many footballs must be sold? D. If the company wants to earn $280,000 operating income, how many footballs must be sold? E. If the company wants to earn $400,000 net income, how many footballs must be sold? F. If the company wants to reduce the selling price to $1,500. how many footballs must be sold to breakeven? G. A supplier has come forward and offered to supply the leather at a significantly lower price per football of $600. If the company chooses to use this supplier, what is the effect on the breakeven point? H. What is the current operating profit? Net income? L What is the effect on contribution margin, operating income, and net income if the number of units sold increases to 5007 Decreases to 3507 Decreases to 250?

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION A Contribution Margin per unit Revenue per unit Variable costs per unit 1800 800 90 60 50 800 Contribution Margin Percentage Contribution Mar...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started