Answered step by step

Verified Expert Solution

Question

1 Approved Answer

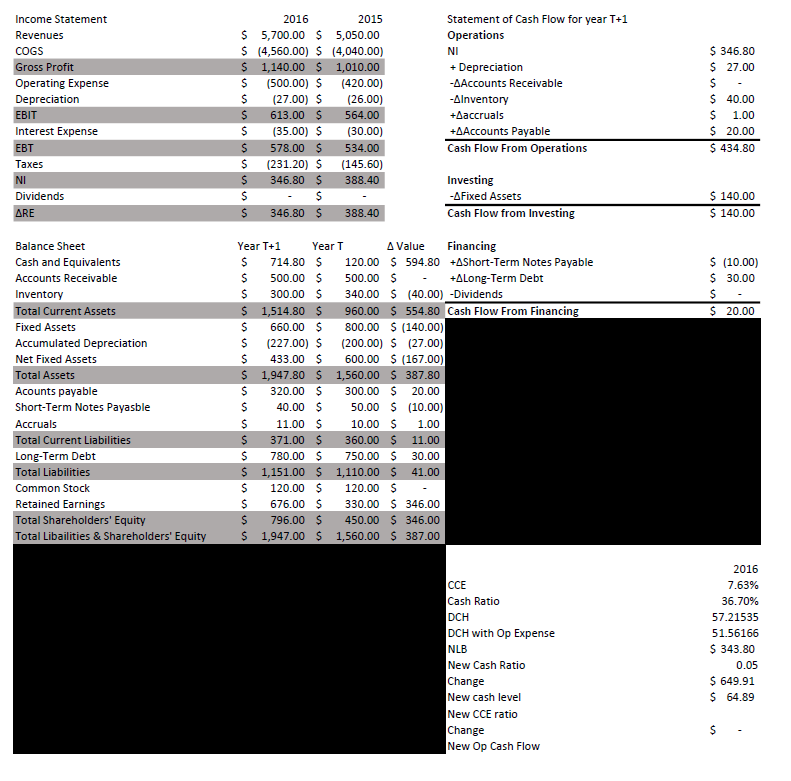

JWs shareholders are once again causing problems. This time, the issue concerns the CCE. Shareholders want to see the firm become more efficient at turning

- JWs shareholders are once again causing problems. This time, the issue concerns the CCE. Shareholders want to see the firm become more efficient at turning revenues into operating cash flow. Assuming that revenues remain unchanged from fiscal year 2016, what level of operating cash flow will be required to generate the following values for the CCE?

- 10%

- 15%

- 20%

- 25%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started